Market

Arbitrum Buyback Plan Arrives Ahead of Major ARB Token Unlock

Arbitrum announced a strategic buyback plan to acquire ARB tokens amid a prolonged price decline. Its backing company, Offchain Labs, marks a significant move to reinforce its commitment to the ecosystem.

The buyback comes as ARB is down over 85% from its all-time high (ATH) and continues to lose ground.

Arbitrum Announces Buyback Program

In a post on X (Twitter), Offchain Labs emphasized that the initiative reflects the ongoing growth of Arbitrum’s ecosystem. According to the firm, technical advancements and strategic DAO initiatives are the primary drivers for the Arbitrum network.

“We’re reinforcing our commitment to the ecosystem and strengthening our alignment by adding ARB to our treasury through a strategic purchase plan,” the company stated.

The firm also assured the community that purchases would follow predetermined parameters to ensure sustainability.

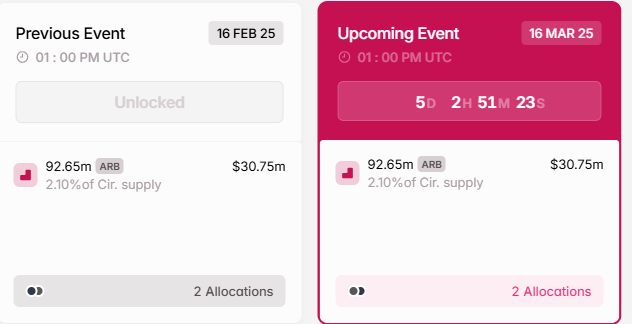

Meanwhile, this announcement comes only days before Arbitrum’s token unlock event. According to data on Tokenomist, the Arbitrum network will unlock 92.65 million ARB tokens worth $30.75 million based on current rates. These tokens constitute 2.1% of the ARB circulating supply.

Therefore, Offchain Labs’ buyback announcement aligns with this token unlocks event, with the plan to purchase ARB likely to absorb the expected supply shock. A recent report indicated that 90% of token unlocks drive prices down.

However, not everyone is convinced that buybacks alone are the right strategy. Yogi, a well-known wallet maxi, criticized the move, arguing that such a strategy lacks long-term vision. He compared it to traditional equity markets, where excessive buybacks often signal a slowdown in innovation.

“Pure buybacks alone feel unimaginative and short-sighted—they create scarcity without driving long-term growth or strategic value,” Yogi wrote.

He suggested a more diversified approach, proposing a framework where 30% of the treasury should be allocated to strategic buybacks and OTC (Over-the-Counter) deals. Further, 30% is directed toward liquidity provision to attract institutional players, and 20% is directed towards a yield-generating treasury for stable dividends.

Yogi also suggested 15% for ecosystem investments and 5% for a protocol insurance fund. In their opinion, this diversified strategy would better align incentives and enhance the protocol’s long-term sustainability.

Criticism Over Buybacks as ARB Price Struggles

Patryk, a researcher at Messari Crypto, echoed similar sentiments. He noted that while such structured plans are beneficial, they can be difficult to outline at the start of a buyback initiative. He suggested that Arbitrum remain flexible and deploy funds into strategic areas over time rather than committing to a rigid framework.

“I think projects will do this eventually. It’s just difficult to announce a concrete plan for the funds at the beginning of buybacks, like those that Arbitrum just announced. Remain flexible,” the researcher suggested.

Despite the ongoing debate, the buyback announcement and token unlocks come as Arbitrum is experiencing renewed market attention. The ARB token recently received a listing on the Robinhood platform.

While the move temporarily boosted the ARB price, it failed to sustain a lasting uptrend. Additionally, Arbitrum has gained significant community support for its BoLD proposal. As BeInCrypto reported, the governance initiative aims to decentralize decision-making further and enhance network security.

While Offchain Labs’ buyback plan signals confidence in the project, questions remain about whether it is enough to restore ARB’s market momentum. The broader sentiment around ARB remains cautious, with the massive token unlocks expected to have price implications.

“I think now may be a good time to short. Or sell. Or both,” Yogi remarked.

With Arbitrum at a crossroads, the effectiveness of this buyback strategy in revitalizing investor confidence and driving long-term growth will be closely watched. The debate between pure buybacks and strategic reinvestment continues to shape the discourse around Arbitrum’s future.

BeInCrypto data shows ARB was trading for 0.33, down almost 9% since Tuesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.