Market

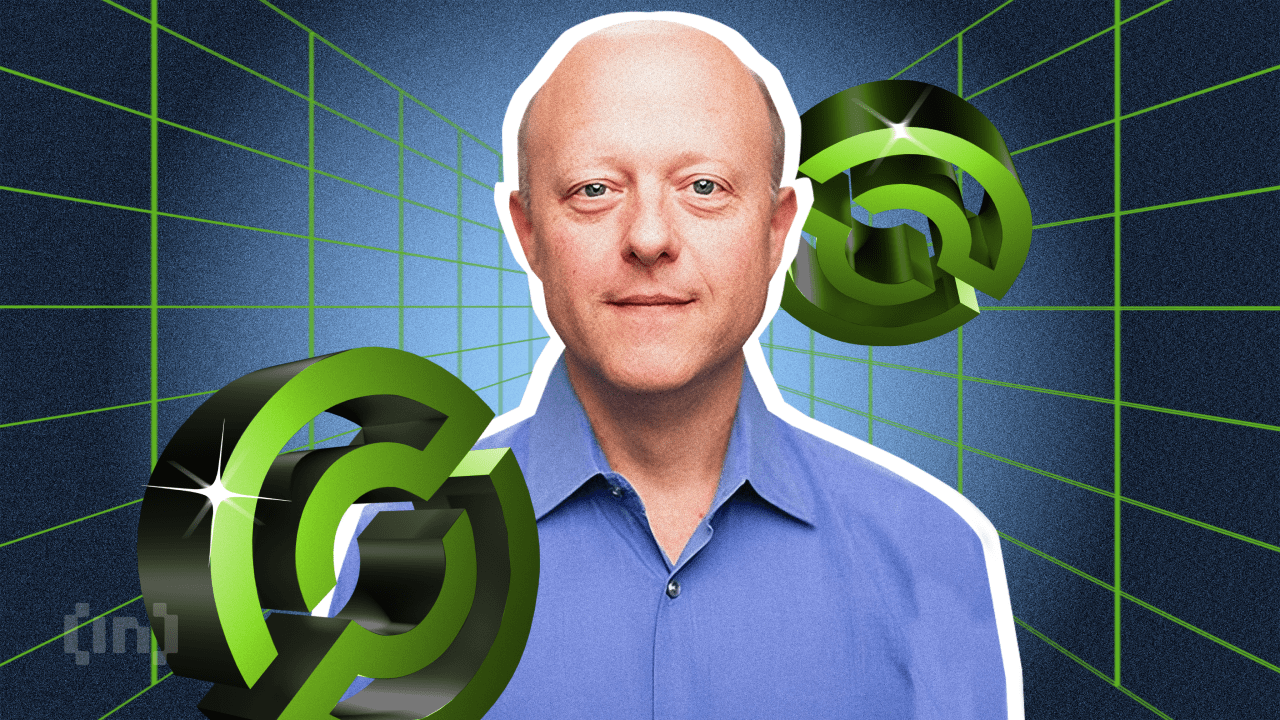

Circle CEO Jeremy Allaire Praised Brasil Crypto Industry

Jeremy Allaire, CEO of Circle, the issuer of the USDC stablecoin, announced new partnerships with industry giants during his visit to Brazil.

Allaire noted that the adoption of cryptocurrencies and stablecoins is still in its early stages.

Circle Officially Enters Brazil, BTG Pactual Will Issue USDC

During his visit to Brazil, Circle’s chairman signed a partnership with BTG Pactual. This means one of Latin America’s largest investment banks will now offer USDC to the market through the local banking system.

“BTG will be our direct liquidity partner for the minting [registration within the blockchain] of USDC 24 hours a day, seven days a week. This means that on a retail and institutional level, companies and investors will be able to almost instantly issue and receive USDC in Brazil using the real in the local banking system,” Allaire said.

The executive with over two decades of experience stated that the partnership with BTG “represents a tremendous milestone.”

“We are still in the early stages and at the beginning of the wider use of digital dollars, we are at the beginning of the wider use of blockchain in the financial system,” he stated.

Read more: Top 12 Crypto Companies to Watch in 2024

Allaire told a small group of journalists in São Paulo that he is certainly excited to see wider adoption by end users. He expressed enthusiasm about the growing number of financial institutions, fintechs, and payment companies gaining access to this infrastructure in Brazil. While these partnerships are important, he noted that Brazil has a much larger overall number of financial institutions and fintechs.

“We want to grow this and I think now we have the real infrastructure, the financial infrastructure, we have the key partners that can really grow this. I think it’s really the beginning and it’s about enabling, you enable thousands of institutions here in Brazil to be able to use this infrastructure,” Circle CEO commented.

BTG CEO Roberto Sallouti stated during the Circle meeting that blockchain is likely the future path for the institutional and financial systems. Jeremy Allaire echoed this sentiment in his discussion with reporters. The CEO highlighted the success of the Central Bank’s PIX system, which now has over 160 million users. He noted that Brazil, with leaders like Roberto Campos Neto, has a progressive approach to advancing financial technology and initiatives like Drex.

“We are committed to making a positive impact on the Brazilian market and partnering with key stakeholders to enable companies to participate in the global economy more easily and efficiently. There are many powerful opportunities on the horizon when Brazil’s advanced fintech ecosystem converges with the world’s most accessible dollar platform,” Circle co-founder said.

Brazil Will Become a Major Crypto Player

Jeremy Allaire explained that Circle initially launched USDC in Singapore due to strong Asian demand. Nevertheless, he now sees Brazil as a major global player.

“People know that Asia is a huge hub for this activity, but when we look at other markets, we look at Brazil,” he stated.

According to Allaire, the proactive stance of Brazilian regulators, such as the Central Bank, has attracted Circle’s attention. Besides partnering with BTG, Circle has also teamed up with Nubank and Mercado Bitcoin.

When asked if the United States lags behind Brazil in digital currency adoption, Jeremy Allaire noted that the US has the largest financial system in the world and the most to lose from inaction. However, he also mentioned that the US government might prefer to wait “until things are more developed before taking the next steps.”

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

“This is a slow-moving trend. But at the same time, there has been a particular environment around fintech innovation. And I consider Circle to be one of them. They were built under an American regulatory regime, and so there has been a lot of progress,” Allaire noted.

Regarding the US presidential race, Jeremy Allaire mentioned Donald Trump, noting that the Republican candidate often supports cryptocurrencies. Circle CEO also pointed out that Trump opposes the digital dollar (CBDC).

“Regardless of who wins the presidential election in the United States, we’re going to see more constructive, bipartisan work to regulate the sector. There may be some differences of opinion here or there, but I think the general direction is, regardless, towards good regulation,” he concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.