Market

Bitcoin Sees $130M Whale Accumulation Despite Election Volatility

Crypto whales withdrew $133 million worth of Bitcoin from Binance on early November 6 amidst heightened volatility surrounding the US presidential election.

Indeed, the actions of these crypto whales signal an intriguing trend in investor confidence in BTC’s long-term value.

Crypto Whales Withdraw $133 Million in Bitcoin from Binance

According to Spot On Chain, large-scale investors have collectively withdrawn around $133 million worth of Bitcoin from Binance in a single day. This notable accumulation by whales appears to reflect growing confidence in Bitcoin’s resilience despite the current price swings.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

These withdrawals involved 11 new wallets, accumulating 1,807 BTC, marking a substantial capital inflow into private wallets. While these actions might be motivated by various strategic reasons, they often signal a belief in Bitcoin’s long-term growth potential or a hedge against broader economic uncertainties.

By moving funds off centralized exchanges, speculation may arise whether these whales may be preparing to hold long-term, limiting immediate liquidity and potentially impacting Bitcoin’s available supply on exchanges.

Election Day Volatility and Its Impact on the Crypto Market

The US presidential election has sparked elevated volatility across global markets, including cryptocurrency. Election day alone saw market turbulence as investors assessed potential impacts on regulatory policies, interest rates, and the overall economic environment. In the case of Bitcoin, it has led to significant liquidations across the board.

According to Coinglass, election-day volatility triggered a staggering $557 million in liquidations, affecting traders who held leveraged positions.

This wave of liquidations highlights the risks associated with high leverage in volatile periods, particularly when political events add to market unpredictability. Bitcoin prices dipped briefly, reflecting this volatility, though prices have shown signs of resilience amid buying activity by whales.

Bitcoin exchange-traded funds (ETFs) have felt the impact, with notable outflows also observed between November 1 and 4. With election day results now revealed, uncertainty surrounding potential political shifts will cease to stir up the Bitcoin ETFs.

Short-Term Volatility in the Bitcoin Market

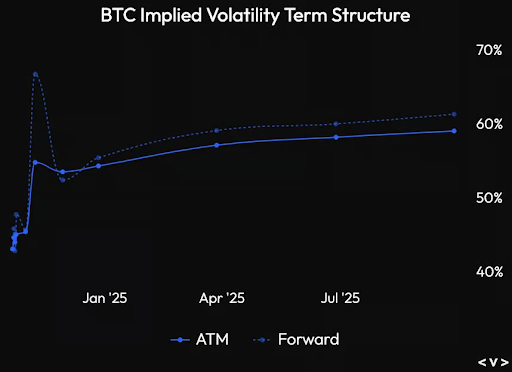

According to Bitfinex analysts, Bitcoin options’ implied volatility is currently in the low 40s, which indicates that market participants are not very confident in big price changes.

“In the options markets, front-end implied volatility for contracts with the earliest expiry is unusually subdued up to election day (November 5th). This muted volatility suggests investors are holding back, waiting for the dust to settle. A spike in volatility is still expected, however, around November 5th to 8th, which could either fuel big moves or, if it fails to materialise, signal a deeper market caution,” said Bitfinex analysts.

Read more: How To Trade Bitcoin Futures and Options Like a Pro in 2024

As predicted by the analysis report, market trends have followed through signaling that Bitfinex’s first hypothesis may be well on the road to materialization. Meanwhile, on X (Twitter), the community reactions have been positive, with many predicting a bullish November.

As the dust from the US presidential election settles, market watchers are likely to see further volatility in Bitcoin prices. However, the recent accumulation of Bitcoin by large-scale investors showcases the asset’s unique position as a long-term store of value.

While volatility persists, the behavior of crypto whales hints at a strong belief in Bitcoin’s resilience and growth potential beyond the current market cycle.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.