Bitcoin

Bitcoin Crash: VanEck Sees an Opportunity

VanEck remains optimistic as Bitcoin (BTC) price continues to nosedive in the aftermath of woes around the German government and Mt. Gox.

Market corrections are a dreaded scenario, spelling fear among traders. While the otherwise “weak hands” cower, the bold lot seize the opportunity to grow their bags.

VanEck Urges Traders: Buy Bitcoin During Market Panic

Describing the ongoing Bitcoin crash as “4th of July discounts,” VanEck sees BTC price falling to the $53,000 range as a ‘buy the dip’ opportunity. On-chain platform Santiment shares the sentiment, urging bold traders to seize the moment.

“Markets have continued to bleed, and social media is now showing historic levels of FUD. It is rare for an hour to go by where there are more mentions of “sell” than there are “buy” across crypto forums. But we’ve seen a few of these instances in just the past 24 hours, including the largest ratio of negative vs. positive comments thus far in 2024. For bold traders, this is a window where some may wish to be a true contrarian and buy into the crowd’s anger and frustration”.

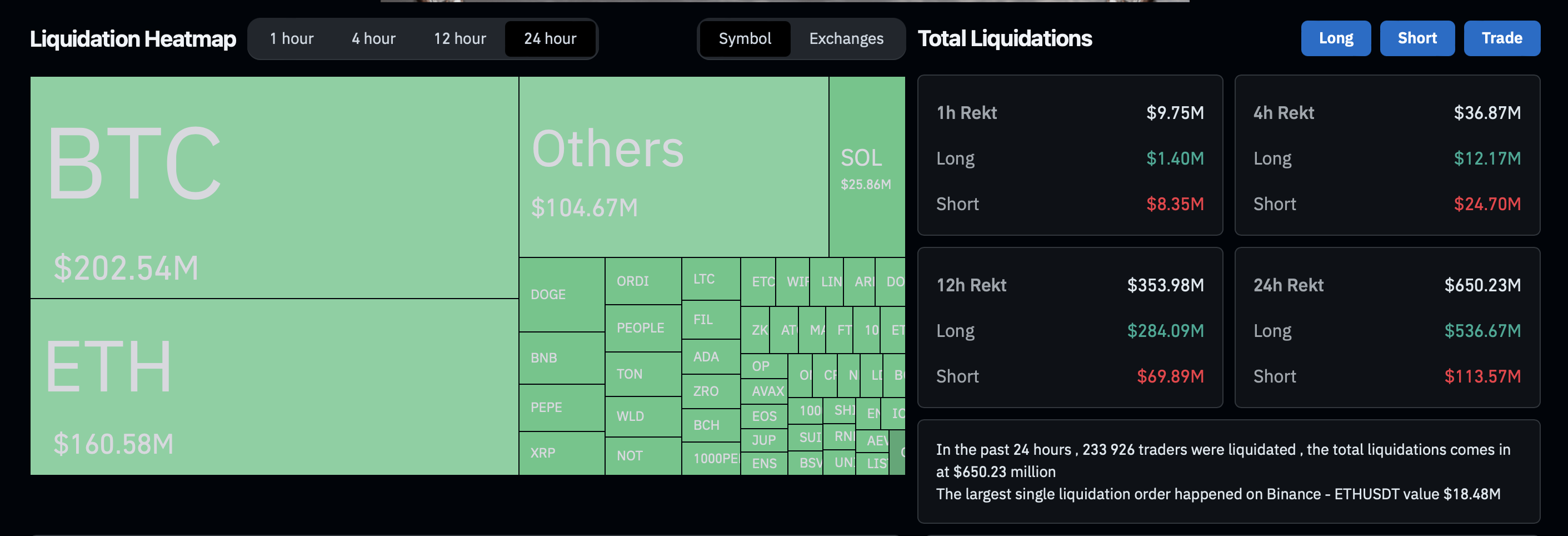

Amid the negative market sentiment, crypto researchers observe elevated fear levels. This is warranted as many traders suffer losses. Hundreds of thousands are getting “rekt” amid an ongoing bloodbath. Derivative data analysis platform Coinglass reports over $650 million in total liquidations.

Read more: Four Mistakes To Avoid When Trading Bitcoin with Leverage

Pseudonymous trader CryptoNagato reported that this is the second-largest liquidation event in the Bitcoin market after the one right after the FTX collapse in November 2022. All indications point to the ongoing sell-off between Mt. Gox and the German government, with their voluminous transactions stirring markets.

In a Thursday post, German lawmaker and Bitcoin activist Joana Cotar slammed the government for its “hasty” actions selling Bitcoin. Calling the selling spree insensible and counterproductive, she urged the state to emulate the US and hold Bitcoin as a reserve currency.

“Instead of holding Bitcoin as a strategic reserve currency, as is already being debated in the USA, our government is selling on a large scale. I informed Michael Kretschmer, Christian Lindner, and Olaf Scholz, why this is not only not sensible, but counterproductive and invited them to our lecture event (Bitcoin Strategies for Nation States” on October 17th in the Paul-Löbe-Haus) with Samson Mow,” Cotar wrote.

Cotar’s pro-crypto stance was best seen in November when she backed Bitcoin as legal tender and advocated for its integration into mainstream German finance.

Whales Buy BTC at a Discount

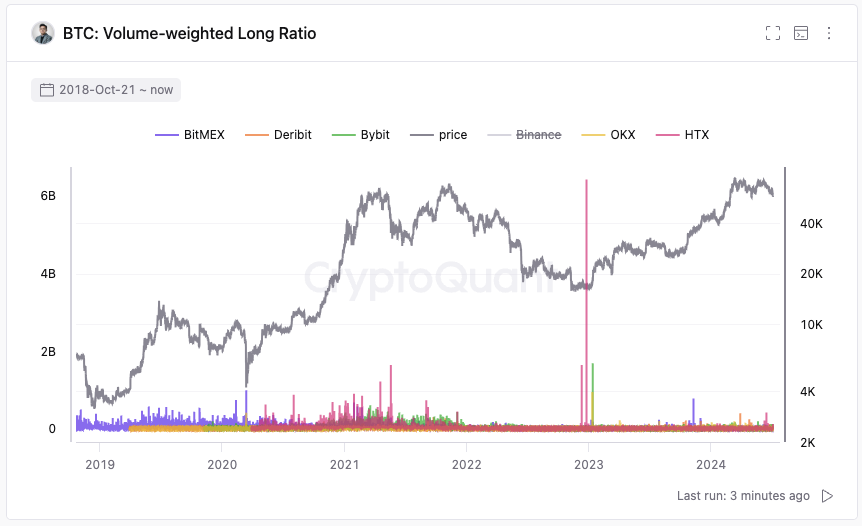

Meanwhile, Ki Young Ju, co-founder and CEO of CryptoQuant, suggests that whales are buying the dip and effectively becoming true contrarians. Based on the report, these traders are opening long positions.

Whales in crypto are investors holding over 1000 BTC, which means they have the power to influence market prices due to their large portfolios. At the moment they are betting on the Bitcoin price increasing in the future.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

CryptoQuant’s Young Ju shares the optimism, saying, “The upward cycle is not over yet.” Nevertheless, he indicates that the ongoing correction could bottom out around the $47,000 threshold, urging spot traders to wait for a strong buying trend. Looking at the weekly chart for the BTC/USDT trading pair, there is a demand zone around the $47,000 range.

A demand zone is an area with significant buying interest. Market participants would be willing to step in and purchase Bitcoin at $47,000, effectively creating a support level that can potentially lead to a price reversal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.