Market

Emory University Invests $15.8 Million in Bitcoin ETF Milestone

Emory University invested $15.8 million into Grayscale’s Bitcoin Mini Trust. According to ETF analysts, every type of institutional investor eligible to buy a Bitcoin ETF has now done so.

Grayscale’s Mini Trust is climbing in prominence, and the firm is still looking for new revenue streams.

Emory’s ETF Buy

According to Bloomberg ETF analyst Eric Balchunas, Emory University has purchased $15.8 million of Grayscale Bitcoin Mini Trust (BTC). He went on to state that this is the first time a university endowment purchased any of the Bitcoin ETFs, and therefore the whole asset class has hit an important milestone.

“Every institution type is now represented in the [ETFs]: (endowment, bank, hedge fund, insurance company, Advisor, Pension, private equity, holding company, venture capital, Trust, Family Office, Brokerage). Absolutely insane feat for a category less than a year old, akin to winning all four tennis grand slams before 16th birthday,” Balchunas stated.

Read more: What Is a Bitcoin ETF?

In other words, Bitcoin ETFs have dramatically changed traditional finance since their approval in January. This new ETF market already has a number of easily-visible gains, like billion-dollar inflows and continued regulatory approval. However, this full spectrum of institutional adoption is a totally independent sign of confidence. The ETFs’ appeal transcends the crypto space.

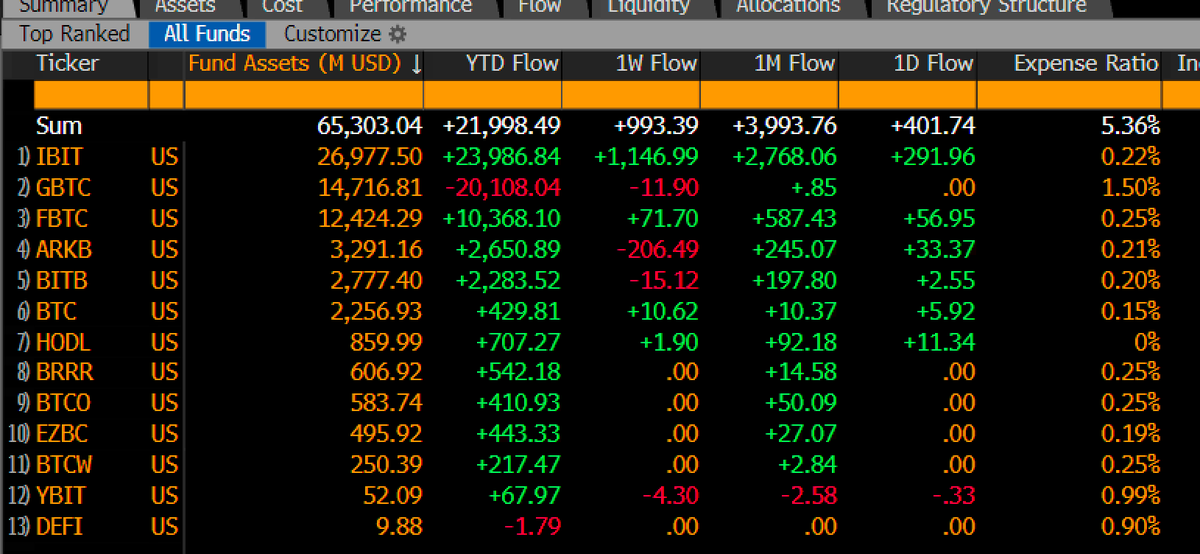

Grayscale launched its Mini Trust in July, boasting the lowest fees of all the various Bitcoin ETF offerings. This move came after BlackRock officially overtook Grayscale’s GBTC in May, cementing dominance that still continues today. BTC has been winning a new appeal nevertheless, and Emory is just one of these investors.

“$BTC [is] quietly moving up the charts, now in 6th place nipping at [the Bitwise ETF]’s heels. All told, Grayscale now positive net flows in past few months…in this category. There’s long history in ETFs of this low cost ‘mini-me’ move working. And it worked again,” Balchunas added.

Both of these ETF issuers have recently been exploring novel investment products in addition to these successes. Grayscale launched an investment fund based on AAVE in early October, and subsequently disclosed it was considering 35 other cryptoassets for similar products. BitWise, for its part, has been applying for a new ETF based on XRP.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

None of the issuers are resting on their laurels. Emory’s investment marks a milestone in the ETF market, though it remains a small part of their overall endowment. Grayscale, managing two of the largest ETFs, continues seeking new opportunities, while BlackRock, leading the pack, has recently made substantial new investments. For the ETFs, innovation is a top priority.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.