Market

Chainlink Price’s 40% Surge Could Be Undone by Investor Activity

Chainlink’s (LINK) recovery has been excellent, and the altcoin is aiming to regain all the losses from late July.

But there is a bump in the road that, surprisingly, could be the result of the intense bullishness.

Chainlink Is Suffering From Success

Chainlink’s price has been benefitting from the gradual recovery and is now enjoying the optimism from large wallet holders. Whales have recently observed their first significant inflows since the beginning of August.

The wallets that hold at least 0.1% of the entire circulating supply of LINK added over 3.4 million LINK in just two days. This $40 million uptick in flows has increased the overall inflows from 256,000 LINK to 3.71 million LINK. It indicates that the recent price rise has sparked renewed confidence among investors.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

The substantial increase in inflows suggests that the recent rally in Chainlink (LINK) has caught the attention of major market players. These investors are now taking positions based on the coin’s upward momentum. This growing confidence could signal a stronger bullish sentiment among the larger trading entities.

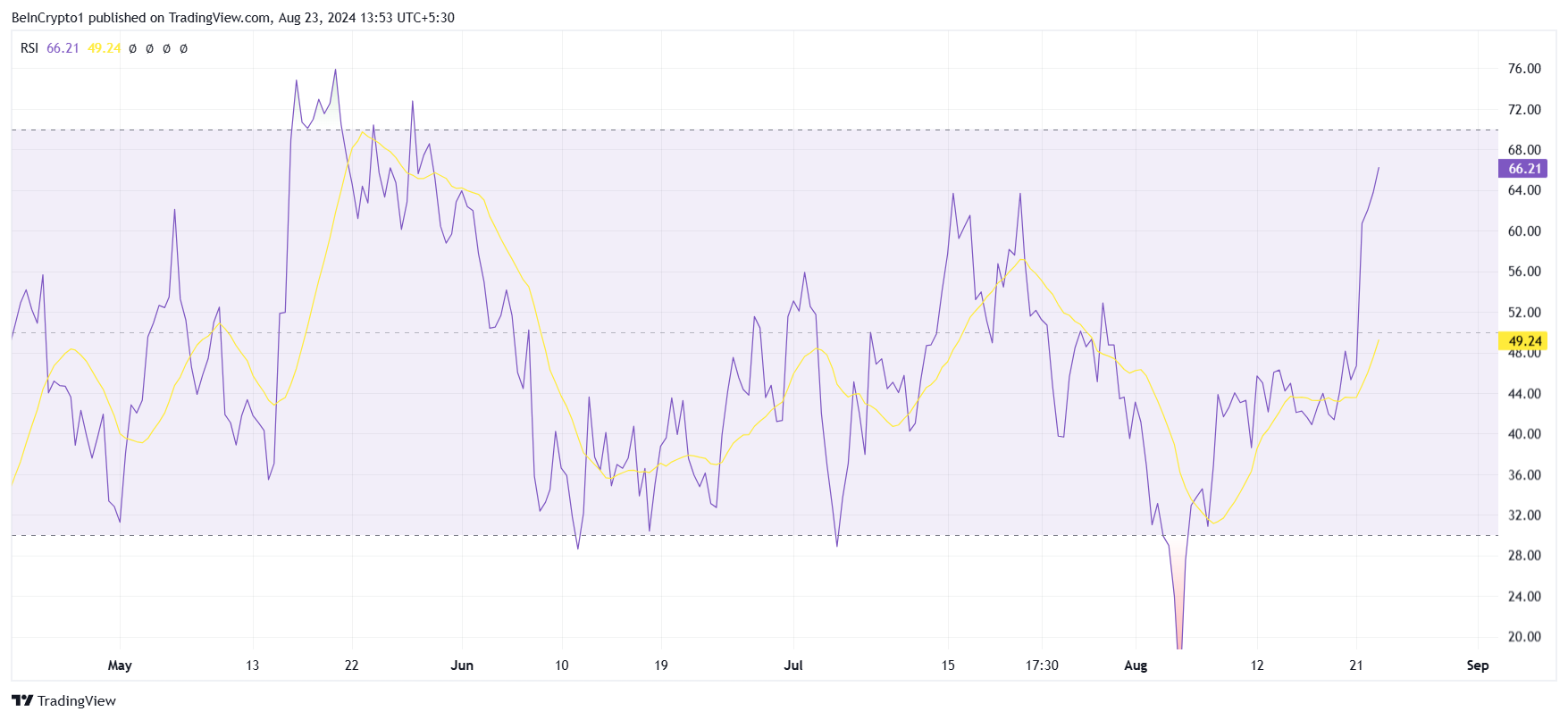

However, the Relative Strength Index (RSI) shows that LINK is approaching the threshold of the overbought zone. Any further increase in price propelled by the consistent accumulation from whales and other investors is risky.

This is because as LINK nears this level, there is a chance that the current rally could face a reversal. This is because the overbought zone is synonymous with price corrections and could put a dent in LINK’s 40% rise in two weeks.

LINK Price Prediction: One More Barrier

Chainlink’s price could recover a significant amount of profits lost in the July crash by flipping one resistance. Marked at $12.00, this level has been tested as support in the past.

However, since the RSI shows that the altcoin is at risk of being overbought, an attempt to breach $12.00 could fail. LINK could reverse the price rise and fall back under it, facing consolidation above $9.35.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

On the other hand, if bullish momentum dominates profit-taking, the altcoin could continue its uptrend. Breaching and testing $12.00 as support would enable Chainlink’s price to push beyond $13.00, invalidating the bearish thesis and ameliorating investors’ profits.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.