Market

Ethereum’s ATH Depends on Bitcoin and Whales, Says Analyst

Ethereum price has faced several attempts to break free from the consolidation range it has been stuck in since early August, hovering around $2,700.

However, a recent rally sparked by Bitcoin’s price increase could continue if Ethereum’s long-term holders (LTHs) maintain their positions rather than selling. This restraint from LTHs would be key in supporting Ethereum’s potential upward momentum.

Ethereum Whales Are Active

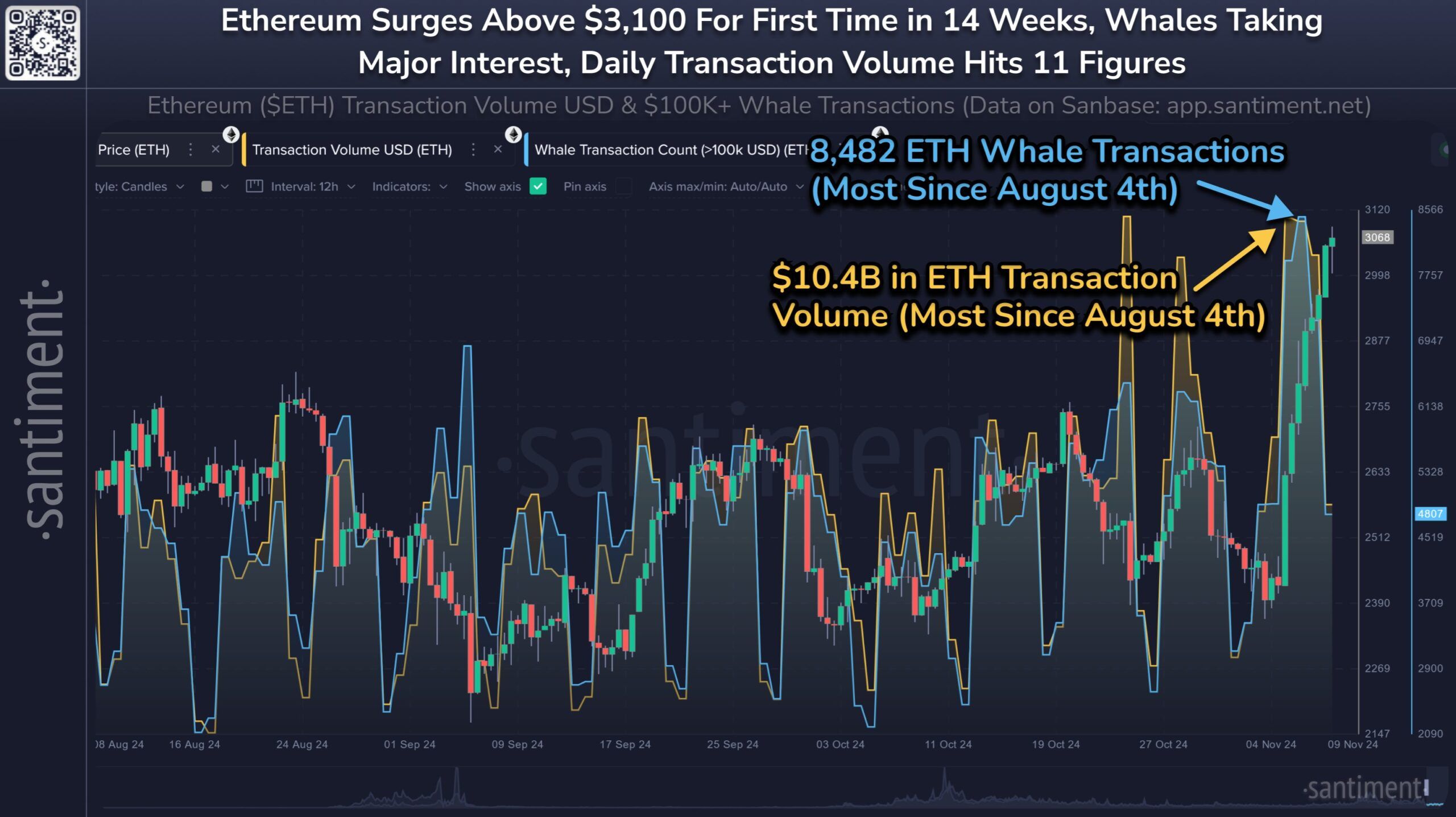

Ethereum whales‘ activity has surged to a 14-week high, signaling increased interest among large-scale investors. Over the last week, transactions exceeding $1 million have climbed to 8,482 — the highest since August. Alongside this, whale transaction volume surpassed $10.4 billion, highlighting the importance of these large wallet holders. Their actions often have a considerable impact on Ethereum’s price, providing stability and driving momentum.

“Expect any growth from Bitcoin, during this bull run, to see profits redistribute into Ethereum and potentially push it toward its own all-time high while its network activity looks very healthy,“ says Santiment.

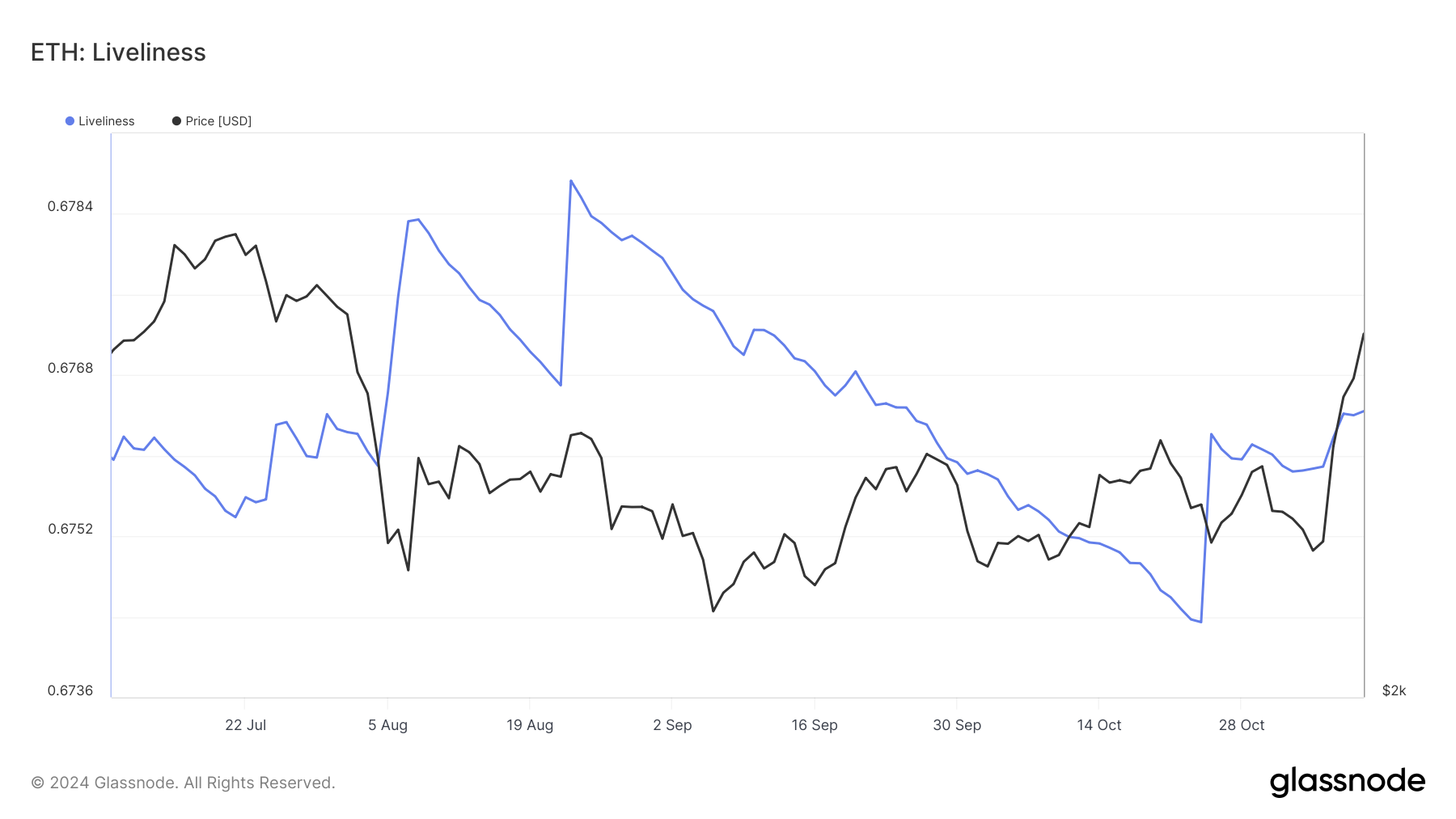

Ethereum’s macro momentum is also influenced by an increase in its “Liveliness” metric, which tracks the behavior of long-term holders. When Liveliness rises, it indicates LTHs are liquidating their positions, while a decrease shows accumulation. The recent uptick in Liveliness suggests that some long-term holders are booking profits amid Ethereum’s price rise, which may slow the rally if more decide to sell.

However, should Ethereum’s LTHs choose to hold rather than liquidate, the altcoin’s rally could gain more support. The activity among LTHs remains a double-edged sword: their selling provides liquidity but also raises the risk of downward pressure on the price. Therefore, Liveliness remains a critical factor to watch as it reflects whether LTHs will bolster or hinder Ethereum’s growth.

ETH Price Prediction: Remaining at a High

Ethereum’s price has risen by 31.8% in the past five days, currently trading at $3,193. The next resistance level for Ethereum is $3,327, which it must breach to maintain its upward momentum. Surpassing this resistance would signify renewed strength in the market and set Ethereum up for further gains.

If bullish momentum holds, Ethereum could flip the $3,327 resistance into a support level, potentially pushing the altcoin to $3,524. This additional rally would depend on the sustained buying interest from both retail and whale investors, further enhancing Ethereum’s price stability.

However, if LTHs continue to liquidate, Ethereum may struggle to break the $3,327 level, possibly resulting in a decline towards $2,930. A drop below this support would invalidate the current bullish outlook, signaling caution among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.