Ethereum

Solana Comes On Top In Product Execution, But Ethereum Is Superior

Solana and Ethereum are the clear competitors in the epic battle of supremacy. Though Ethereum was the first smart contracts platform, there are inherent problems like scalability that new chains like Solana and Cardano, for example, aim to solve.

Solana Developers Doing Well In “Product Execution” And Communication

Taking to X, one observer notes that while Solana might be gaining traction, Ethereum remains superior. From mid-last year, and driven by the positive progress in the resolution of the FTX bankruptcy, SOL prices have been on a sharp uptrend.

Network activity, mainly meme coins, has been fanning demand, pushing its valuation to fifth in the market cap ranking. Meanwhile, Ethereum remains perched at second, primarily because of its first-mover advantage and the depth of its ecosystem.

Developers searching for cheap transactions have been increasingly deploying on Solana. At its core, the platform is designed to be highly performant. Its architecture allows for fast transaction speeds and low costs, making it an attractive option for developers and users seeking efficiency.

The analyst noted that this appeal will only grow because Solana developers take product execution and communications “very well.”

The decision to lean on product execution means developers desiring a network offering high throughput, similar to traditional platforms, can find a home. Since the network can scale, it can duck the high gas fees plaguing legacy chains like Ethereum and Bitcoin.

Is Ethereum A Superior Technology With Poor Marketing?

Even so, their preference for “product execution” is also Solana’s undoing. Blockchain purists argue that though Ethereum is slow, at least it is decentralized. The decentralization in the second most valuable network gives it an edge, allowing it to have a higher level of reliability.

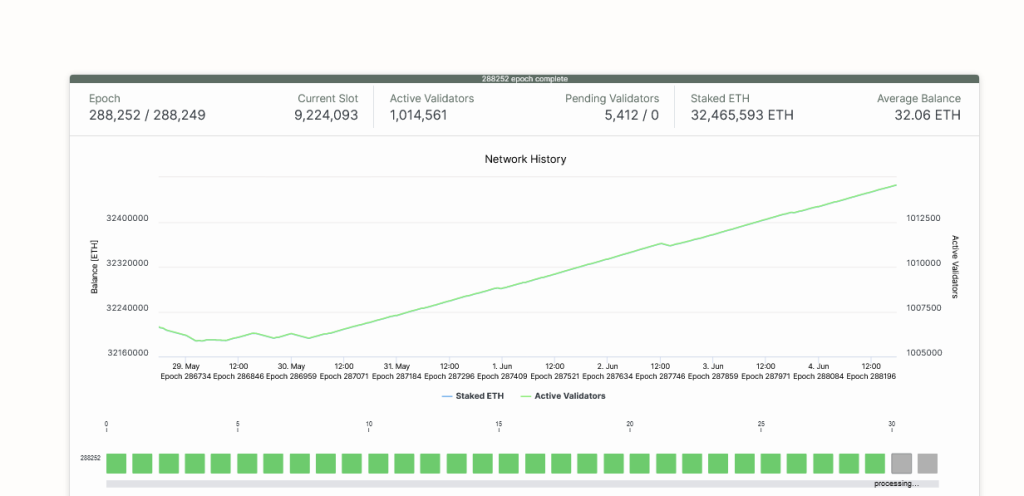

Ethereum’s optimization for decentralization means it operates on a more distributed network of nodes, enhancing its security and resilience against censorship. So far, beaconcha.in data shows there are over 1.8 million validators, and the number keeps increasing.

However, this emphasis on decentralization comes at a cost. Ethereum is slower and more expensive than Solana, which, the analyst said, is more centralized in exchange for higher performance, slashing transaction costs.

Subsequently, due to the emphasis on decentralization, the analyst thinks Ethereum is emerging as a choice infrastructure primitive, boosting great tech. Since it was the first smart contracts network, it is emerging as a platform for creating virtually any verifiable system, including cheap and performant solutions.

Feature image from Canva, chart from TradingView