Market

Bearish Indicators Signal Risks of Further Losses for SOL Price

Solana (SOL) price reached a new all-time high on November 22 and has surged 208% in 2024, showcasing impressive growth throughout the year. However, SOL has struggled recently, declining nearly 10% over the past 30 days as bearish indicators begin to weigh on the market.

Momentum metrics, such as BBTrend and DMI, suggest persistent selling pressure and weakening trend strength, keeping SOL in a cautious zone. Whether SOL can hold key support levels or stage a recovery to test new resistances will determine its trajectory in the coming weeks.

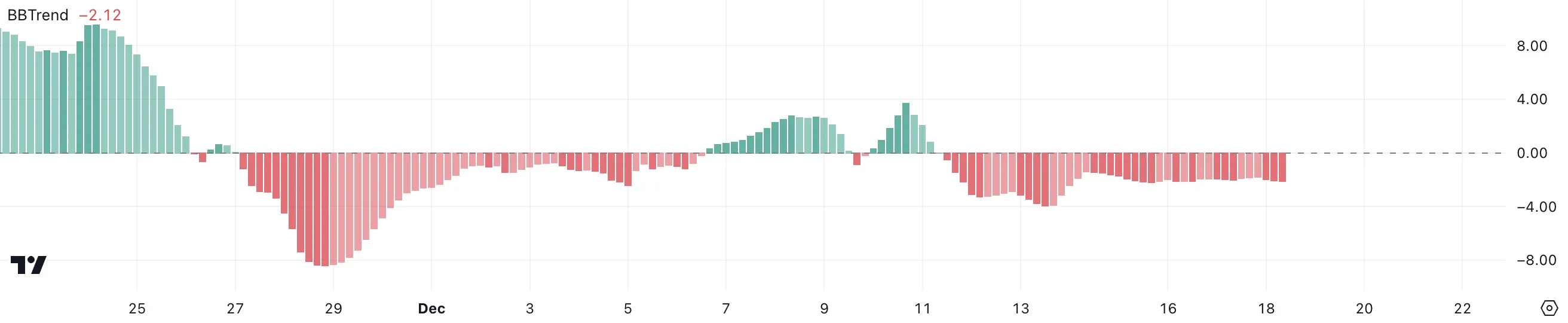

Solana BBTrend Is Still Negative

SOL BBTrend is currently at -2.12 and has remained in negative territory since December 11, hitting a low of -3.94 on December 13.

Since December 15, it has hovered around -2, indicating a period of sustained bearish momentum with limited signs of recovery. This suggests that selling pressure has persisted, keeping SOL in a cautious market environment.

BBTrend is a momentum indicator derived from Bollinger Bands, which measures the strength and direction of a price trend. A negative BBTrend indicates bearish momentum, while a prolonged period near -2 reflects a market struggling to regain upward strength.

For Solana price, this could imply further sideways movement or a continuation of the downtrend unless a shift in momentum occurs to support a price reversal.

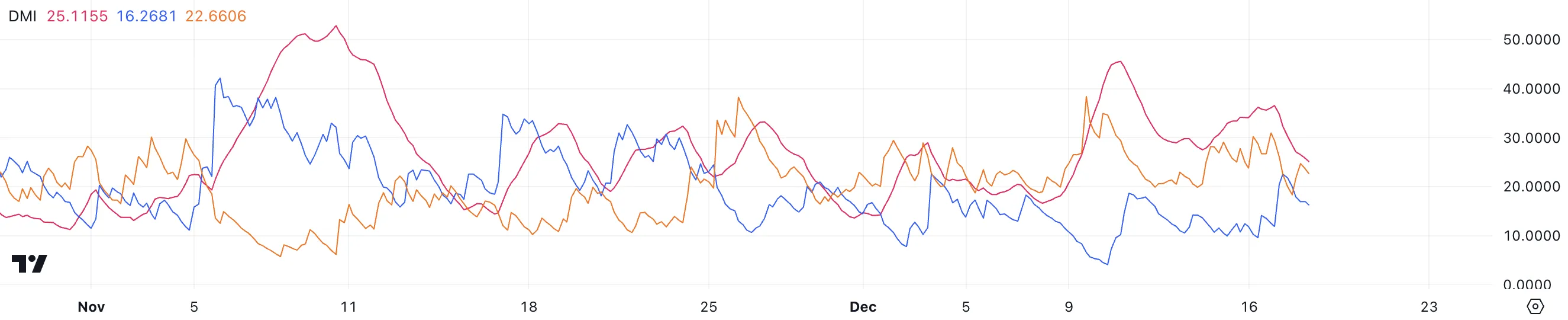

SOL Trend Isn’t That Strong Anymore

SOL’s DMI chart shows its ADX at 25.11, down significantly from nearly 40 just two days ago. This decline indicates that the strength of the current trend, whether bullish or bearish, is weakening.

While an ADX above 25 still reflects a moderately strong trend, the recent drop suggests fading momentum in the market.

The ADX (Average Directional Index) measures the strength of a price trend without indicating its direction. Values above 25 indicate a strong trend, while values below 20 signal a weak or non-trending market.

In Solana case, the D+ at 16.2 and D- at 22.6 suggest that bearish pressure currently outweighs bullish momentum. This imbalance points to short-term downside risks for SOL unless buyers regain control and push D+ above D-.

Solana Price Prediction: Can SOL Fall Back to $180?

Solana EMA lines are currently in a bearish configuration, with short-term EMAs positioned below long-term EMAs, confirming a death cross on December 15. This pattern typically signals continued downside momentum, and if the trend persists, SOL may test the $203 support level.

A failure to hold this support could lead to further losses, with prices potentially dropping to $183, representing an almost 15% correction.

However, if SOL price manages to regain its uptrend, it could challenge the resistance at $221. A successful breakout above this level could pave the way for further gains, with SOL price potentially targeting $234 and even $246 in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.