Market

AI16Z Price Rebounds 12% After Sharp 50% Five-Day Correction

AI16Z price has experienced significant volatility, correcting by 50% in just five days but rebounding 12% in the last 24 hours. This sharp recovery hints at improving market sentiment, but technical indicators suggest the trend remains fragile.

The RSI and CMF show signs of recovery, reflecting increasing buying pressure, though both metrics remain in moderate ranges. As the EMA lines point to potential continued bearish momentum, the price could test critical support at $0.569 or, if bullish momentum builds, challenge resistance at $0.976 and even $1.39.

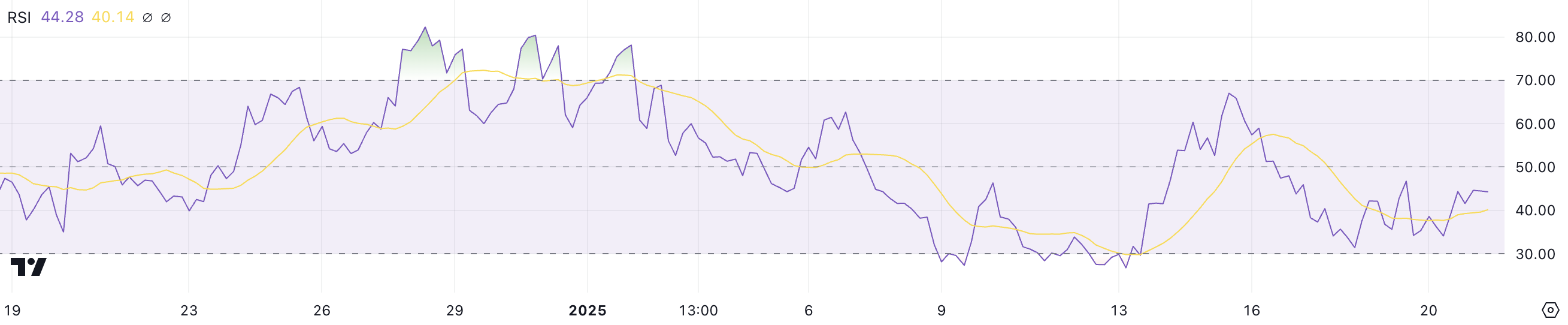

AI16Z RSI Shows Signs of Recovery

AI16Z RSI currently stands at 44.2, a notable rise from 31.3 just three days ago. This upward movement signals an improvement in market momentum as the token recovers from oversold conditions.

The increase in RSI suggests growing buying pressure, which could indicate a potential shift in sentiment for AI16Z after a period of weakness.

The Relative Strength Index (RSI) is a widely used technical indicator that measures the speed and magnitude of price changes to identify overbought or oversold conditions. RSI values range from 0 to 100, with readings above 70 typically signaling overbought conditions and below 30 indicating oversold conditions.

At 44.2, AI16Z’s RSI reflects improving momentum while still below the neutral midpoint of 50, suggesting a cautious recovery. This level indicates that AI16Z’s price could stabilize further or see moderate gains as it moves toward neutral territory. Additional upward movement is needed to signal a stronger bullish trend, especially if good momentum around artificial intelligence cryptos is back.

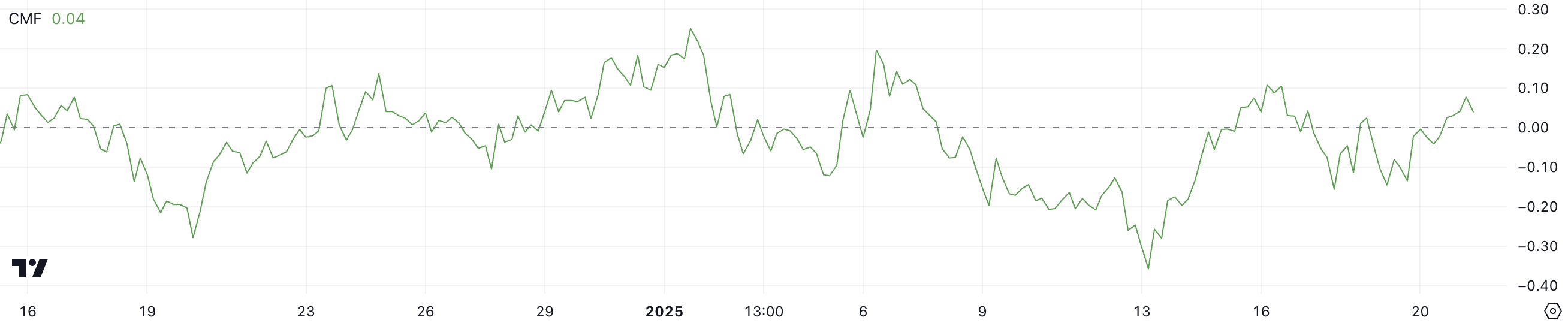

AI16Z CMF Is Positive, But At Low Levels

AI16Z CMF currently reads 0.04, marking a significant recovery from -0.14 just two days ago. This shift into positive territory suggests an increase in buying pressure and a potential reversal in market sentiment.

The movement indicates that capital flow into AI16Z is improving, reflecting growing investor confidence.

The Chaikin Money Flow (CMF) is a technical indicator used to measure the strength of money flow volume over a specific period. CMF values range between -1 and 1, with positive values indicating net buying pressure and negative values reflecting net selling pressure.

At 0.04, AI16Z CMF demonstrates moderate buying interest, signaling that while the bullish momentum is gaining traction, it is still in its early stages. If buying pressure continues to build, this improvement could pave the way for further price stability or gradual growth.

AI16Z Price Prediction: Will It Recover $1 Level?

AI16Z’s EMA lines have shown significant bearish momentum, forming two death crosses over the past three days and potentially on the verge of forming another. These bearish crossovers, where shorter-term EMAs fall below longer-term ones, often signal a continuation of downward trends.

This aligns with AI16Z price recent 50% drop between January 15 and January 20, despite its 12% recovery in the past 24 hours. The recent uptick suggests temporary relief, but the broader trend remains uncertain.

If AI16Z’s bearish trajectory continues, the price could test the support level at $0.569, a critical zone for preventing further declines.

Conversely, if AI16Z price manages to regain its uptrend, it may challenge the resistance at $0.976. Breaking this resistance could pave the way for a continued rise, with $1.39 as the next major target, making it one of the biggest crypto AI agents coins in the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.