Bitcoin

Bhutan Holds $1 Billion in Bitcoin Amid Growing State Adoption

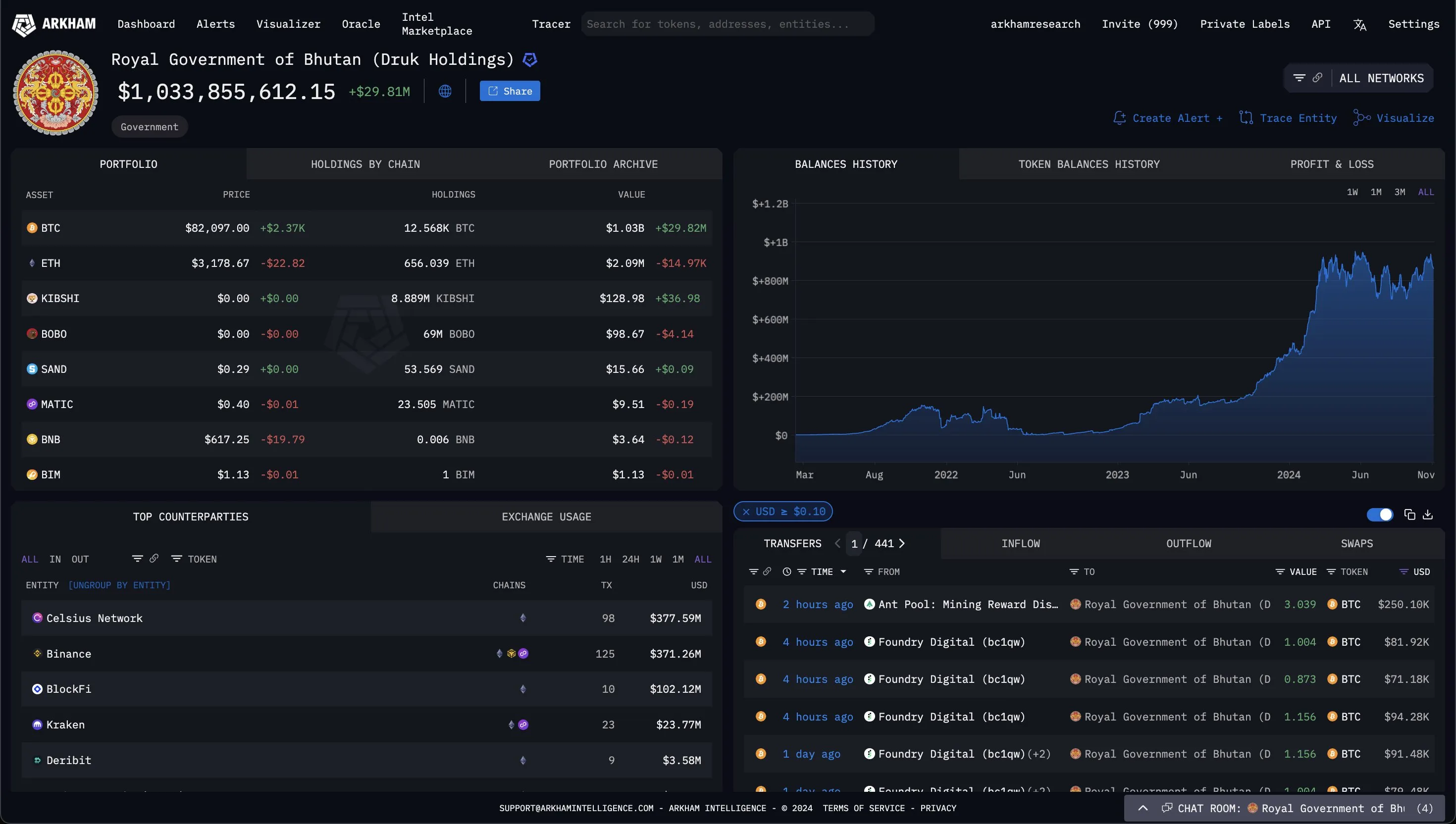

According to Arkham Intelligence, the Royal Government of Bhutan now holds more than $1 billion worth of Bitcoin. Two weeks ago, the country moved $65 million in Bitcoin to Binance wallets to prepare for a sale, but it’s still diligently acquiring more.

Bhutan has yet to sell these assets. Meanwhile, in the US, Donald Trump’s promises for an official Bitcoin Reserve highlight a growing trend.

Bhutan’s Growing Bitcoin Stockpile

According to new on-chain data from blockchain analysis firm Arkham Intelligence, the Royal Government of Bhutan’s Bitcoin holdings are worth more than $1 billion. Bhutan has been acquiring Bitcoin through mining since 2021, increasing this growth rate last year. Thanks to Bitcoin’s all-time high, these holdings have grown even faster.

This news comes less than two weeks after Bhutan deposited more than 900 BTC worth $65 million into a Binance account. A transfer of this size would typically indicate a major sell-off, like in Germany’s substantial asset sales this summer. However, Bhutan has continued mining Bitcoin at the same rates.

In other words, this $1 billion milestone is largely due to Bitcoin’s extremely bullish momentum, not a major Bitcoin acquisition. Bhutan’s wallets actually hold slightly fewer bitcoins than before the transfer, but the country might recoup this drop.

New State Bitcoin Holders

While Bhutan sent Bitcoin to Binance, other countries, such as El Salvador, refrained from selling. El Salvador has publicly stated it will not sell its massive holdings, regardless of how high they might get. Donald Trump, too, has vowed to halt attempted sell-offs as a campaign promise.

However, Peter Schiff, a noted Bitcoin critic, recently commented on potential market effects:

“If the US government actually established a Bitcoin reserve and bought 1 million Bitcoin, it might end up buying millions more. Since the US government’s purchase of 1 million Bitcoin would drive the price so high, many HODLers, then worth millions or billions, would finally begin cashing out to spend their windfalls,” Schiff claimed.

This scenario takes several things for granted, not least of which is that buying several million out of 21 million total Bitcoin would be very difficult, especially while the price is soaring. However, it does illustrate the kind of confidence that these massive Bitcoin stockpiles can engender. If the US government does turn its stockpile into a true Reserve, it would drive the price up.

For Bhutan, these sorts of dynamics would take place at a much smaller scale. Although it is a major Bitcoin holder and miner, Bhutan’s government hasn’t stated any desire to transform market dynamics. At the moment, it seems positioned to be another standard bearer for state-held Bitcoin reserves, in a time when the trend is growing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.