Market

Galaxy Says US Unlikely to Buy Bitcoin in 2025

Galaxy Research has unveiled its predictions for the cryptocurrency market in 2025. The report highlights key trends, including Bitcoin’s potential to reach a new all-time high and the continued expansion of the stablecoin market.

Other industry insights also point to a dynamic year ahead, with nation-state Bitcoin adoption and Tether’s dominance in the stablecoin sector expected to fall.

Bitcoin and Ethereum to Reach New Heights

Galaxy Research forecasts that Bitcoin will reach new all-time highs in 2025. The firm expects the leading cryptocurrency to surpass $150,000 in the year’s first half and climb to $185,000 by the fourth quarter.

This surge will be fueled by growing adoption among major corporations and nations. The report predicts that five Nasdaq 100 companies and five countries will add Bitcoin to their balance sheets, driven by strategic diversification and trade settlement needs.

“Competition among nation states, particularly unaligned nations, those with large sovereign wealth funds, or even those adversarial to the United States, will drive the adoption of strategies to mine or otherwise acquire Bitcoin,” Galaxy Research stated.

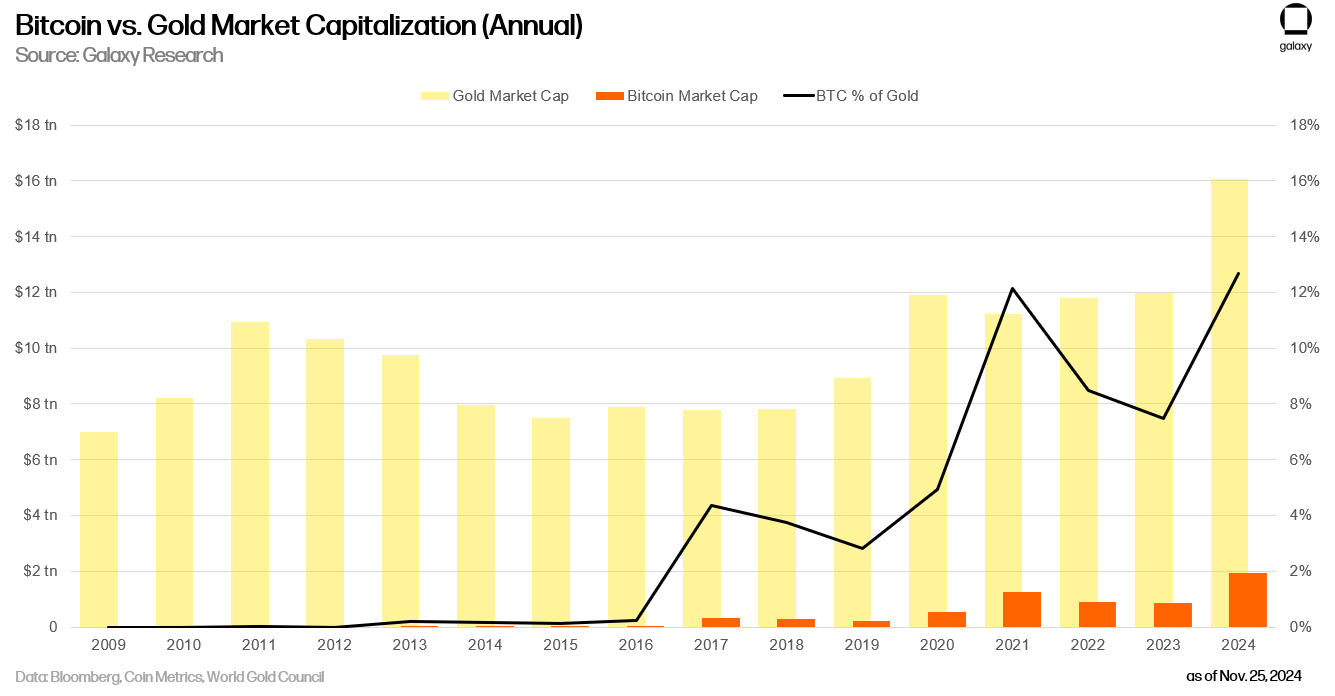

Bitcoin is also expected to gain further traction in investment markets. US-based spot Bitcoin ETFs could collectively manage over $250 billion in assets, reinforcing BTC’s role as a leading alternative asset. By 2025, its market cap may rival 20% of gold’s valuation, solidifying its position as a top-performing investment.

Ethereum, the second-largest cryptocurrency, is also poised for substantial growth. The report estimates Ethereum could trade at $5,500 in 2025, with DeFi and staking acting as key growth drivers. Regulatory improvements are likely to create favorable conditions, pushing Ethereum’s staking participation above 50% and boosting its network activity.

The firm also forecasts that Dogecoin will achieve a milestone, reaching $1 and a market cap of $100 billion, thanks to sustained community support and utility expansion.

Stablecoin Market to Evolve Further

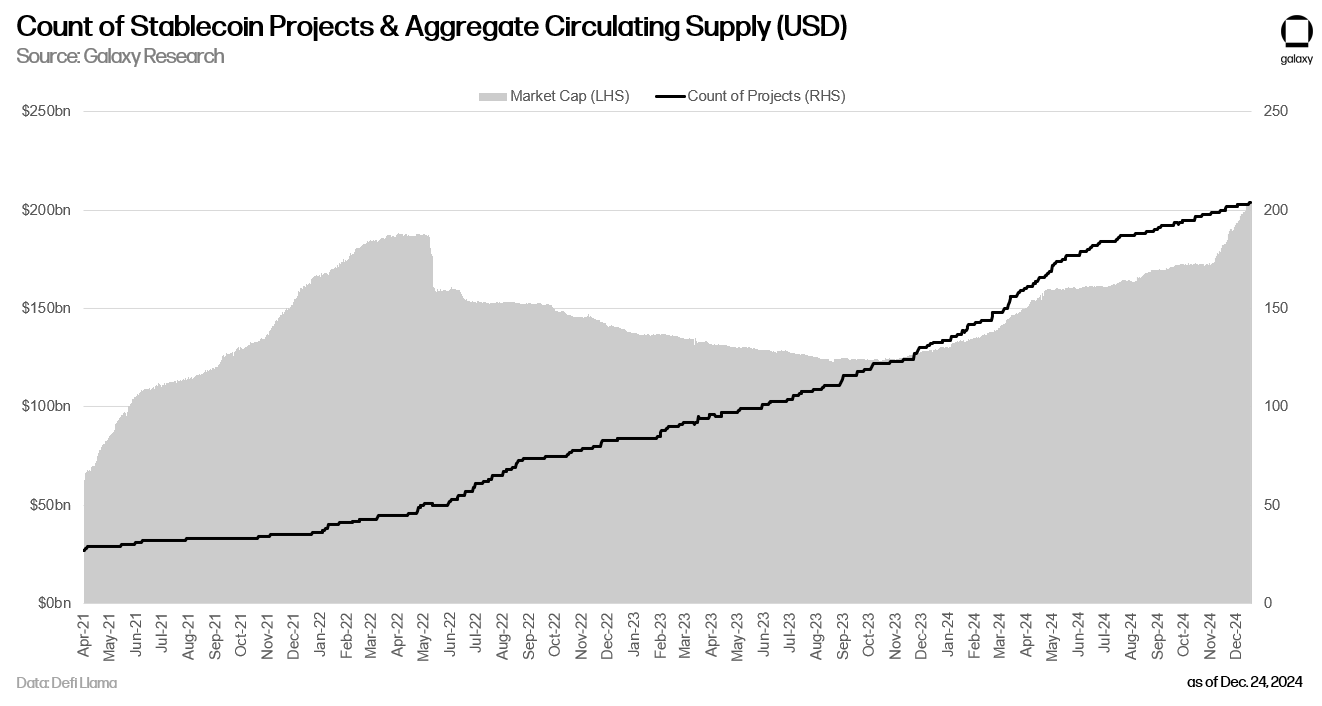

Galaxy Research predicts a dynamic shift in the stablecoin sector. The report expects the total stablecoin supply to surpass $400 billion by 2025, with at least ten new stablecoin projects backed by traditional finance partnerships entering the market. These developments will expand the use of stablecoins for payments, remittances, and settlements.

“Increasing regulatory clarity for both existing stablecoin issuers and traditional banks, trusts, and depositories will lead to an explosion of stablecoin supply in 2025,” Galaxy stated.

However, Tether’s dominance is anticipated to drop below 50% as new entrants offer yield-bearing alternatives. Competitors may attract users by sharing revenue from reserve yields, compelling Tether to adjust its strategy. The firm suggests Tether could introduce a delta-neutral stablecoin to stay competitive.

USDC will likely gain further momentum, supported by rewards programs integrated into leading platforms like Coinbase. This strategy could significantly enhance user adoption and boost the DeFi ecosystem, demonstrating the growing convergence of crypto and traditional financial services.

Policy and Market Structure in Focus

On the regulatory front, the US government is unlikely to buy Bitcoin outright but may consolidate its existing holdings. There is potential for discussions around a Bitcoin reserve policy, although significant steps may not materialize immediately.

“There will be some movement within the departments and agencies to examine an expanded Bitcoin reserve policy,” the firm stated.

Galaxy Research also predicts bipartisan legislation establishing stablecoin regulations in the US. This move could create a framework for greater oversight and encourage broader adoption of dollar-backed digital currencies.

The firm continued that while stablecoin clarity may advance, delays in comprehensive regulatory reforms for the wider crypto market will leave some uncertainty in the space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.