Market

Crypto Wallet Users at All-Time High, Stablecoins Thrive

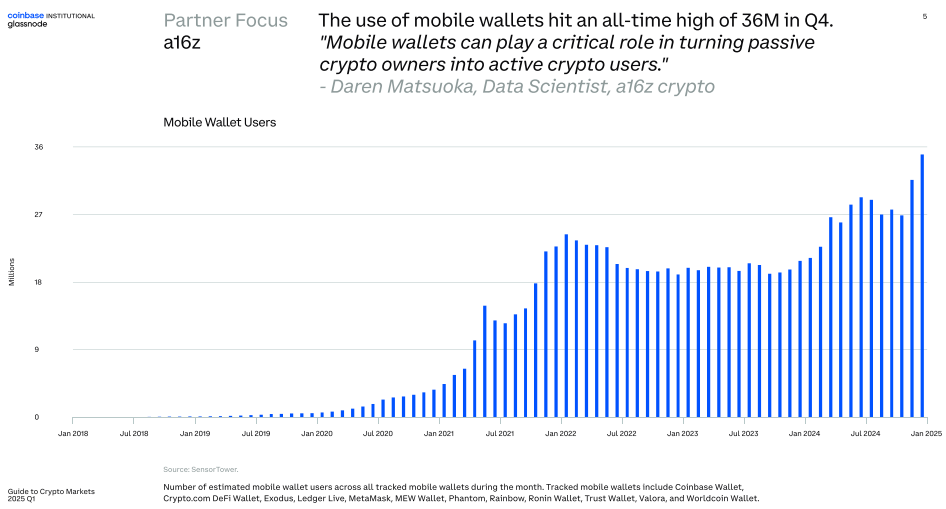

Cryptocurrency mobile wallet adoption reached an all-time high of 36 million active users in the fourth quarter (Q4) of 2024.

Meanwhile, stablecoins recorded a significant surge in supply, with both trends signaling a broader transformation in how individuals interact with cryptocurrencies.

Coinbase Report Role of Mobile Wallets in Crypto Engagement

According to Coinbase’s Q1 2025 market report, released on January 29, mobile wallets are crucial in driving increased interaction with digital assets. This trend highlights a growing shift from passive crypto ownership to active engagement in blockchain-based applications and decentralized finance (DeFi) protocols.

“Mobile wallets can play a critical role in turning passive crypto owners into active crypto users,” an excerpt in the report read, citing Daren Matsuoka, data scientist at a16z Crypto.

Historically, many cryptocurrency holders have limited their activity to simply storing their assets. However, the latest data indicates that more users are actively participating in DeFi, non-fungible tokens (NFTs), and other blockchain-based services.

As more users shift from holding to actively engaging with digital assets, the crypto market is likely to see increased innovation and mainstream adoption. With institutional investors closely monitoring market trends and retail users embracing decentralized applications (dApps), the future of mobile wallets appears to be one of continued expansion and influence in the digital economy.

Meanwhile, a parallel report from Triple-A shows there were approximately 560 million total crypto holders worldwide. Taken together, the surge reflects broader mainstream acceptance and confidence in the crypto economy.

“As of 2024, we estimated global cryptocurrency ownership at an average of 6.8%, with over 560 million crypto owners worldwide,” the report said.

While the rise in mobile wallet adoption is encouraging, security threats remain a persistent challenge. A recent scam involving fake XRP wallets linked to the US Treasury has been spreading across social media.

As BeInCrypto reported, the scam misled unsuspecting users into transferring their funds to fraudulent accounts. This scam reflects the need for enhanced security measures and user vigilance in the fast-paced crypto market.

Despite security risks, the increasing engagement with mobile wallets and blockchain technology represents a significant step toward a more integrated and accessible financial future for cryptocurrency users worldwide.

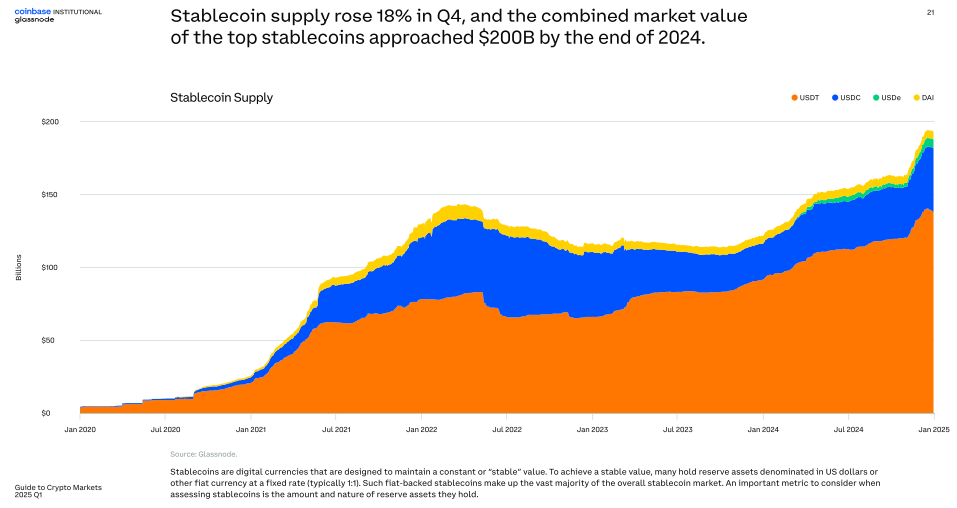

Stablecoin Supply Rose Over 18% in Q4

In the same tone, the Coinbase report highlights the growth of stablecoins in 2024, with supply rising by 18%. According to the report, it nearly surpassed the $200 billion mark before the end of the year. Growing stablecoin supplies can signal incoming crypto buying pressure and growing investor appetite, as stablecoins serve as the primary on-ramp from fiat into the crypto market.

Further, stablecoin trading volume saw a significant surge, increasing more than threefold to $30 trillion during 2024. In December alone, trading volume exceeded $5 trillion, coinciding with Bitcoin’s historic rally to $100,000.

Additionally, stablecoin inflows to crypto exchanges reached a record monthly high of $9.7 billion on November 21. This was just two weeks before Bitcoin broke the $100,000 mark for the first time in crypto history.

Nevertheless, while stablecoins are poised for broader adoption, clearer crypto regulations will be crucial in promoting financial inclusion. The report emphasized that the framework for using stablecoins in remittances, digital capital markets, and financial services for the unbanked or underbanked is now in place.

“The stage has now been set for broader adoption of stablecoins in remittances, digital capital markets, and financial services for the unbanked or underbanked,” the report read.

This aligns with recent remarks from Circle’s Chief Business Officer. In a statement shared with BeInCrypto, Kash Razzaghi highlighted how stablecoins are reshaping high-inflation economies, providing an alternative to volatile local currencies.

“This can be particularly helpful for businesses in the region that struggle with high cross-border payment costs and unstable local currencies while allowing workers to be paid quickly and affordably in US dollars,” Razzaghi told BeInCrypto.

Meanwhile, Binance and Hashed CEOs Richard Teng and Simon Kim, respectively, predicted that stablecoins will be a key trend in 2025.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.