Market

Crypto Venture Funding to Hit $18 Billion in 2025

Crypto venture capital funding is projected to reach approximately $18 billion in 2025, according to a PitchBook analyst.

This is because, following Donald Trump’s victory, venture capitalists are anticipating a favorable regulatory environment.

2025 Crypto Investments Set to Soar

In an interview with CNBC, analyst Robert Le predicted $18 billion in crypto investments in the new year, citing the return of ‘generalist’ investors following Bitcoin’s post-election rally. This represents a 50% jump from 2024 levels.

“Our prediction is we’re going to see $18 billion or more in venture capital dollar in 2025,” said Robert Le of PitchBook.

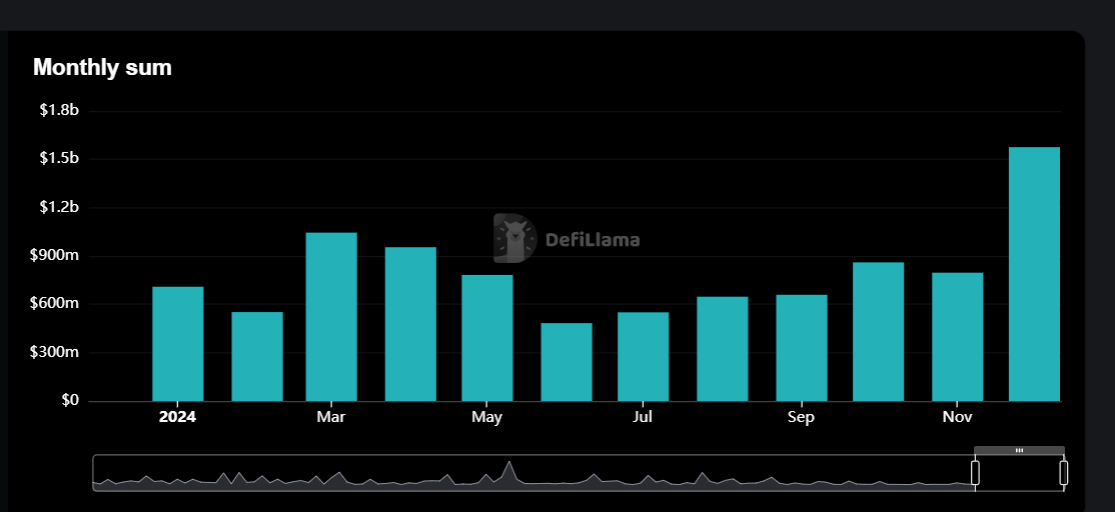

Talking about funding in 2024, Le said that Q1 saw a good amount of investments after Bitcoin ETFs were approved. The positive sentiment drove venture capitalists to the market.

However, investments slowed down later as Bitcoin staggered amid a summer slump.

Robert Le further observes that multiple favorable conditions have been set for the return of investors in 2025.

“The setup looks great, there is expectation that regulatory environment is going to be more favorable, macroeconomic environment looks pretty decent, and a lot of the tokens, Solana, Bitcoin, they all hit their ATHs or surpassed it. Our prediction is we’re going to see $18 billion or more in venture capital in 2025 which will amount to 50% increase compared to last year.” Le explained.

However, the $18 billion figure is much less than the $33 billion in investments made in 2021. According to Galaxy Research, venture capitalists invested more than $33 billion into crypto/blockchain startups in 2021, of which $22 billion went to fundraising rounds.

Moreover, crypto startups received almost 5% of venture capital distributed in 2021.

In the conversation with CNBC, Robert Le also talked about how in 2025, more traditional financial institutions will be entering crypto. He said tradfi has a more ‘trusted’ relationship with regulators. This could help lend more credibility to the crypto space.

“We’re speaking to some of the large firms, and they’re all interested in crypto again. So we’re going to expect to see them start investing in crypto next year as well, and that’s going to be a big driver. More traditional financial institutions will enter into the space, and that’s going to add a lot more credibility and trust in crypto,” Le added.

Another interesting point was that the focus of investments will change in 2025. Le said that in the last two years, a lot of investments were made in the infrastructure side. So, in the next year, investments will be made to strengthen the application layer to lure in more users.

When it comes to regulators, Le said that if the SEC writes new crypto rules, that would be beneficial. However, Le further added that, even if they do nothing positive, that is still much better than the strict enforcement over the last two years.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.