Market

Can Ethereum Price Break $3,300? Here’s What Needs to Happen

For the first time since September 27, Ethereum has surged past the $2,700 mark and is showing strong signs of maintaining its upward momentum. About ten days ago, ETH dropped below $2,400, sparking speculation that the cryptocurrency might struggle to break out again.

However, over the past seven days, ETH has surpassed key resistance levels. In this on-chain analysis, BeInCrypto reveals how this upward momentum could drive the price even higher.

Ethereum Sees Reduced Selling Pressure

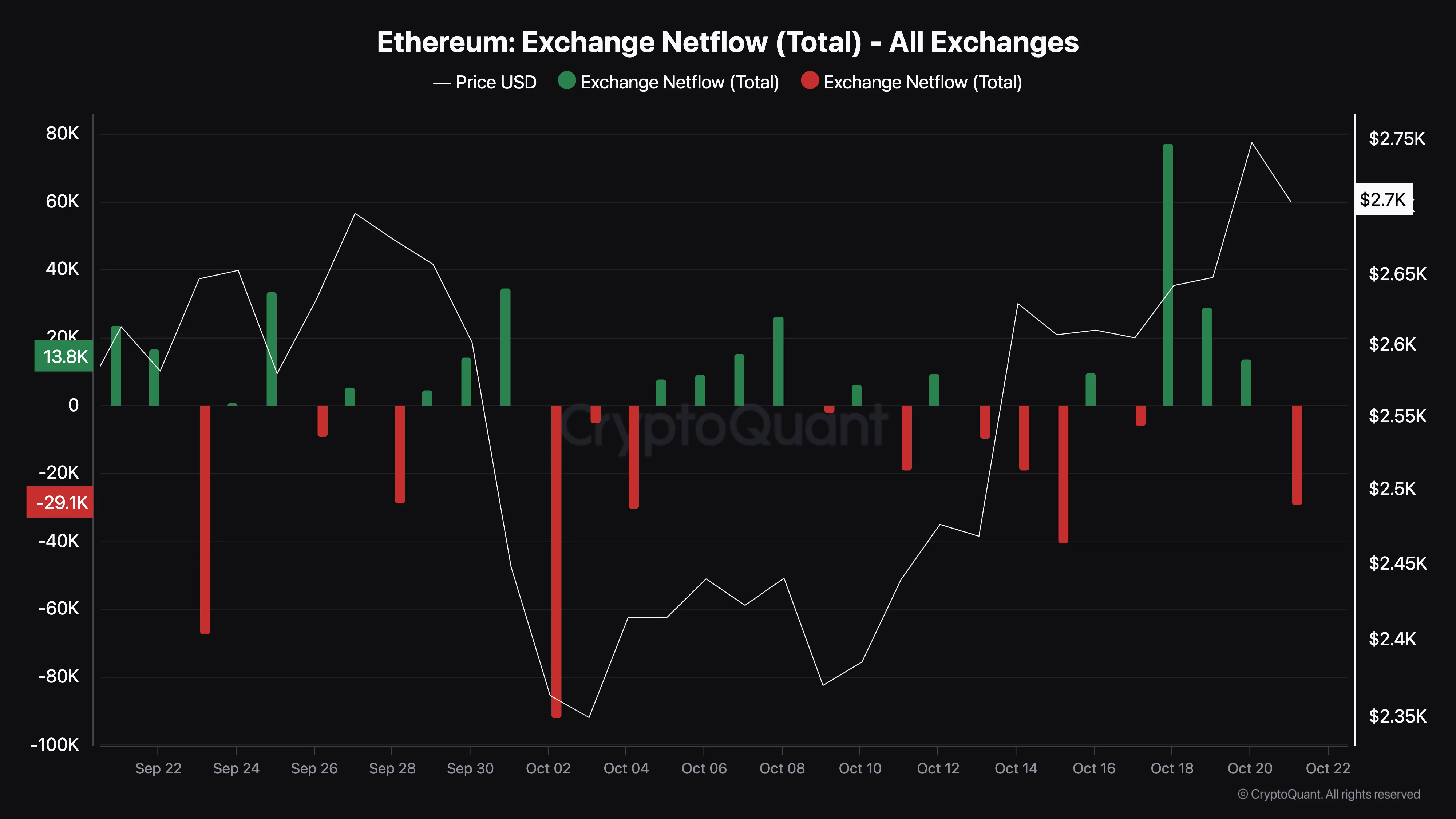

One indicator fueling this prediction is the Ethereum Exchange Netflow, which shows the amount of coins flowing in and out of exchanges. According to CryptoQuant, market participants have taken 29,378 ETH off exchanges as of this writing.

From a spot trading perspective, high values typically signal increased selling pressure. However, with approximately $80 million being removed, it suggests that ETH may not face significant selling pressure in the near term.

On the derivatives side, the decline points to low volatility, indicating that traders with open positions are less likely to face liquidations. When combined, this current condition could be bullish for Ethereum’s price.

Read more: Ethereum ETF Explained: What It Is and How It Works

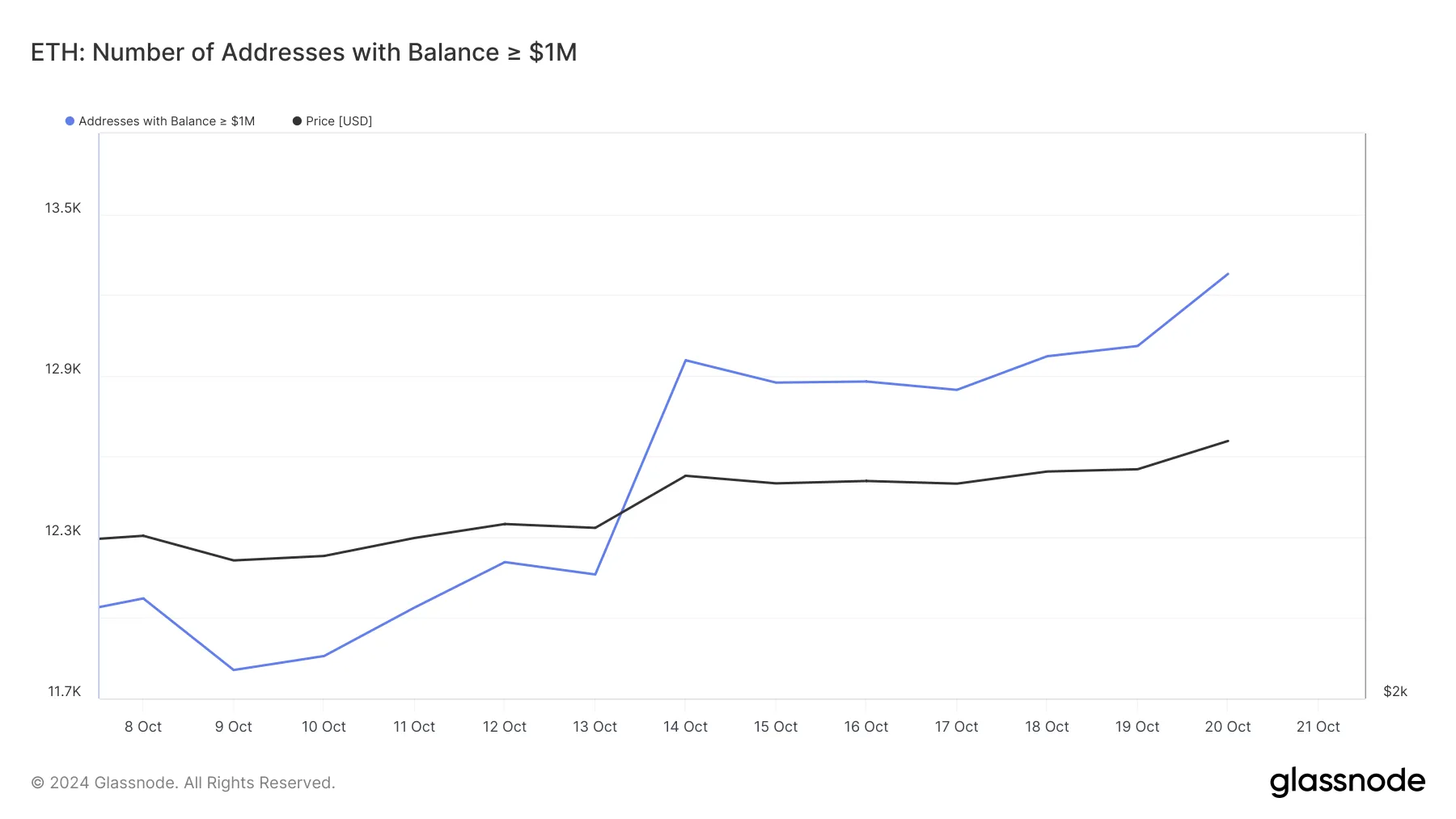

Another metric supporting the bullish outlook is the number of addresses holding ETH valued at $1 million or more. When this metric rises, it indicates that HODLers are accumulating more coins, reflecting bullish behavior. Conversely, a decline suggests that long-term holders are cashing out, typically signaling bearish sentiment

Based on Glassnode’s data, the number of addresses holding ETH worth $1 million and above has increased, suggesting that Ethereum’s price could avoid going through another drawdown.

Crypto analyst and founder of MN Consultancy Michaël van de Poppe shares a similar view. However, in his post, van de Poppe noted that ETH needs to rise above $2,770 to have any chance of surpassing $3,000.

“Ethereum might finally reverse. Breaking through the crucial resistance at $2,770 would be great. If that happens, the next target is $3,200, ” the analyst emphasized.

ETH Price Prediction: Bulls Must Defend $2,689 Support

A look at the daily chart shows that Ethereum’s price has broken out of a symmetrical triangle. For context, a symmetrical triangle is a chart pattern defined by two converging trendlines that connect a series of sequential peaks and troughs.

Usually, when an asset’s price breaks below the triangle, the asset’s price tends to fall further. For ETH, it is the other way around, suggesting that the value could continue climbing. But for that to happen, bulls have to defend the $2.689 support

Beyond that, buying pressure needs to increase so the price can climb above the resistance at $2,989. If that is the case, ETH’s price could rally to $3,316.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

However, this thesis could be rendered null and void if ETH falls below the aforementioned support line. In that scenario, the price could tumble to $2,471.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.