Bitcoin

Crypto Volatility Expected as US Releases Key Economic Data

The crypto market’s correlation with key macroeconomic events has returned after dissipating for most of 2023. With the influence back on, crypto market participants must brace for volatility with key releases lined up this week.

In a sentiment-driven market, getting ahead of market-moving economic data releases is critical for traders and investors looking to revise their trading strategies.

What Could Cause Market Volatility This Week

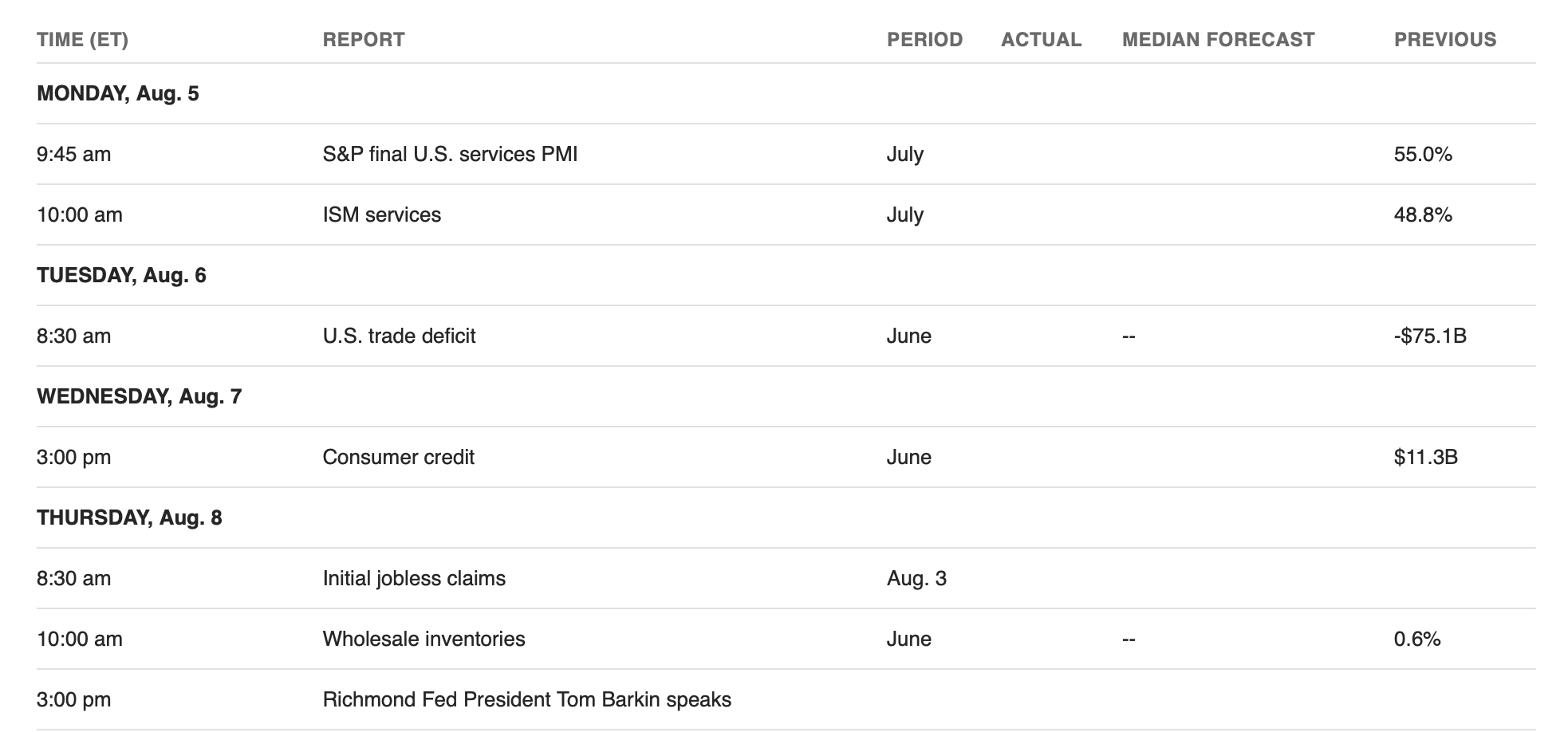

Four events will be of interest to crypto market players this week. They include:

S&P Final US Services PMI

Traders will watch the S&P Global Services PMI on Monday, which is compiled by the S&P Global. Sectors covered include consumer (excluding retail), transport and information, communication, finance, insurance, real estate, and business services.

In July, the S&P Global Services PMI beat expectations of 55, rising to 56 points, higher than June’s 55.3. This indicates expansion in the services sector, a positive sign for traditional markets, showing higher service demand.

US Trade Deficit

Markets also await the US trade deficit on Tuesday, which could cause TradFi and crypto volatility this week. Like the S&P Services PMI, the country’s trade deficit also pointed to increased services in June and more car exports.

The two positive data points to sharp increases in business inflows, reaching their quickest pace in over a year.

“The US is transitioning to a services economy, less manufacturing,” Lumida Wealth CEO Ram Ahluwalia said over positive services data.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

These lead to increased investment opportunities and improved economic conditions, boosting sentiment in traditional markets like stocks. The impact may not be as direct or significant on crypto compared to traditional markets. However, if the positive trajectory continues, capital could rotate into risk-on assets like crypto.

Positive economic data often influences investor sentiment in the crypto space. As traditional markets strengthen, investors may become more confident in the economy. This could increase risk appetite and lead to greater interest in alternative assets like cryptocurrencies.

Consumer Credit

The US Consumer Credit data for June will be released on Wednesday, July 7. The data reports outstanding credit extended to individuals. The data helps measure conditions in consumer credit markets and analyze the effects of monetary policy. In May’s report, released on July 8, consumer credit increased at a seasonally adjusted annual rate of 2.7%. Revolving credit increased at an annual rate of 6.3%, while non-revolving credit also increased at an annual rate of 1.4%.

The increase in consumer credit indicates that consumers are borrowing and spending more. In traditional finance markets, this is a positive sign for the economy. It suggests consumers are more confident about their financial situation, which explains the willingness to take on debt to make purchases.

If authorities report a similar trend in June, it would stimulate economic activity and drive corporate earnings, leading to higher stock prices. Nevertheless, there is a risk associated with higher consumer credit levels. If consumers become overleveraged and struggle to repay their debts, it could lead to defaults and financial instability.

This could negatively affect traditional finance markets by increasing volatility and investor uncertainty. Crypto, on the other hand, could benefit indirectly from the implied stronger overall economy. Increased economic stability and consumer activity could attract investors to alternative assets like cryptocurrencies.

Richmond Fed President Tom Barkin’s Speech

The Richmond Fed President Tom Barkin will speak on Thursday, August 8, giving insight into policymakers’ thinking and potentially inspiring traditional market and crypto volatility. He will also comment on what recent economic reports mean for future action from the central bank. The Federal Open Market Committee (FOMC) recently decided to keep interest rates unchanged at 5.25%—5.50% for the eighth consecutive meeting.

Jerome Powell, the Federal Reserve (Fed) chair, did not explicitly signal a September rate cut. He demonstrated increasing but cautious optimism about disinflation progress resuming in the second half of 2024.

“He is clearly expecting a correction of some kind or otherwise simply cannot see better investments than Treasury bills. The Fed needs to drop rates. They have been foolish not to have done so already,” X CEO Elon Musk said in a Sunday post.

Musk’s comments came following a lackluster jobs report last week, which raised concerns about an economic slowdown. Meanwhile, Wall Street banks advocate for aggressive interest rate cuts amid evidence that the labor market is cooling. Citigroup economists Veronica Clark and Andrew Hollenhorst, for example, anticipate “half-point rate cuts in September and November and a quarter-point cut in December.”

JPMorgan economist Michael Feroli echoed Clark and Hollenhorst, adding that there’s “a strong case to act” before the next meeting on September 18. According to Feroli, Powell may not “want to add more noise to what has already been an event-filled summer.”

Macro Data Drives Crypto Sell-Off

Meanwhile, crypto volatility has markets bleeding, with the total market capitalization down a stark 12%. Bitcoin is down 12.35%, trading for $53,000 at the time of writing, while Ethereum lost 20%.

Some ascribe the crash to the Japanese stock market suffering its worst losses since 1987. Market analyst Zach Jones associates the crash with Japan defending its Yen currency and dumping all of its Treasury Holdings (US-owned debt).

“Japan created an everything bubble in the 80’s/90’s. The bubble got so big that in the 30-40 years since their stock market has never gotten close to the highs of the bubble. The US economy has a 122% debt to GDP ratio which is insane. Japan has doubled that. They were between a rock and a hard place, either letting their currency collapse and experience a Great Depression-esque collapse or printing money and hyperinflating their currency. They chose to print hundreds of billions of dollars per day to defend their currency. This has been an inevitability to anyone who pays attention to markets,” Jones wrote.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Elsewhere, Republic ticket nominee for the November elections, Donald Trump, blames the recent financial markets crash on Kamala Harris, Joe Biden, and “inept US leadership.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.