Market

Ethereum Foundation Criticized For $100 Million ETH Transfer

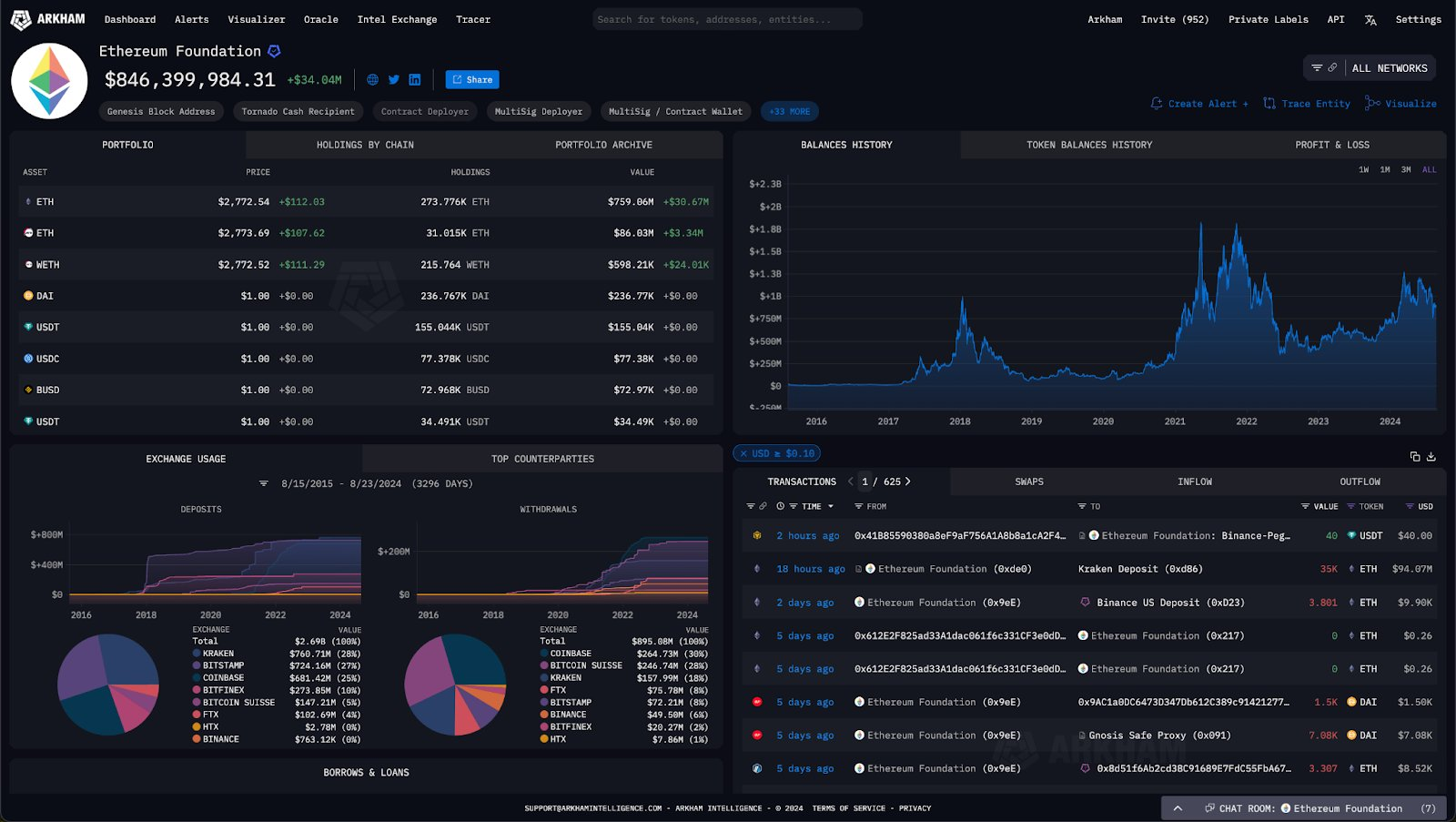

The Ethereum Foundation is under fire for transferring 35,000 ETH, worth about $100 million, to the Kraken exchange without informing the community. On August 23, on-chain analytics firm Lookonchain reported the transaction, sparking widespread concern.

In response, Aya Miyaguchi, the Executive Director of the Ethereum Foundation, clarified that the transfer aligns with the Foundation’s $100 million annual budget. This budget supports grants and salaries, some of which require fiat payments. She explained that the Foundation couldn’t disclose the transaction beforehand due to regulatory constraints.

Despite Miyaguchi’s explanation, the crypto community remains divided. Many criticized the Foundation for not being transparent about its financial decisions.

Crypto lawyer Gabriel Shapiro noted that transparency and accountability shouldn’t lose significance because activities aren’t on-chain. According to him, the Foundation’s explanation does not hold water because it suggests that “the people with power over Ethereum don’t respect ETH as an investment anymore.”

“Enough is enough — this mentality is the biggest constraint on growth of the crypto industry as no one wants to invest in something with un-dependable value-drivers where those responsible for generating value to the asset are already too wealthy and have massive conflicts of interest,” Shapiro added.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Marc Zeller, founder of AaveChan, was also unimpressed by Miyaguchi’s explanation. He questioned the allocation of the $100 million budget, pointing out that some Ethereum teams, like Geth (Go Ethereum, a popular Ethereum client), receive minimal compensation.

“Once the Purge & Verge upgrades are delivered, it’s time to seriously consider defunding and dissolving the Ethereum Foundation,” Zeller stated.

Meanwhile, some community members defended the Foundation’s spending, citing the substantial resources needed to maintain Ethereum. Mudit Gupta, Polygon’s Chief Information Security Officer, argued that the Foundation’s $100 million annual expenditure is justified.

However, he criticized the heavy focus on tool development over on-chain applications. He questioned why the Foundation doesn’t explore more revenue streams, such as staking its billion-dollar ETH holdings.

“The Ethereum Foundation should be more transparent, open to other teams, explore new revenue streams, and invest more in promoting on-chain apps,” Gupta urged.

Former Ethereum Foundation employee Hudson James also defended the organization’s expenditure. According to him, the Foundation also incurs costs like global trademark protection, server maintenance, and research collaborations.

“The ~$100m budget per year is not crazy when you take into account everything the EF does. The reason people are having trouble grasping that number is because the EF’s structure and philosophy doesn’t lend itself to having every single initiative they contribute to and work on in a single place,” Jameson chimed.

Read more: How to Invest in Ethereum ETFs?

On its part, Arkham Intelligence pointed out how the Foundation selling activity impacts the market. The firm stated the Foundation has historically sold ETH at various price points, including near-market highs and lows. This pattern has fueled speculation that the recent transfer might signal either a market top or a potential price surge.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.