Market

Bearish Signals Point to Further Losses

Ripple (XRP) price has been under significant pressure following a series of bearish technical signals and legal developments. After the SEC filed an appeal against Ripple, XRP experienced a sharp decline.

Despite this, the RSI has moved from deeply oversold levels. That indicates that the selling pressure may be easing, though the overall trend remains bearish.

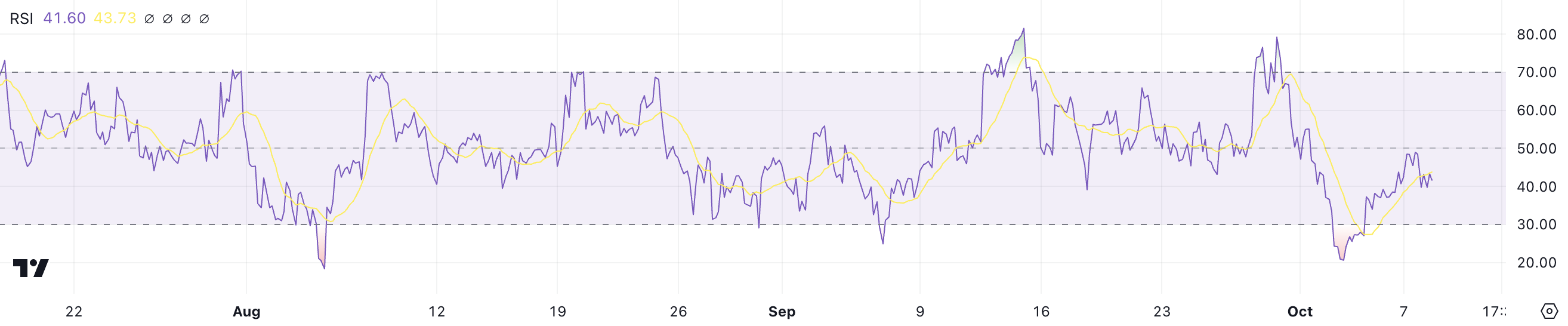

XRP RSI Is Currently Neutral

XRP’s RSI is currently sitting at 41.60, a notable jump from its deeply oversold level of 19.79 on October 3. This increase signals that the intense selling pressure seen earlier in the month has eased, and some buyers have stepped in.

However, the upward shift in RSI doesn’t necessarily point at reversal of the downtrend. It suggests that the asset has moved out of extremely oversold territory and is experiencing a potential relief rally.

The Relative Strength Index (RSI) is a momentum oscillator used in technical analysis to measure the speed and magnitude of recent price changes. It ranges from 0 to 100, with key thresholds at 30 and 70. When the RSI falls below 30, it indicates that the asset is oversold and may be due for a rebound. On the other hand, an RSI above 70 means the asset is overbought.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

An RSI of 41.60 means that XRP, while still in a downtrend, is seeing some stabilization as the market has cooled off from extreme selling. This level indicates that the bearish momentum is weakening.

However, it seems the buyers haven’t gained enough strength to reverse the trend fully. In the context of XRP’s ongoing downtrend, an RSI around 40 suggests that while the asset isn’t in oversold territory anymore, it is still under selling pressure.

Traders typically view RSI levels in this range as neutral or slightly bearish, meaning there may still be room for downward movement unless significant buying pressure emerges to push the RSI toward 50 or higher. For XRP price to break out of its downtrend, stronger bullish signals and an RSI above 50 would be needed to confirm a potential trend reversal.

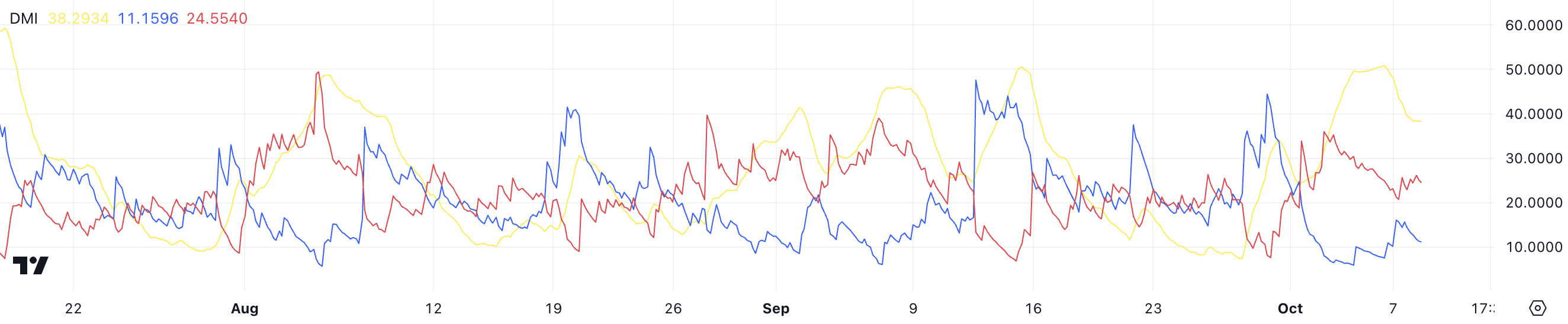

Ripple’s DMI Shows Downtrend is Strong

The XRP DMI chart shows that the current market sentiment is dominated by bearish momentum. The blue line, which represents the Positive Directional Index (+DI), is sitting at 11.16. That indicates that the buying pressure is quite weak.

In contrast, the red line, or Negative Directional Index (-DI), is higher at 24.55, suggesting that selling pressure is stronger. This imbalance between buyers and sellers reflects a clear downtrend in XRP’s price movement.

The Directional Movement Index (DMI) is a technical indicator used to assess the strength of a trend. It consists of the +DI and -DI, which measure the strength of upward and downward movements, respectively, and the Average Directional Index (ADX), which measures the overall trend strength regardless of direction.

In this case, the ADX, represented by the yellow line, is currently at 38.29. That signals that the bearish trend is relatively strong. While the ADX doesn’t specify whether the trend is bullish or bearish, when paired with a higher -DI, it confirms that XRP is in a fairly strong downtrend.

For a potential trend reversal, we would need to see the +DI crossing above the -DI and the ADX continuing to rise, signaling a shift in momentum.

XRP Price Prediction: A 17% Decline Soon?

On October 2, XRP’s EMA lines formed a death cross, a significant bearish signal that occurs when a short-term EMA crosses below a long-term EMA. This event often signals a shift in market sentiment, indicating that bearish momentum is taking control.

Since the death cross, XRP’s price has dropped by 13%. That reinforces the downtrend that has been dominating the market after the SEC filed an appeal against Ripple.

EMA, or Exponential Moving Average, is a key technical indicator used to smooth price data while giving more weight to recent prices. Compared to the simple moving average, it is more responsive to short-term movements. Traders often rely on the interplay between short-term and long-term EMA lines to gauge market trends and potential reversals.

Read More: Everything You Need To Know About Ripple vs SEC

When a death cross forms, it’s generally viewed as a warning that a prolonged downtrend could be on the horizon. If XRP continues to follow this negative trend, the price could drop further. It could potentially reach $0.43, which would represent a 17% decline from the current levels.

However, if XRP price manages to reverse the bearish momentum, it could retest the resistance at $0.61. If this resistance is broken, it may create room for a further rally, pushing XRP price toward the next resistance at $0.66. That would represent a potential 26% upside from the current price level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.