Market

Coinbase Finds FDIC Advised Banks to Limit Crypto Services

Coinbase has uncovered more than 20 instances in which the United States Federal Deposit Insurance Corporation (FDIC) advised banks to avoid offering crypto-related services.

On November 1, Coinbase’s Chief Legal Officer, Paul Grewal, reported finding at least 23 FDIC letters that discourage banks from engaging in crypto-related activities.

FDIC Has Been Cautioning Banks Against Crypto Since 2022

Grewal explained that this discovery resulted from the firm’s recent Freedom of Information Act (FOIA) request. This initiative aimed to examine the FDIC’s influence on US banks’ decisions regarding crypto services and the regulator’s role in Operation Chokepoint 2.0.

Grewal emphasized the concerning nature of these letters, calling them a “shameful example” of government agencies aiming to limit financial access to crypto companies. He underscored the public’s right to transparency rather than a regulatory body operating “behind a bureaucratic curtain.”

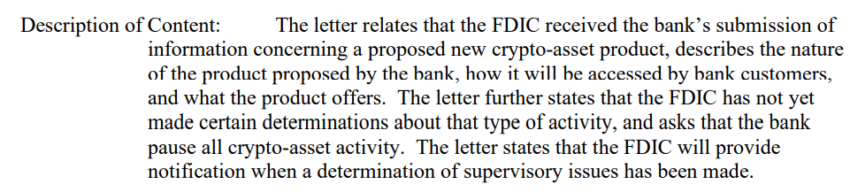

The FDIC’s Vaughn Index details a series of communications in which the agency warns banks of perceived risks associated with crypto. The documents cite concerns around consumer protection, financial stability, and institutional security. As early as March 2022, the FDIC was already advising some banks to hold off on new crypto initiatives pending further assessments on safety and compliance.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

Another document from March 2022 records the FDIC recommending that a bank “pause all crypto asset-related activity” as it reviewed potential safety risks tied to crypto services. In another document from September 2022, the FDIC advised a bank to delay crypto services for its customers while it evaluated crypto’s potential effects on safety, stability, and consumer protection.

Crypto advocates have expressed disapproval over these findings. Chronicle Labs founder Niklas Kunkel criticized the FDIC’s approach, stating it contradicts earlier claims from Deputy Treasury Secretary Wally Adeyemo.

“Shameful and in direct contrast to a statement Deputy Secretary of the Treasury Wally Adeyemo made in August. Having a policy is one thing, lying about your policy is just absurd. Operation chokepoint 2.0 is ongoing,” Kunkel stated.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

Similarly, Mike Belshe, the CEO of crypto custodial service provider BitGo, stated that the firm “knew this was the case” of the regulator deliberately stopping the traditional financial institutions from providing services to the emerging industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.