Market

Bitcoin Price Surges to $59,000

According to CoinGecko data, Bitcoin (BTC) price jumped to $59,313 immediately after the Bureau of Labor Statistics (BLS) published the US Consumer Price Index (CPI) inflation data for June on Thursday.

Traders had front-run the report, bracing for volatility, as this is among the fundamentals traders were watching in anticipation of Bitcoin recovery.

US CPI Inflation Drops to 3%

In June, inflation in the US, measured by the change in the CPI, dropped to 3% year-over-year. This figure is below market expectations of 3.1%. It is also lower than the 3.3% recorded in May, indicating a 0.1% decline from the previous month.

This follows Federal Reserve (Fed) Chair Jerome Powell’s delivery of the Semi-Annual Monetary Policy Report on Tuesday. Testifying before the US Congress, Powell stated that the Fed is not ready to cut interest rates yet. He cited policymakers’ lack of confidence that inflation is sustainably heading towards the 2% target as a primary reason.

The impact of decreased inflation on the crypto market is positive. Generally, risk-on assets like cryptocurrencies tend to react bullishly when the US CPI indicates low or lower-than-expected inflation.

“The lower-than-expected CPI reading today signals a more significant slowdown in inflation. This could reinforce the market’s expectation of a rate cut in September. Fed Fund futures put the probability at 70% currently, boosting both equities and cryptocurrencies by increasing liquidity and risk appetite,” Jag Kooner, Head of Derivatives at Bitfinex, told BeInCrypto.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Amid the hype, traders should brace for volatility. After the two meetings this week, investors will closely monitor Fed communications and market reactions to today’s CPI release.

“We believe that a single inflation print would not undo the supply overhang concerns for Bitcoin which would take some more time for the market to price in completely,” Kooner added.

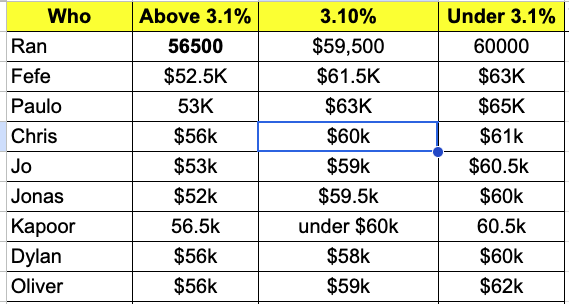

Analysts at Crypto Banter shared bullish targets for Bitcoin price in the aftermath of the CPI data, with founder Ran Neuner anticipating a move to $60,000.

Bitcoin Price Outlook after US CPI

BTC is trading with a bullish bias on the weekly timeframe, holding above the ascending trendline. Amid euphoria following the US CPI data, bullish momentum is rising, as seen with the Relative Strength Index (RSI) tilting north.

Based on the volume profile, the spikes in bullish nodes (orange) suggest a bump or spike in traders buying BTC at current prices. This, coupled with the position of the Moving Average Convergence Divergence (MACD) in positive territory, increases the odds of further upside.

Increased buying pressure above current levels could see Bitcoin price reclaim the $60,000 threshold. In a highly bullish case, the gains could extend for BTC to test the supply zone between $66,504 and $71,151. A stable close above this order block would confirm a further upside, paving the way for a new all-time high.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Conversely, the position of the MACD below its signal line suggests a potential bearish momentum in BTC price action. In a southbound directional bias, a break and close below the ascending trendline on the weekly timeframe could see BTC provide another buying opportunity within the demand zone between $43,964 and $40,013.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.