Bitcoin

Bitcoin’s Halving Cycle No Longer Drives Price Trends

Bitcoin (BTC) has gone through three previous halving cycles with a relatively clear price pattern. The supply decreased, demand surged, and Bitcoin’s price skyrocketed afterward. However, in the fourth halving cycle, there is a deviation.

Data suggests that Bitcoin’s growth trajectory no longer follows the historical range set by previous cycles. Many industry experts believe Bitcoin has entered a completely different phase compared to before.

What’s Different About Bitcoin’s Fourth Halving Cycle?

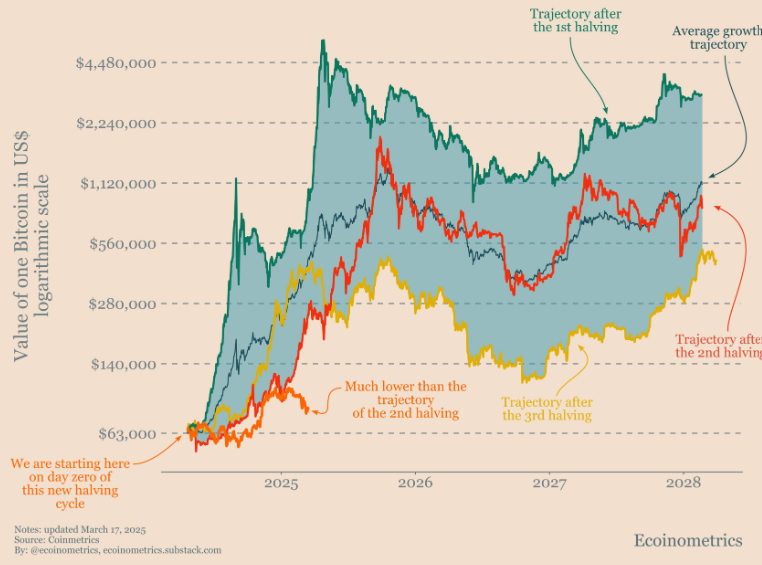

Observations from Ecoinometrics show that Bitcoin’s growth rate in this cycle is significantly lower than in previous ones. This indicates that the halving event no longer plays a central role in driving Bitcoin’s price as it did before.

If Bitcoin were to grow similarly to previous cycles, its price could range from $140,000 to $4,500,000, starting from $63,000. However, Bitcoin is currently trading at around $80,000.

“At this stage of the cycle, the lower bound of the historical range should be around $250,000.” – Ecoinometrics commented.

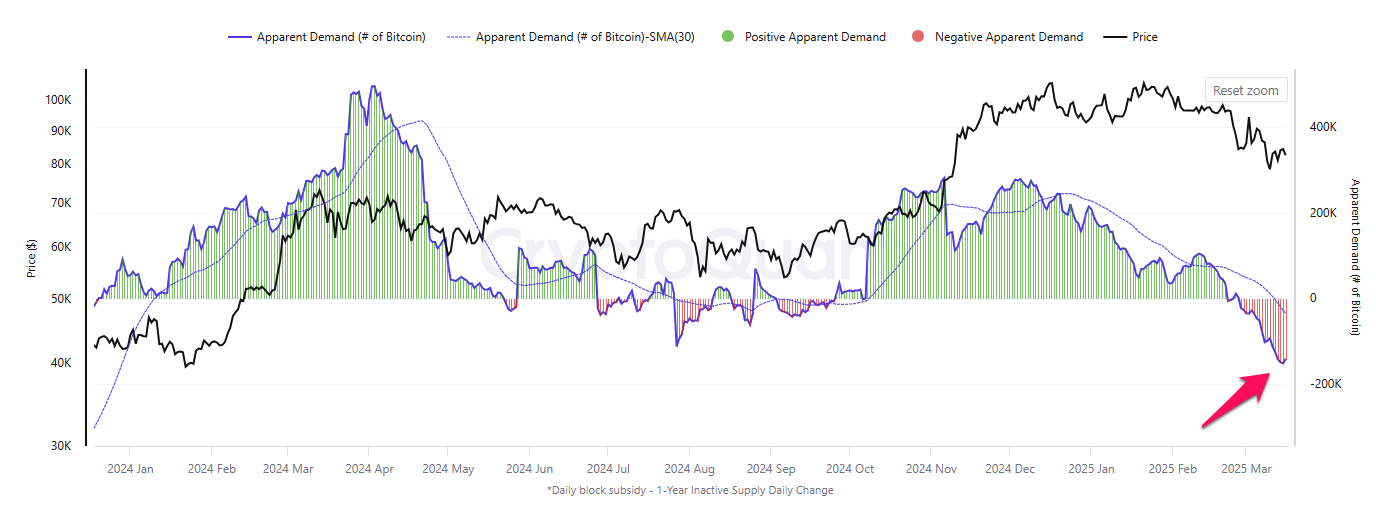

Another crucial factor is that Bitcoin demand has dropped to its lowest level in over a year, according to CryptoQuant data. The Bitcoin Apparent Demand metric compares new supply to inactive supply held for over a year, highlighting the true demand.

This means that even though the halving event reduces supply, Bitcoin’s price may struggle to rally without new capital inflows or strong investor interest.

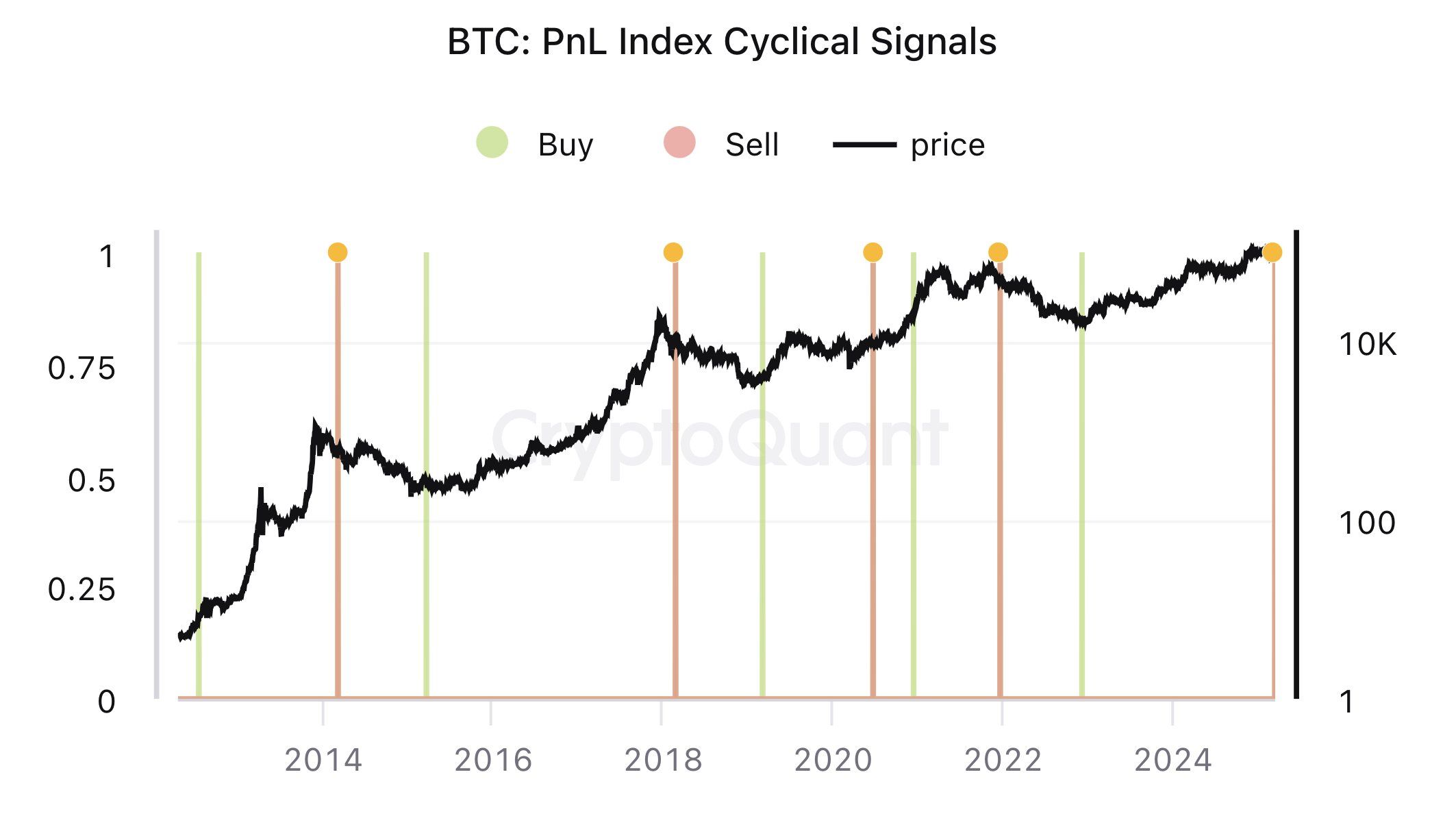

Alongside Bitcoin Apparent Demand, Ki Young Ju, founder of CryptoQuant, also analyzed the Bitcoin PnL Index Cyclical Signals. This metric applies a 365-day moving average to key on-chain data like MVRV, SOPR, and NUPL. It signals “Buy” or “Sell” at major turning points in a large cycle rather than short-term fluctuations.

Based on this data, Ki Young Ju predicted that Bitcoin’s bull cycle has ended.

“Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action,” Ki Young Ju predicted.

Charles Edwards, founder of Capriole Investments, pointed out another key difference in this Bitcoin cycle. Unlike the previous one, which benefited from expansionary monetary policies by central banks, this time, central banks are either tightening or maintaining neutral policies.

During the last cycle, Bitcoin thrived as central banks injected liquidity into the economy, creating a favorable environment for risk assets like crypto. However, the current monetary stance lacks that same supportive force, making it harder for Bitcoin to sustain strong upward momentum.

Despite this, Charles Edwards remains somewhat optimistic. He noted that US liquidity is showing technical signs of a potential recovery.

“This Bitcoin cycle we have largely been battling a flat monetary cycle, versus last cycle’s strong uptrend (green). That may be about to change. We are now seeing the first signs of a potential major multi-year bottom in US Liquidity, with an eve/adam bottom forming today. It’s been almost 4 years since tightening began. 2025 would make sense for a monetary policy trend change amid tariff stressors. Let’s see if this new trend can stick,” Charles Edwards predicted.

The halving cycle was once the most important factor influencing Bitcoin’s price. However, current data paints a different picture. Weak demand, unfavorable monetary policies, and expert predictions suggest that Bitcoin has entered a new phase.

In this environment, macroeconomic factors and institutional capital flows will likely dictate Bitcoin’s price trends more than the halving event itself.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.