Market

Bitcoin Miners HODL as Price Nears New All-Time High

On Thursday, Bitcoin (BTC) network miners saw their total revenue surge to a two-month high. Notably, this uptick coincided with a remarkable day of HODLing, as miners refrained from selling their holdings for the first time in the past month.

As Bitcoin approaches its all-time high of $73,764, the decline in miner sell-offs indicates a bullish trend. This suggests that this milestone could be within reach in the near term.

Bitcoin Miners Hold Still

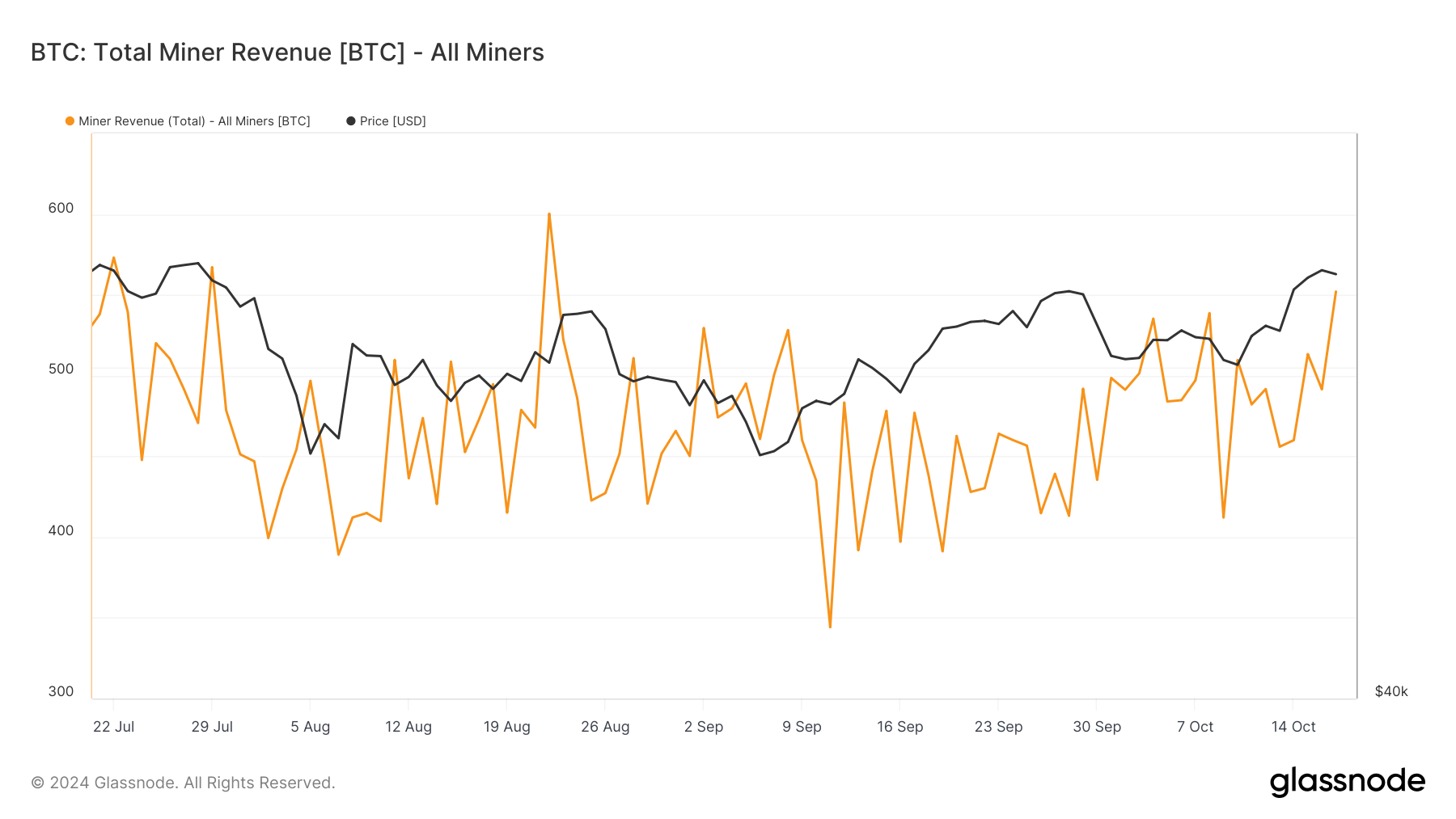

Yesterday, the miner revenue on the Bitcoin network totaled 552 BTC, valued above $37 million at current market prices. Per Glassnode’s data, this marked its highest since August 22 and represented a 12% surge from the 491 BTC recorded in total revenue on Wednesday.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

The recent surge in BTC miner revenue is directly linked to the sharp increase in average transaction fees on the network. Messari’s data shows that the average fee paid to process transactions on the network has climbed by 166% over the past seven days. According to the on-chain data provider, this currently stands at $5.31.

As Bitcoin network transaction fees rise, miners earn more from processing each block, contributing to the steady uptick in their overall revenue.

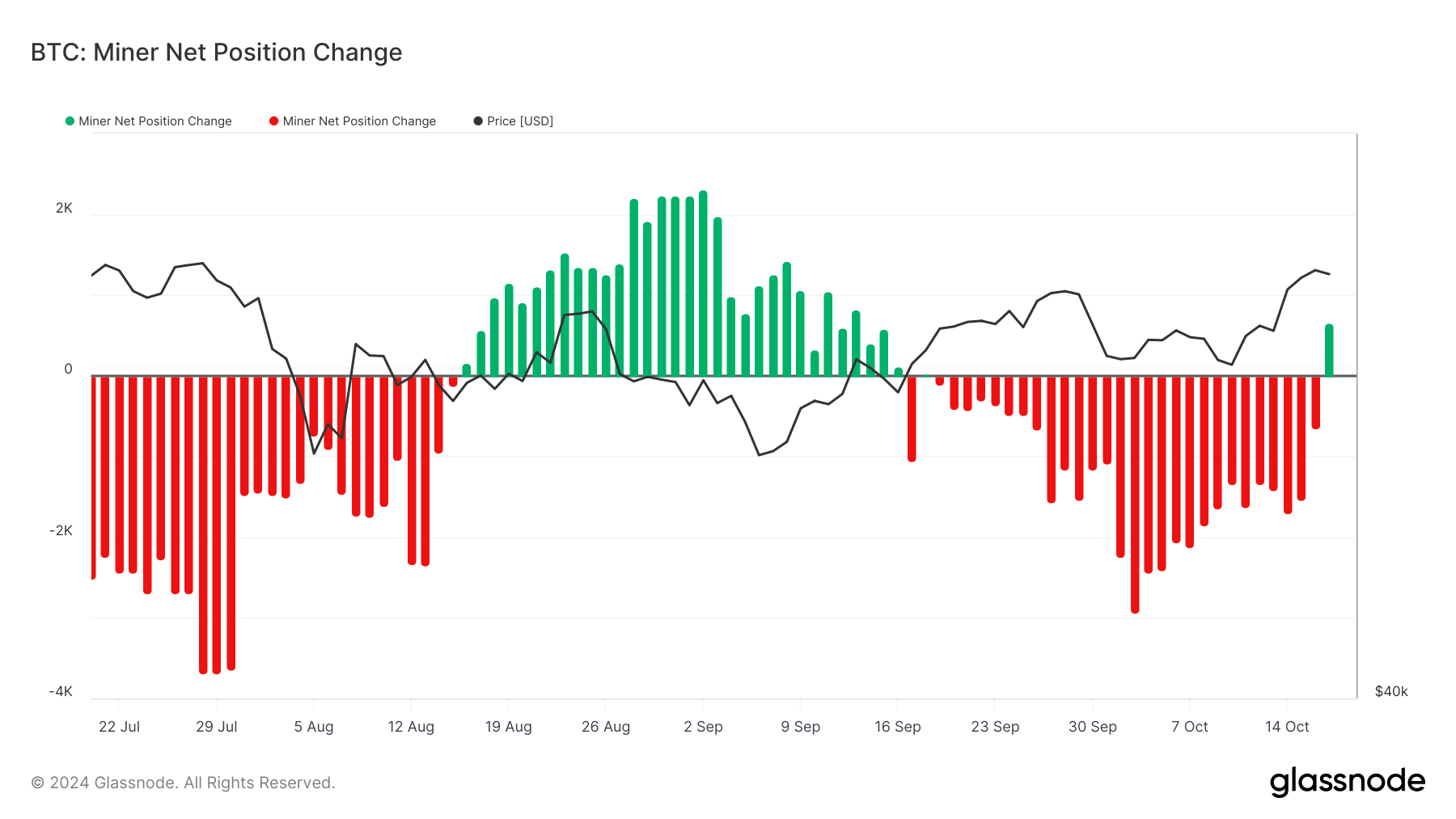

Interestingly, Thursday’s two-month spike in total miner revenue coincided with a notable shift in miner behavior. It marked the first day in the past month that miners chose not to sell their coins. BeinCrypto’s assessment of BTC’s Miner Net Position Change, which measures the change in the supply held in miner addresses, confirms this.

On that day, miners collectively held onto 658 BTC. This was the first time since September 16 that most miners on the Bitcoin network refrained from selling their holdings.

BTC Price Prediction: All-Time High Within View

Bitcoin is currently trading at $67,738, just below the resistance level of $68,464. Over the past few days, the coin has seen a surge in demand. This is reflected in its rising Relative Strength Index (RSI), which currently stands at 67.57.

The RSI measures an asset’s overbought and oversold conditions. It ranges from 0 to 100. Values above 70 indicate an asset is overbought and may face a correction, while values below 30 suggest it is oversold and could be poised for a rebound.

With BTC’s RSI at 67.57, the market is signaling strong buying momentum, as purchasing activity currently outweighs selling. If this trend continues, Bitcoin’s price will likely break through the resistance at $68,464 and could potentially reclaim its all-time high of $73,764.

Read more: Bitcoin Halving History: Everything You Need To Know

However, this bullish outlook would be invalidated by even a slight increase in profit-taking activity, which could trigger a downward trend. In that case, Bitcoin’s price might retreat to support levels at $64,304 or lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.