Market

Crypto Industry Losses Top $1 Billion Due to Major CeFi Hacks

According to a recent Immunefi report, the crypto industry has faced significant financial setbacks since the beginning of 2024. Losses due to hacks and fraud have exceeded $1.19 billion.

The losses recorded in the first seven months of this year showed a notable 16.3% increase compared to the same period in 2023, when losses amounted to $1.02 billion. These numbers highlight the persistent and growing threat cybercriminals pose to the crypto industry.

CeFi Suffers Most as Crypto Losses Skyrocket in July

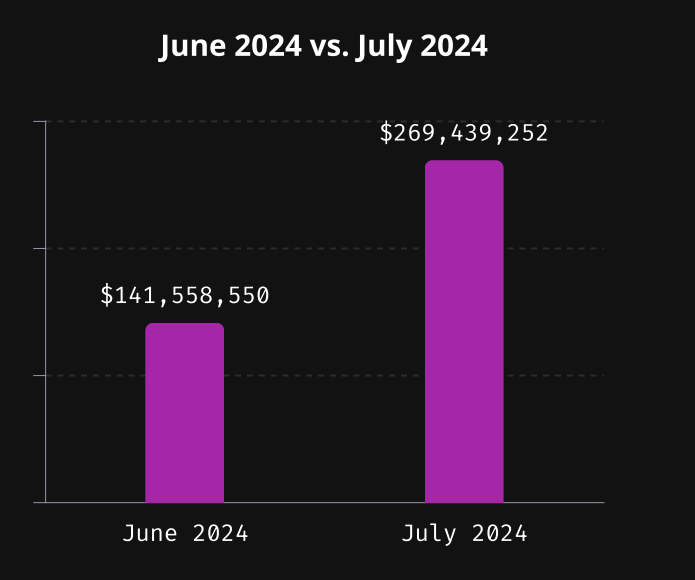

In July, Immunefi reported that the crypto sector suffered losses of $269.4 million in 14 separate incidents. This reflects a 90% increase from June, making July the second most damaging month of 2024. The most significant losses were in May, reaching $358 million.

Despite the monthly rise, the year-over-year comparison shows a 15.9% decrease in July losses. The bulk of these recent losses can be attributed to a major hack on the Indian centralized exchange WazirX, which suffered a devastating $235 million loss.

Read more: 15 Most Common Crypto Scams To Look Out For

Centralized finance (CeFi) has borne the brunt of these attacks, surpassing decentralized finance (DeFi) in terms of the total volume of funds lost. In July, CeFi accounted for 87% of the total losses, while DeFi platforms saw $34.4 million in losses spread across 13 incidents.

Furthermore, the report pointed out that hacks remain the predominant cause of these losses, with $266.5 million lost to such incidents in July alone. In comparison, fraud and scams only accounted for 1.1% of the total losses for the month.

Immunefi’s report also sheds light on the involvement of North Korean hacker groups, particularly the notorious Lazarus Group, in some of the most significant attacks. The WazirX hack, for instance, is suspected to be orchestrated by North Korean hackers.

The report reveals that Ethereum and BNB Chain were the most targeted blockchain networks in July. These blockchains collectively accounted for 71.4% of the total losses. Ethereum alone suffered seven attacks, representing half of the total incidents, while BNB Chain experienced three significant breaches.

ChainSwap’s founder and CEO, Fitzy, shared his perspective with BeInCrypto regarding this situation. He acknowledges that while Web3 technology drives innovation, it also opens avenues for financial crimes and fraud. He clarifies that Web3 tools aren’t inherently criminogenic but rather are exploited as new mediums by scammers.

“Web3 tools do not cause crime, it is just used as a new medium to commit some scams. The common thing across all these mediums is that the best way someone can protect themselves from scams and fraud is to proceed with caution. Victims of scams and fraud are usually the ones who do not know any better,” Fitzy explained.

Additionally, Slava Demchuk, CEO of AMLBot, pointed out that the significant losses due to hacker attacks and fraud in this industry show the urgent need for strong security measures. He suggested that beyond implementing general software security and encryption, conducting frequent audits and penetration tests is crucial.

“Personal training in handling sensitive data and stricter employee hiring processes are crucial as well. For instance, the Fractal ID hack exposed vulnerabilities in KYC data handling, leading to leaked information on the dark web. Similarly, the Coinspad hack illustrated the risks associated with inadequate employee vetting when a new, well-paid employee exploited the system from within,” Demchuk said.

Read more: Top 5 Flaws in Crypto Security and How To Avoid Them

Echoing Demchuk, Fitzy also cautioned individual investors to protect themselves from scams and fraud, particularly in decentralized applications.

“For centralized companies and systems, governments need to find new ways to monitor activities for this new asset class and companies around it. For decentralized applications, the best way for people to stay safe is to have caution and knowledge for themselves. Indicators like volume, number of people in the community, credible founders or partners – are all good indicators for an application that is likely safe to use,” he added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.