Bitcoin

Trump and Lummis Unite on $76 Billion National Bitcoin Reserve

Senator Cynthia Lummis is making a bold new proposal to establish a Bitcoin reserve in the US. This follows President-elect Donald Trump’s recent declarations in the run-up to the US elections.

Her bill, the BITCOIN Act of 2024, aims to have the US Treasury acquire 1 million Bitcoin (BTC) over five years, a massive move that would position the US as a leader in financial innovation.

Senator Cynthia Lummis Advocates Bitcoin Reserve

The Wyoming senator wants the plan spread across five years, with purchases of 200,000 BTC tokens every year to develop America’s Bitcoin reserve. At current rates, that translates to an investment of about $76 billion.

“We are going to build a strategic Bitcoin reserve,” Lummis shared on X (formerly Twitter).

Notably, Lummis’s side of the political divide now holds the majority in both the Senate and House committees. According to Stand With Crypto, 261 pro-crypto candidates have been elected to the House of Representatives against 116 anti-crypto candidates. On the other hand, there are 17 pro-crypto candidates in the Senate and 12 anti-crypto lawmakers.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

With this, the chances of Senator Lummis’ Bitcoin Bill passing through Congress are far better. This is as opposed to the Biden administration, where efforts toward bipartisan bills were greatly stifled due to a divided Congress.

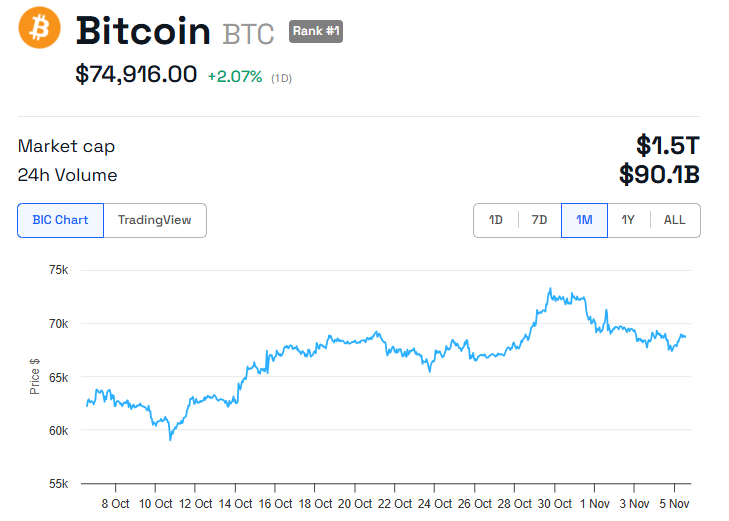

This political alignment, along with Bitcoin’s recent surge to a new all-time high, adds momentum to Lummis’ initiative. Industry leaders, including Michael Saylor of MicroStrategy and Samson Mow, have shown support, stressing Bitcoin’s potential as a national asset.

Mow highlighted Bitcoin’s value at sub-$100,000, pointing out its potential strategic importance if prices soar above $500,000 in coming years.

“Good luck Senator Lummis. I suggest acting quickly. The difference between acquiring Bitcoin below $0.1 million vs. $0.5 million will have massive geopolitical ramifications,” Mow wrote.

Framework for Secure BTC Management

The BITCOIN Act does not stop at Bitcoin acquisition. It also introduces a framework for managing Bitcoin securely within Treasury vaults. It aims to reduce national debt by half by 2045. This would serve as a hedge against inflation and a potential powerhouse for US debt management.

President-elect Trump publicly endorsed the creation of a national Bitcoin reserve during the Bitcoin 2024 conference in Nashville. His remarks continue to stir interest among crypto proponents and Republicans as the then-presidential aspirant emphasized Bitcoin as a “core of financial independence” for the US.

“It will be the policy of my administration…to keep 100% of all the Bitcoin the US government currently holds or acquires into the future. This will serve in effect as the core of the strategic national bitcoin stockpile…It’s been taken away from you,” Trump said.

Meanwhile, state governments are also eyeing Bitcoin, with Florida’s Chief Financial Officer Jimmy Patronis recently endorsing Bitcoin as a “strategic reserve” for state pensions. Florida’s pension fund, among other states like Wisconsin and Michigan, would benefit from Bitcoin’s long-term appreciation, diversifying investments amid economic uncertainty.

Nevertheless, while the plan has garnered support, it raises questions about economic risks and global impacts. Some economists warn of potential volatility in tying national debt management to cryptocurrency. However, advocates point to Bitcoin’s finite supply and growing international adoption as a hedge against inflation and market fluctuations.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

With Trump’s support, a Republican-led Congress, and growing state-level backing, the plan has momentum. This makes the concept of a national Bitcoin reserve a closer reality than ever before. If implemented, the BITCOIN Act could place the US at the forefront of a global financial evolution.

“Other countries will follow,” another popular user on X added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.