Market

Bitcoin’s Price May Not Form a New ATH for This Reason

Bitcoin’s price recently experienced a surge, pushing it to a near three-month high. This rally has brought Bitcoin closer to its all-time high (ATH), sparking renewed optimism among traders and investors.

However, despite this momentum, the presence of large whale transactions and substantial profits suggests a possible market drawdown, putting Bitcoin’s bullish outlook in jeopardy.

Bitcoin Is the Talk of the Town

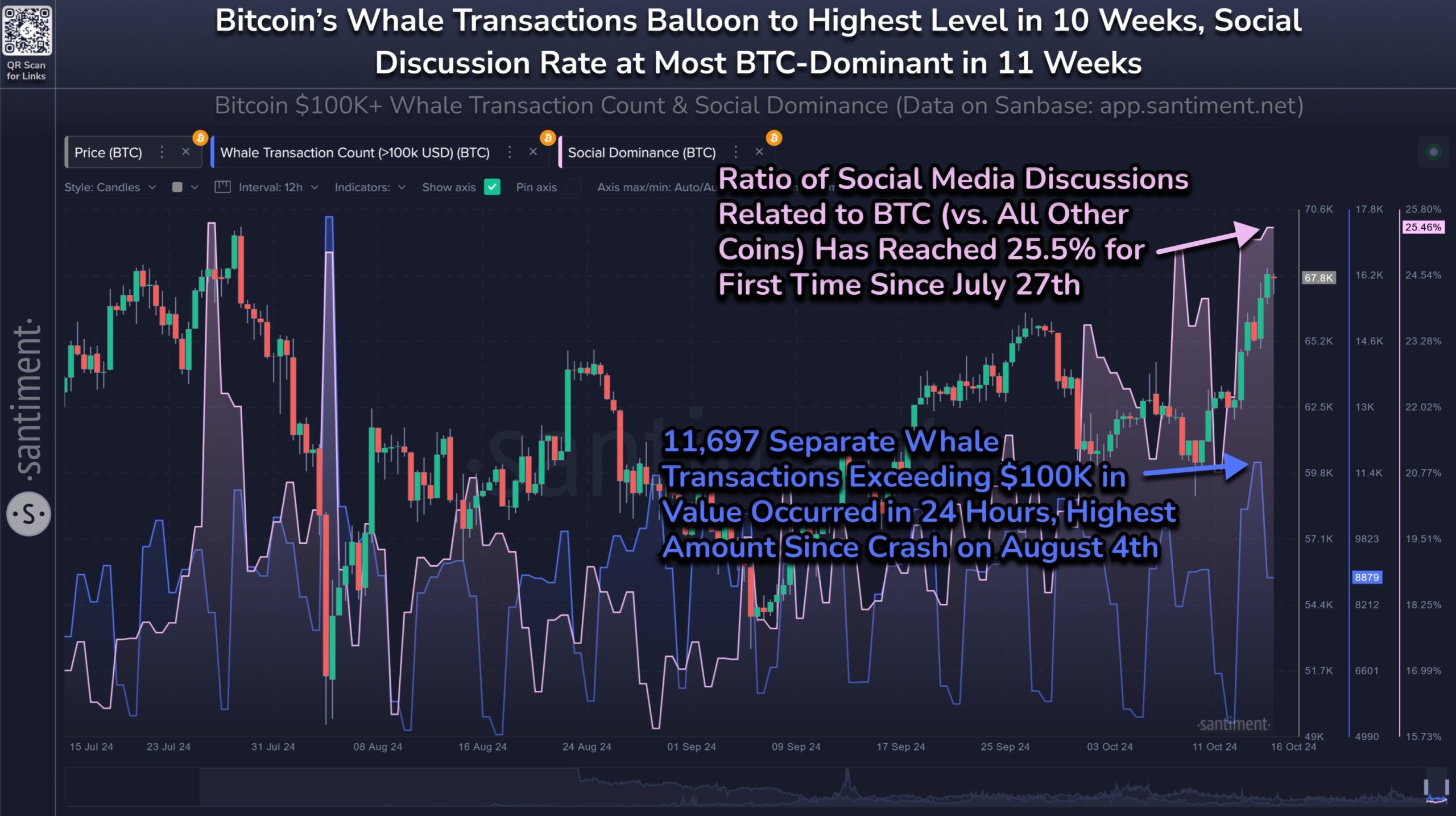

Santiment’s latest data reveals a significant increase in whale transactions, with Bitcoin transactions over $100,000 reaching a 10-week high. This surge in whale activity often signals a shift in market behavior, as large holders are known to influence price movements by either accumulating or offloading their assets. Currently, the heightened volume of whale transactions is raising concerns about a potential price correction.

At the same time, Bitcoin’s dominance in social media conversations has grown substantially, accounting for 25% of all crypto-related discussions. This trend indicates a shift in attention away from altcoins, with many traders focusing on Bitcoin’s performance. Historically, when Bitcoin captures such a large share of the crypto spotlight, it often precedes market volatility, heightening the likelihood of a drawdown.

“Both of these signals are signs that the rally may be on hold due to key stakeholder profit taking and high crowd FOMO. However, with mid and long term metrics still looking bullish, any price correction would likely be a short one,” said Santiment.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Bitcoin’s macro momentum paints a similarly cautionary picture. At present, 95% of Bitcoin’s circulating supply is in profit, a statistic that has historically aligned with market tops.

When the majority of holders are in profit, selling pressure often increases, leading to downward price corrections. This scenario has unfolded in previous market cycles and appears to be repeating itself, suggesting that Bitcoin may be approaching a near-term peak.

With such a high percentage of the supply in profit, the current market environment is reminiscent of conditions that led to previous corrections. The high profitability encourages many investors to secure their gains, thereby putting pressure on Bitcoin’s price. If these conditions persist, a market top may form, triggering a decline.

BTC Price Prediction: No ATH

Bitcoin is currently trading at $67,432, edging closer to the critical $68,000 resistance level. Additionally, Bitcoin is on the verge of breaking out of a descending wedge pattern that has been in play since March. A breakout from this pattern could fuel a rally of up to 27%, potentially pushing the price to $88,077.

However, past patterns indicate that Bitcoin may not sustain such a rally. A breakout attempt could fail, leading to a correction that brings the price back down to $65,000. This price action would likely result in a temporary dip rather than a sustained move toward a new ATH.

Read more: Bitcoin Halving History: Everything You Need To Know

Without the necessary momentum, Bitcoin will struggle to break its ATH of $73,800, a level that remains just 9% above the current price. A failure to breach this level would invalidate the bullish outlook, keeping Bitcoin below its previous peak.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.