Market

Bitcoin Climbs To New All-Time High

Leading coin Bitcoin BTC has touched a new all-time high of $109,350 during Monday’s early trading session. This surge comes amid the broader market decline that has persisted over the past 24 hours.

At press time, BTC trades at $107,422. With the strengthening buying pressure, the coin could resume its rally in the near term.

Bitcoin Bulls Drive Prices Higher

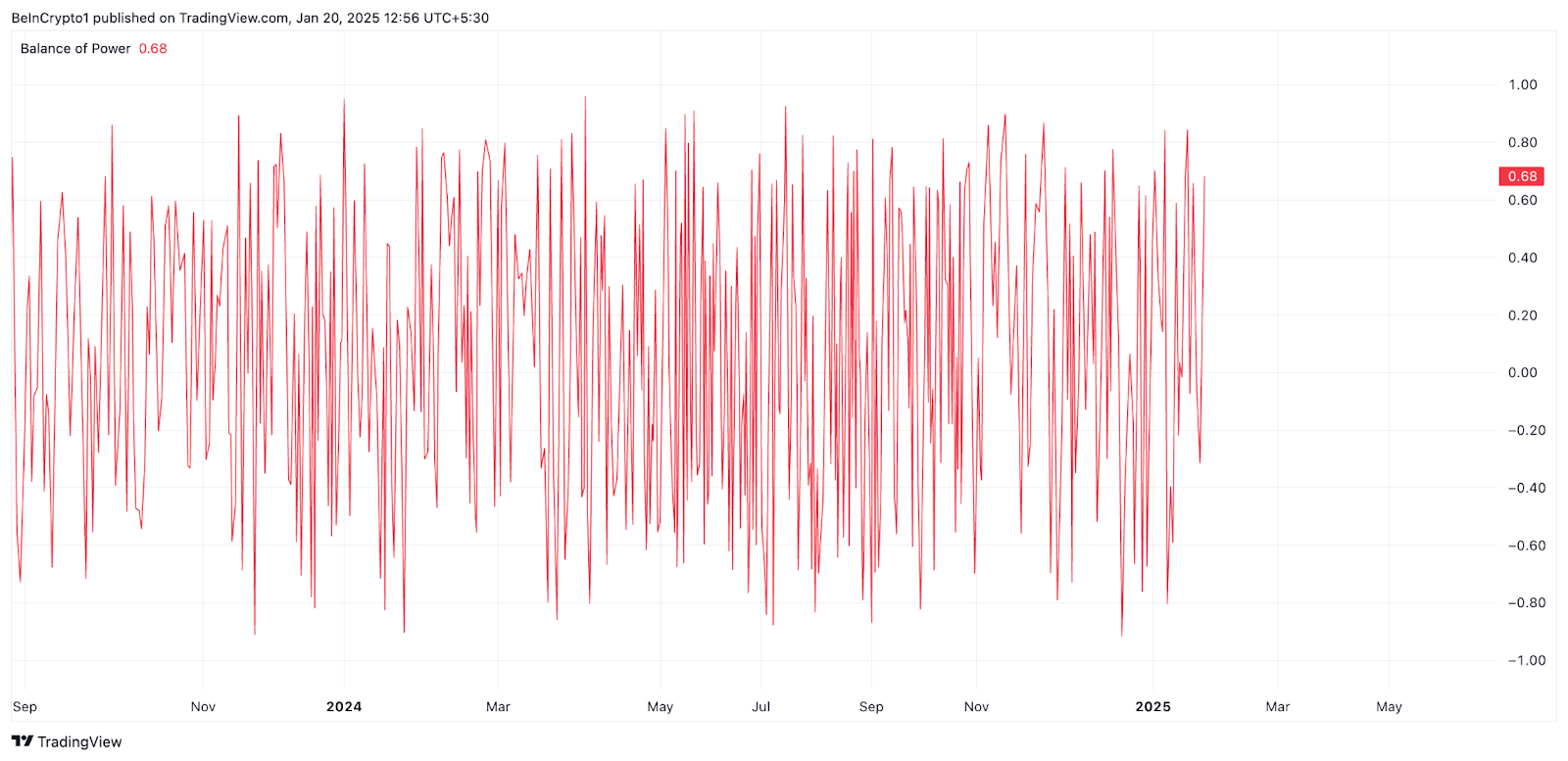

An assessment of the BTC/USD one-day chart has shown the sustained demand for BTC despite the general market downturn. For example, its Balance of Power (BoP) is an uptrend at 0.75, reflecting the bullish bias toward the leading crypto asset.

This momentum indicator measures the dynamic between buying and selling pressure, indicating whether bulls (buyers) or bears (sellers) are in control. As with BTC, a positive BoP means buyers are dominant, driving prices upward as demand outweighs supply.

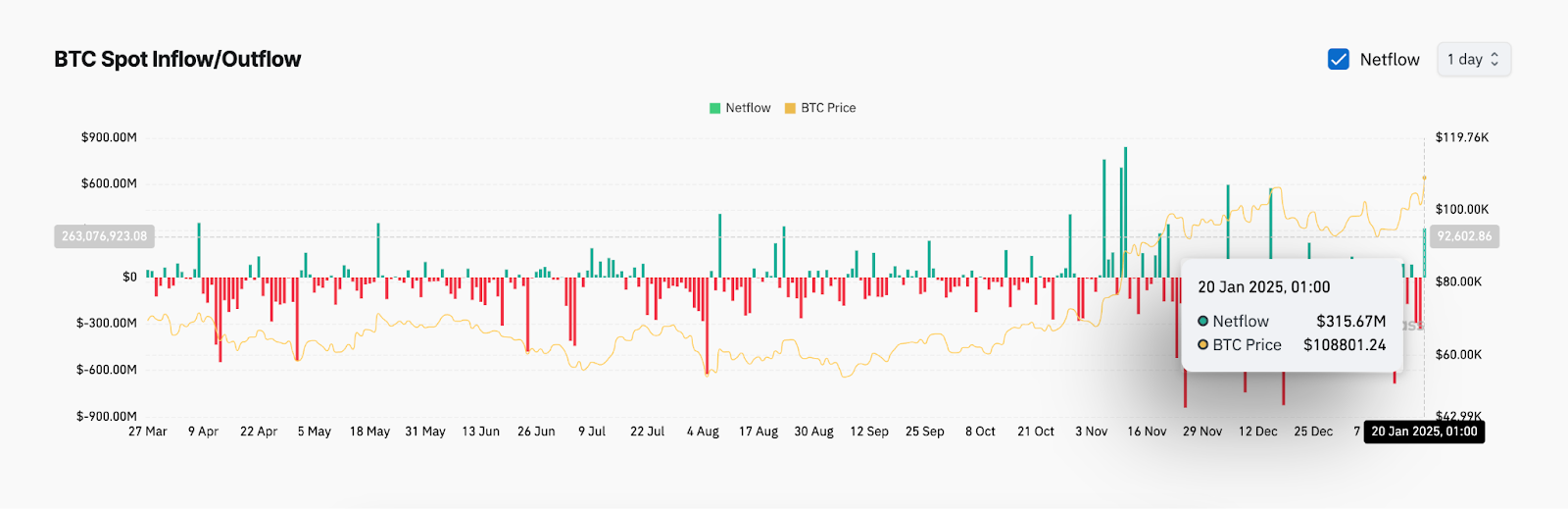

Notably, BTC’s spot inflows have risen to a 30-day high, confirming the surge in demand for the coin. According to Coinglass, this totals $316 million at the time of writing.

When an asset’s spot inflows rise, more funds are moving into spot markets, often signaling increased buying activity and interest in the asset. This indicates growing demand for BTC, driving its price higher if supply remains limited.

BTC Price Prediction: Is $110,000 Next?

If this buying momentum is maintained, Bitcoin’s price could reclaim its all-time high. In that scenario, the coin’s price could rally toward the highly coveted $110,000 price mark and attempt to surpass it.

On the other hand, a spike in coin selloffs would invalidate this bullish thesis. In this case, BTC’s price could fall below $100,000 to trade at $99,80.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.