Market

Crypto Inflows Hit $436 Million on Anticipated Fed Rate Cuts

Digital asset investment products recorded $436 million in inflows last week, a paradigm shift after a series of outflows reaching $1.2 billion.

Crypto markets have much to anticipate this week, with a key moment on Wednesday as the Federal Open Market Committee (FOMC) decides the scale of September’s interest rate cuts.

Crypto Investments Inflows Reach $436 Million

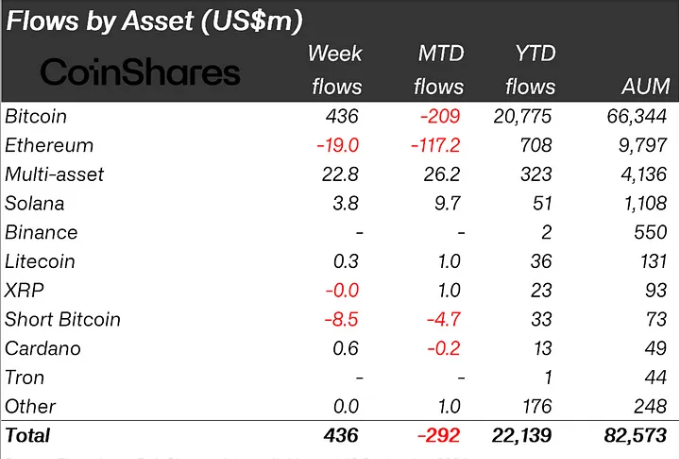

Bitcoin (BTC) led crypto inflows last week, bringing in up to $436 million and reversing the negative flows from the week ending September 6. In contrast, Ethereum (ETH) continued to experience negative flows, with $19 million in outflows following the $98 million outflows recorded the previous week.

The latest CoinShares report attributes Bitcoin’s positive inflows to expectations of a 50 basis point (0.50%) rate cut. Regional inflows support this theory, with the US leading the way, accounting for up to $416 million.

Specifically, comments from Bill Dudley fueled optimism. The former New York Fed President stated on Thursday that there was a strong case for a 50 basis point interest rate cut.

“I think there’s a strong case for 50, whether they’re going to do it or not,” Dudley said at the Bretton Woods Committee’s annual Future of Finance Forum in Singapore.

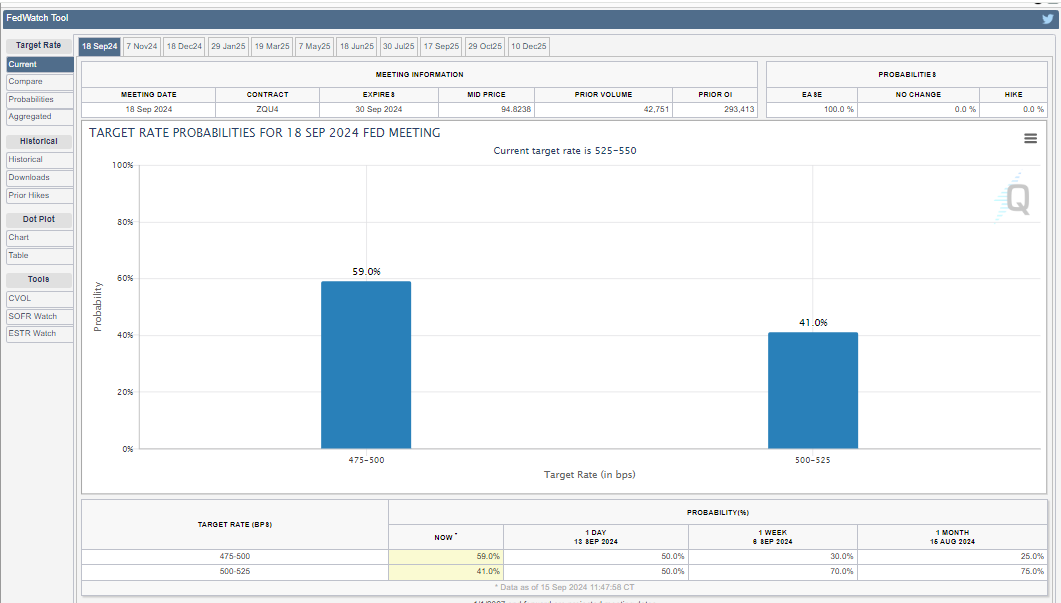

The FOMC’s interest rate cut decision on Wednesday is a key event that crypto markets will closely watch this week. Traders and investors are preparing for the impact on their portfolios, depending on the policymakers’ chosen rate cut. Data from the CME FedWatch Tool shows a 59% probability of a 50 bps rate cut, compared to a 41% chance of a 25 bps cut.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

JPMorgan also advocates for a 50 bps interest rate cut, but uncertain times lie ahead for Bitcoin regardless of whether the cut is 50 or 25 bps. A 25 bps cut is already priced in, while analysts caution that a heavier 50 bps cut could negatively impact Bitcoin.

Regardless of the outcome, markets are eagerly awaiting Wednesday’s FOMC decision, which could bring the first rate cut since early 2020.

Rotation of ETFs Is Growing

Meanwhile, CoinShares reports that trading volumes in exchange-traded funds (ETFs) remained flat at $8 billion last week. However, Eric Balchunas notes that data shows a surge in flows into value ETFs, reaching $11.4 billion over the past 30 days. This reflects a significant shift of capital toward these financial instruments.

“If we do rolling 30 days the flows into value ETFs are $11.4b, which is huge. While many value ETFs have taken in cash a big chunk of this is via BlackRock’s model portfolio which rotated heavily into EFV,” Balchunas added.

The ETF expert acknowledges that several value ETFs have benefited from the recent influx of cash, with a significant portion attributed to BlackRock’s model portfolio. Balchunas highlights the growing rotation into value ETFs, citing $5.6 billion in inflows in the first two weeks of September.

He compares this surge to the “Great Head Fake of Late 2020,” when markets experienced an unexpected shift in trends. During that period, growth stocks, particularly in the tech sector, significantly diverged in performance from value stocks, surprising many investors.

It remains uncertain whether this value rotation will continue to strengthen or face obstacles, particularly from the dominance of tech-heavy ETFs like Invesco NASDAQ Futures (QQQs). Balchunas questions the longevity of the shift, given the continued appeal of technology-focused investments.

Reflecting on the “Great Head Fake,” which prompted a reassessment of traditional strategies and debates about its sustainability, the current rotation raises similar questions. Whether this rotation will endure or face challenges from competing investment themes is yet to be determined, but it presents a compelling development for investors to closely monitor.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.