Bitcoin

What Factors Suggest Bullish Q4?

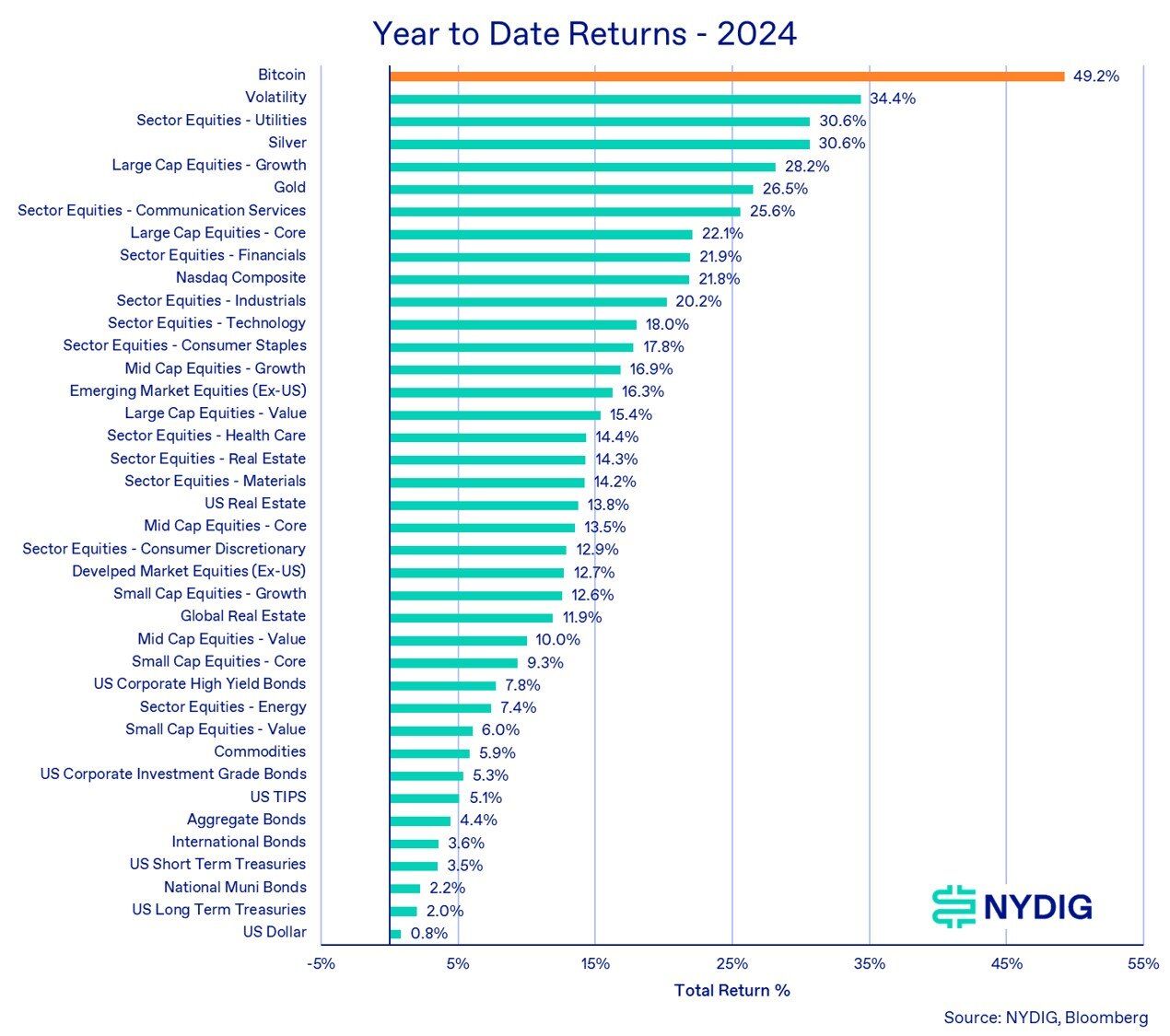

According to the latest report from New York Digital Investment Group (NYDIG), Bitcoin continues to stand out as the best-performing asset in 2024. Additionally, Q4 is expected to remain positive for Bitcoin’s price, despite facing various challenges.

The report also said that Bitcoin has a lot of momentum to continue to increase in Q4.

Bitcoin Maintains a 49.2% Increase in 2024

Despite a large 30% decline in Q3, Bitcoin has so far managed to stay above $60,000. When compared to other assets in 2024, its performance far surpasses that of precious metals and stocks, with a 49.2% year-to-date increase. In contrast, silver has risen by 30.6% and gold by 26.5%.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, in Q3 alone, Bitcoin’s gains were modest, lagging behind traditional assets with just a 2.5% increase. This dip is attributed to selling pressure from governments during Q3, which stirred concerns among investors.

“At play during the quarter was the (near) resolution of numerous bankruptcies, including the long-running Mt Gox bankruptcy, which saw billions in BTC returned to creditors. The US government and German authorities (BKA) were also notable sellers during the quarter,” NYDIG reports.

Reasons for Optimism About Bitcoin’s Q4 Performance

Despite this, the report remains optimistic about Bitcoin’s outlook in Q4. The bullish forecast is based on several key factors:

- Political Support: Both presidential candidates, Trump and Harris, have shown a more open stance towards the crypto industry. Regardless of who wins, crypto investors could benefit.

- Increased Correlation with Stocks: Bitcoin’s 90-day correlation with US equities continued to rise in Q3, ending the quarter at 0.46. This suggests Bitcoin’s growing role in portfolio diversification.

- Rising Global M2 Money Supply: The continued rise of global M2 money supply to new highs could benefit Bitcoin as it thrives under loose monetary policies.

“If Bitcoin continues following the trajectory of global M2 money supply, it’s heading to $90,000 before the end of the year,” Investor Joe Consorti predicts

Additionally, other signals reinforce the bullish case for Bitcoin in Q4. Bitcoin ETFs continue to increase their BTC holdings, while major companies like MicroStrategy and Marathon Digital show no signs of slowing down their Bitcoin accumulation.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Historical data reveals that Bitcoin often posts average gains of over 81% in Q4, with the price closing in the green in 7 of the past 11 years.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.