Market

Can Shiba Inu (SHIB) Avoid a September Price Collapse?

Shiba Inu (SHIB), the popular dog-themed meme coin, has seen its price drop by 44% over the last 90 days. This trend raises concerns that SHIB could face further decline, potentially trapping it in the historically weak performance known as the “September Slump.”

This on-chain analysis delves into the potential for further price drops and their possible impact on SHIB holders.

Shiba Inu Metrics Hint at Low Chance of Recovery

An assessment of Shiba Inu’s price performance shows that the last time it posted a monthly gain was in May. Since June, the situation has changed, with some market participants suggesting that the broader market might be sliding into a bear phase.

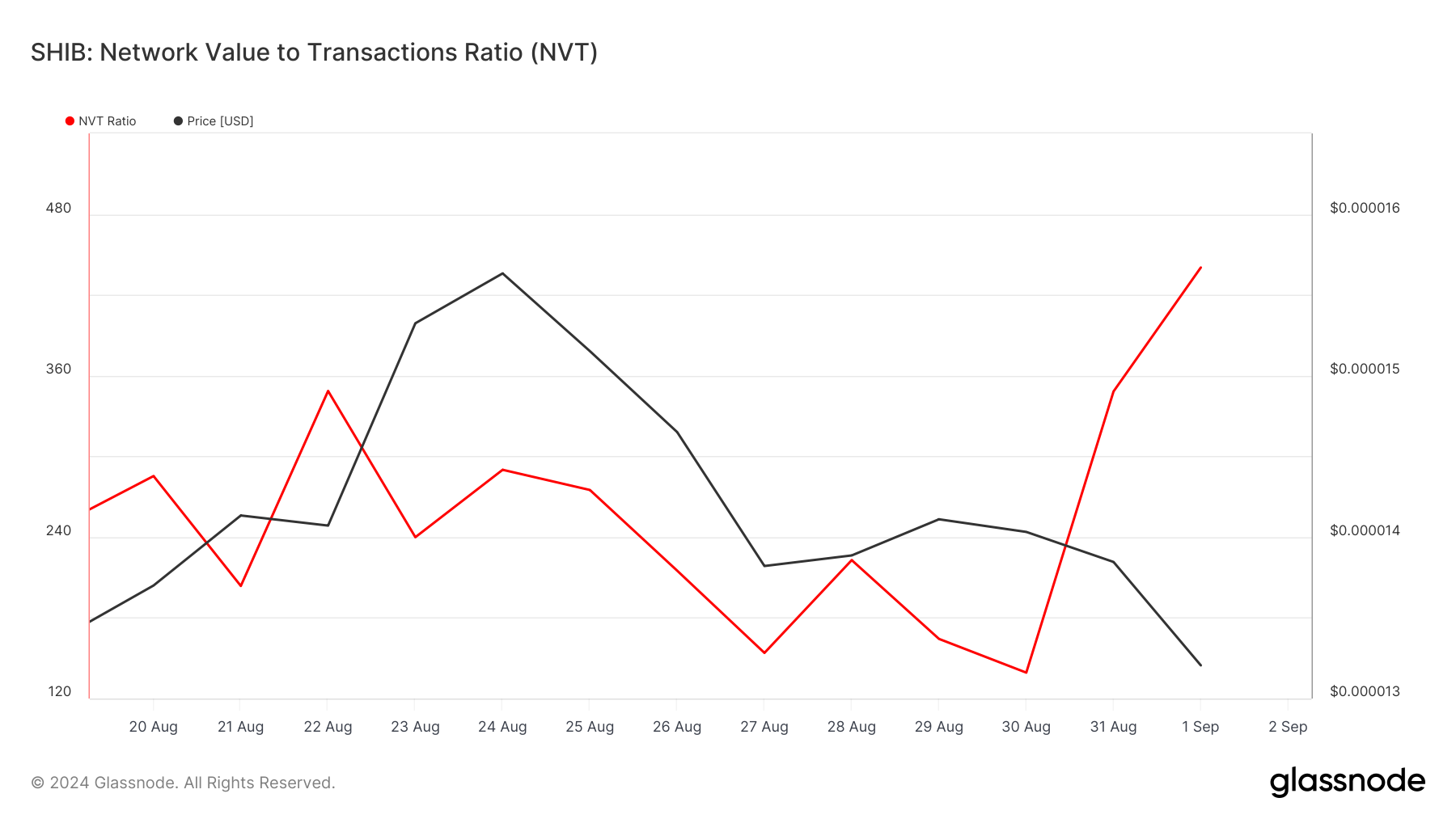

While some holders may be hoping for a better performance this month, the Network Value to Transaction (NVT) ratio suggests that the chances are slim. Additionally, historical data from the 2021 bull market shows that September has typically been a quiet or bearish month for SHIB.

The NVT ratio measures how quickly a cryptocurrency’s market cap is growing compared to the transaction volume on its blockchain. If the transaction volume is higher than the market cap, it could indicate that the cryptocurrency is undervalued.

Read More: 6 Best Platforms To Buy Shiba Inu (SHIB) in 2024

For SHIB, the NVT ratio has suddenly spiked, indicating that the market cap is growing faster than the value transacted on the network. This suggests that investors might be overvaluing SHIB as a high-return asset. However, this could create an unsustainable bubble, potentially leading to another price decline.

Additionally, SHIB’s Large Holders Netflow has dropped by 163% over the past seven days. The Large Holders Netflow measures the difference between the amount bought and sold by addresses that hold more than 1% of the crypto’s circulating supply.

An increase in the Large Holders Netflow metric typically signals that more SHIB is being bought than sold, which can lead to a price increase. However, for SHIB, the opposite is happening.

The ratio of SHIB holders currently at a loss stands at 44%. If this trend continues, the token might face a sharper correction, potentially pushing 50% of its holders into the red zone.

SHIB Price Prediction: Deeper Decline Ahead

On the daily chart, SHIB bulls look positioned to prevent a further drawdown, aiming to hold the support at $0.000012. However, the technical setup remains bearish, suggesting that it could be challenging to defend the zone successfully.

Additionally, the Chaikin Money Flow (CMF) indicator for SHIB has entered the negative territory. A higher CMF indicates more accumulation, but a decline, as seen in SHIB’s case, suggests increased distribution, meaning more tokens are being sold than bought.

SHIB’s current price is $0.000013, and it is trading below both the 20-day (blue) and 50-day (yellow) Exponential Moving Averages (EMAs). Trading below these EMAs is a bearish signal, indicating that SHIB could continue its decline if these trends persist.

Read More: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

Should this remain the same, SHIB’s price might drop to $0.000010 by the end of September. On the other hand, for a bullish reversal, buyers would need to push the price above the 20-day EMA. If successful, this could allow SHIB to retest the 38.2% Fibonacci level, potentially driving the price up to $0.000017 and even as high as $0.000020.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.