Bitcoin

Crypto Outflows Surge to $1.7 Billion, XRP Stands as Rare Positive

The crypto market continues to face a sustained period of capital flight. According to the latest CoinShares report, digital asset investment products experienced a fifth week of outflows.

It comes amid continued bearish sentiment, with Bitcoin (BTC) bearing the worst as seen in its price, which remains well below the $90,000 threshold.

Crypto Outflows Surge to Nearly $1.7 Billion

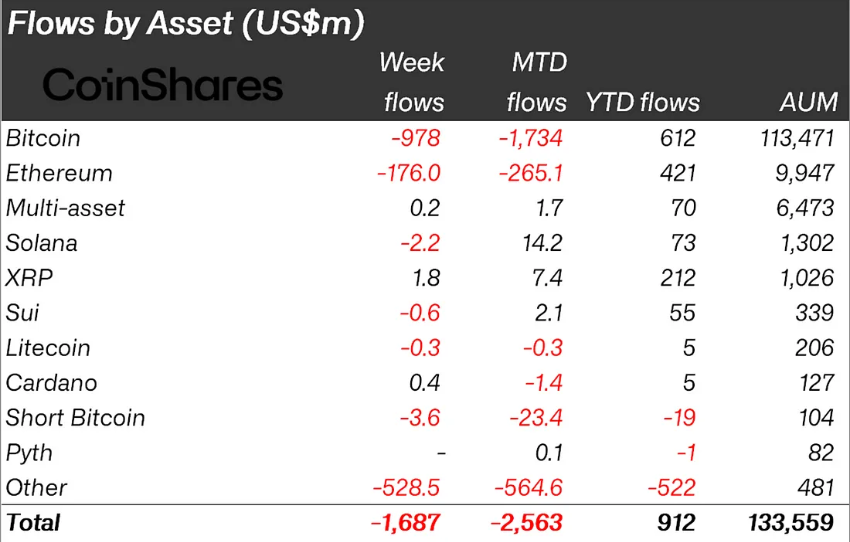

The report indicates that total crypto outflows reached $1.687 billion, bringing cumulative losses over this negative streak to $6.4 billion. This also marks the 17th straight day of outflows, the longest unbroken period of capital withdrawals since 2015.

Despite the sustained downturn, year-to-date (YTD) inflows remain positive at $912 million. However, the latest market correction and consistent investor withdrawals have resulted in a $48 billion decline in total assets under management (AuM) across digital asset investment products.

Per the report, the US remains the epicenter of the ongoing crypto outflows, accounting for $1.16 billion in outflows. This represents approximately 93% of all outflows during this negative streak. In contrast, Germany experienced a modest inflow of $8 million, indicating regional variations in investor sentiment.

Bitcoin continues to withstand the worst of investor withdrawals, with an additional $978 million in outflows over the past week, bringing its five-week total to $5.4 billion. Meanwhile, short-Bitcoin positions also saw $3.6 million in outflows, indicating a general decrease in bearish bets against the pioneer crypto.

While most digital assets have declined, XRP continues to attract investment. It recorded an additional $1.8 million in inflows, standing out as one of the few assets seeing positive momentum.

This optimism likely draws from abounding hope of an imminent conclusion to the longstanding legal battle between Ripple and the US SEC (Securities and Exchange Commission). There is also hope that the SEC may reclassify XRP as a commodity.

One of the most striking developments during this market downturn was the Binance exchange’s near wipeout of assets under management. A key seed investor’s exit drained almost all of Binance’s AuM, leaving the exchange with just $15 million in remaining AuM.

Meanwhile, this sustained sell-off follows a weeks-long pattern of negative sentiment. The previous week, crypto outflows hit $876 million, with US investors leading the charge in market liquidations.

Before that, outflows had already neared $3 billion, driven by weak investor sentiment and rising market fears.

The persistent crypto outflows and declining AuM figures suggest that confidence in the crypto sector is yet to recover. However, pockets of resilience—such as XRP’s inflows and minor gains in Germany, indicate that investor appetite has not vanished entirely.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.