Market

BTC Price Holds Steady as Whale Activity Hits One-Year Low

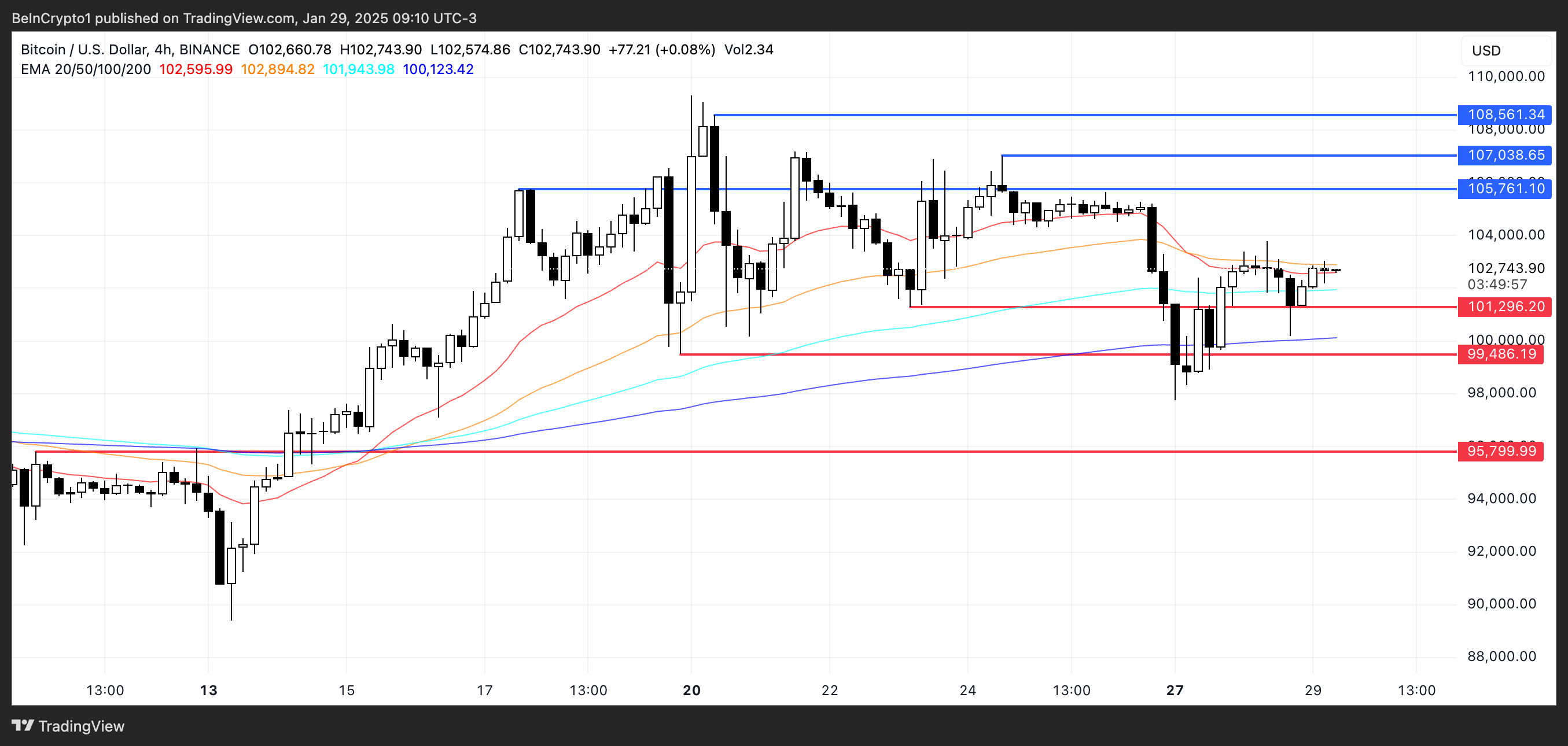

Bitcoin (BTC) price has been volatile, gaining 9% in the last 30 days but dropping 3% in the past week, with its market cap hovering around $2 trillion. Despite the recent downside, BTC appears to be consolidating, as its EMA lines trade closely together, and its DMI chart signals weak trend strength.

Meanwhile, the number of BTC whales has dropped to its lowest level in a year, suggesting some large holders have been offloading their coins. With key support at $101,300 and resistance at $105,700, BTC’s next move will be crucial in determining whether it continues consolidating or attempts a push toward $110,000.

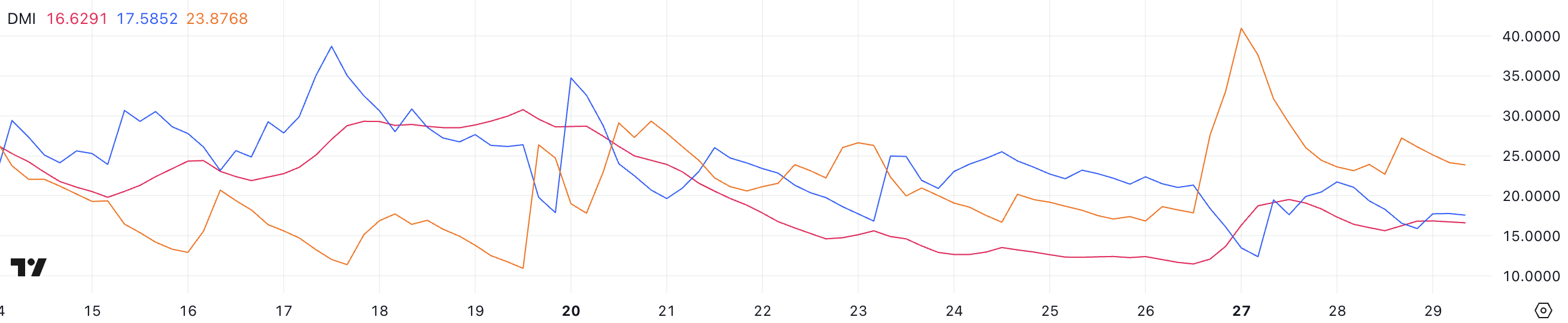

Bitcoin DMI Signals Uncertainty

Bitcoin DMI chart shows its ADX at 16.6, fluctuating between 15 and 19 over the past two days, signaling weak trend strength. ADX measures the strength of a trend, with values below 20 indicating consolidation and above 25 suggesting a stronger trend. Right now, BTC lacks clear momentum in either direction.

The DMI chart also shows +DI at 17.5 and -DI dropping to 23.8 from 27.2. Notably, -DI peaked at 40.9 two days ago when BTC fell from $105,000 to $98,600 in a few hours. This suggests bearish pressure has eased, and BTC is now consolidating.

If +DI crosses above -DI with a rising ADX, an uptrend could form. Otherwise, BTC price may stay range-bound or continue its previous downtrend.

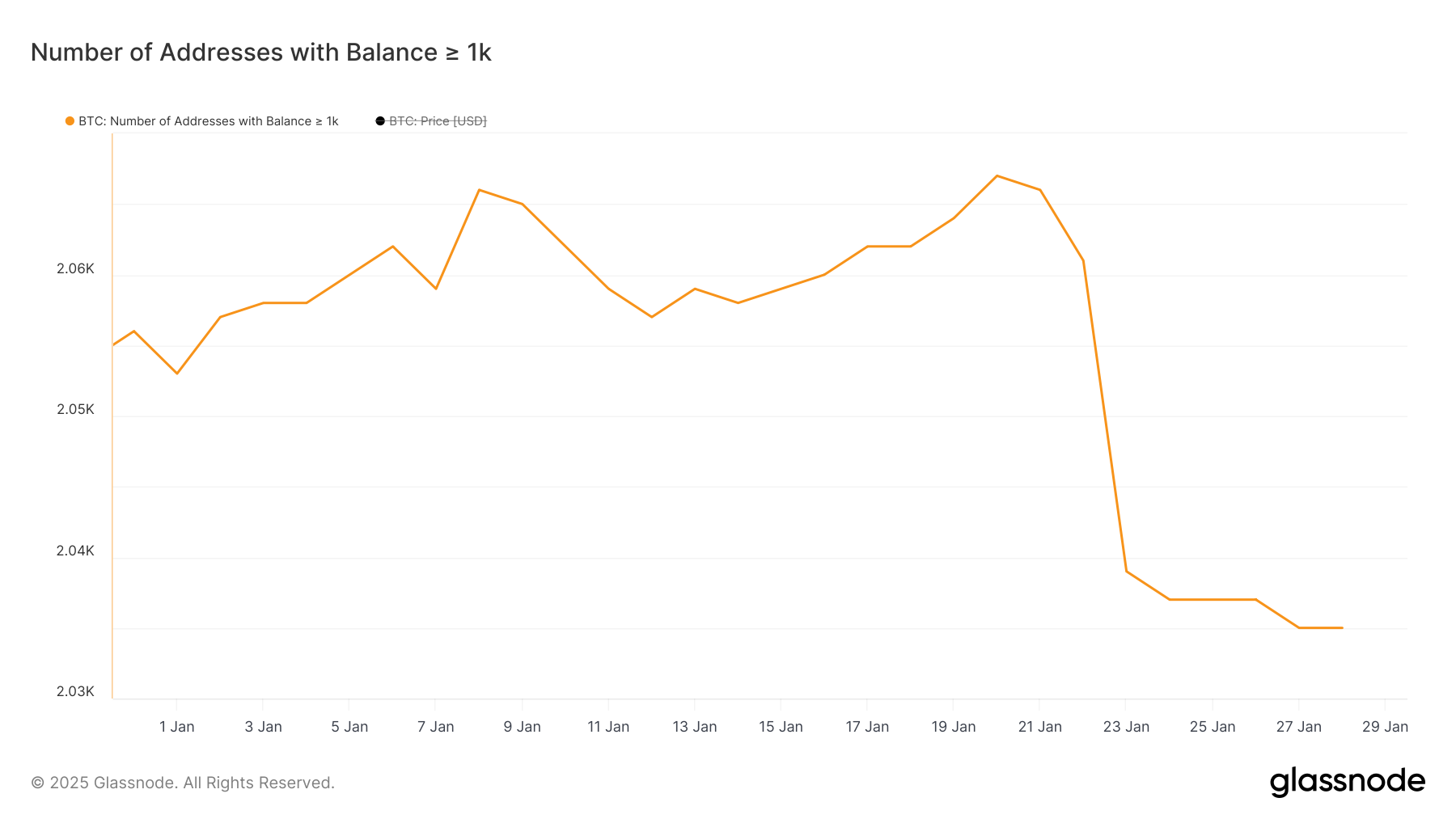

Bitcoin Whales Drop to Lowest Level in a Year

The number of BTC whales — addresses holding at least 1,000 BTC — has dropped to 2,035, the lowest level since January 2024. A significant decline occurred between January 20 and January 24, when the count fell from 2,067 to 2,037.

This sharp drop suggests that some large holders have been offloading their BTC, potentially rotating into other coins or holding their money waiting for new movements.

Tracking BTC whales is important because they hold a large share of Bitcoin’s supply and can influence market trends. A decline in whale addresses may indicate distribution, meaning large holders are selling rather than accumulating.

With whale numbers at a one-year low, BTC price could face increased selling pressure, making it harder for the price to sustain strong upward momentum. However, if new accumulation starts, it could provide support and help stabilize the market.

BTC Price Prediction: Will It Finally Reach $110,000 In February?

Bitcoin’s EMA lines indicate a consolidation phase, as they are trading closely together. The current support level is around $101,300, which has been held so far.

However, if Bitcoin price tests and loses this support, it could drop further to $99,400, with a deeper decline possibly reaching $95,800.

On the upside, if BTC gains momentum, it could test resistance at $105,700. A breakout above this level may push BTC price toward $107,000 and $108,500, potentially paving the way for a move to $110,000 for the first time.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.