Altcoin

US PCE Inflation To Come In Hot, Bitcoin & Ethereum To Face Huge Liquidations

The U.S. Federal Reserve’s preferred gauge to measure inflation personal consumption expenditures (PCE) is expected to come in slightly hot, as per US economists. This will likely cause the US FOMC to deliberate again on starting Fed rate cuts in September. Bitcoin and Ethereum prices will also witness further selling pressure if the PCE inflation comes in higher.

Economists Estimate PCE Inflation at 2.6%, Core PCE at 2.7%

The U.S. Bureau of Economic Analysis will release US PCE inflation data for July on Friday, August 30. According to economists, the annual PCE to come in at 2.6%, higher than 2.5% last month. Also, the PCE on a monthly basis is expected to rise 0.2%, against 0.1% earlier month.

They expect the annual core PCE, which excludes food and energy prices, to rise 0.18% on a monthly basis and 2.7% on an annual basis. The estimates are slightly hotter than June’s PCE numbers, but markets considering inflation to continue lower.

“We’re going to see continued progress on inflation,” says José Torres, senior economist at Interactive Brokers, reported Morningstar. He attributed this to falling prices for goods, along with crude oil and gasoline. However, crude oil, natural gas, and gold prices are soaring today, making traders cautious.

Bitcoin and Ethereum prices are likely to fall if PCE inflation comes in higher. This will trigger a broader liquidation in crypto market.

Will Fed Start Rate Cuts in September?

The European Central Bank (ECB) is considering another rate cut on September 12, which will provide traders with further cues before the Fed plans rate cuts on September 18. ECB policymakers have indicated the rate cut is likely, while eyes are on inflation figures for France, Italy, and the broader Eurozone release this Friday.

The Fed expects three rate cuts this year, with a potential start in September as per the latest signal by Fed Chair Jerome Powell. However, the Fed could delay rate cuts to November if PCE inflation and jobs data come in higher.

Meanwhile, the stock and crypto market has turned volatile as traders track Nvidia earnings and PCE inflation. Nvidia shares tumbled about 7% in extended trading even after beating revenue and earnings expectations, as the firm’s sales outlook for the current quarter failed to impress investors.

CME FedWatch data shows a 65.5% probability of 25 bps rate cuts in September. Also, it still shows a total of 100 bps rate cuts this year.

The Buffett Indicator (Total US Market Value/GDP) is a ballpark measure of how expensive stocks are at any one point in history…

It’s now sitting at ~200%.

“If the ratio approaches 200%, as it did in 1999, you are playing with fire.” – W. Buffett pic.twitter.com/WD18O7SoMb

— Geiger Capital (@Geiger_Capital) August 28, 2024

Bitcoin and Ethereum Price Under Pressure

BTC price jumped 2% from the 24-hour low of 58,637, with the price currently trading at $60,142. This happened after a breakout in the lower time frame. The trading volume has decreased by 23% in the last 24 hours, indicating a decline in interest among traders.

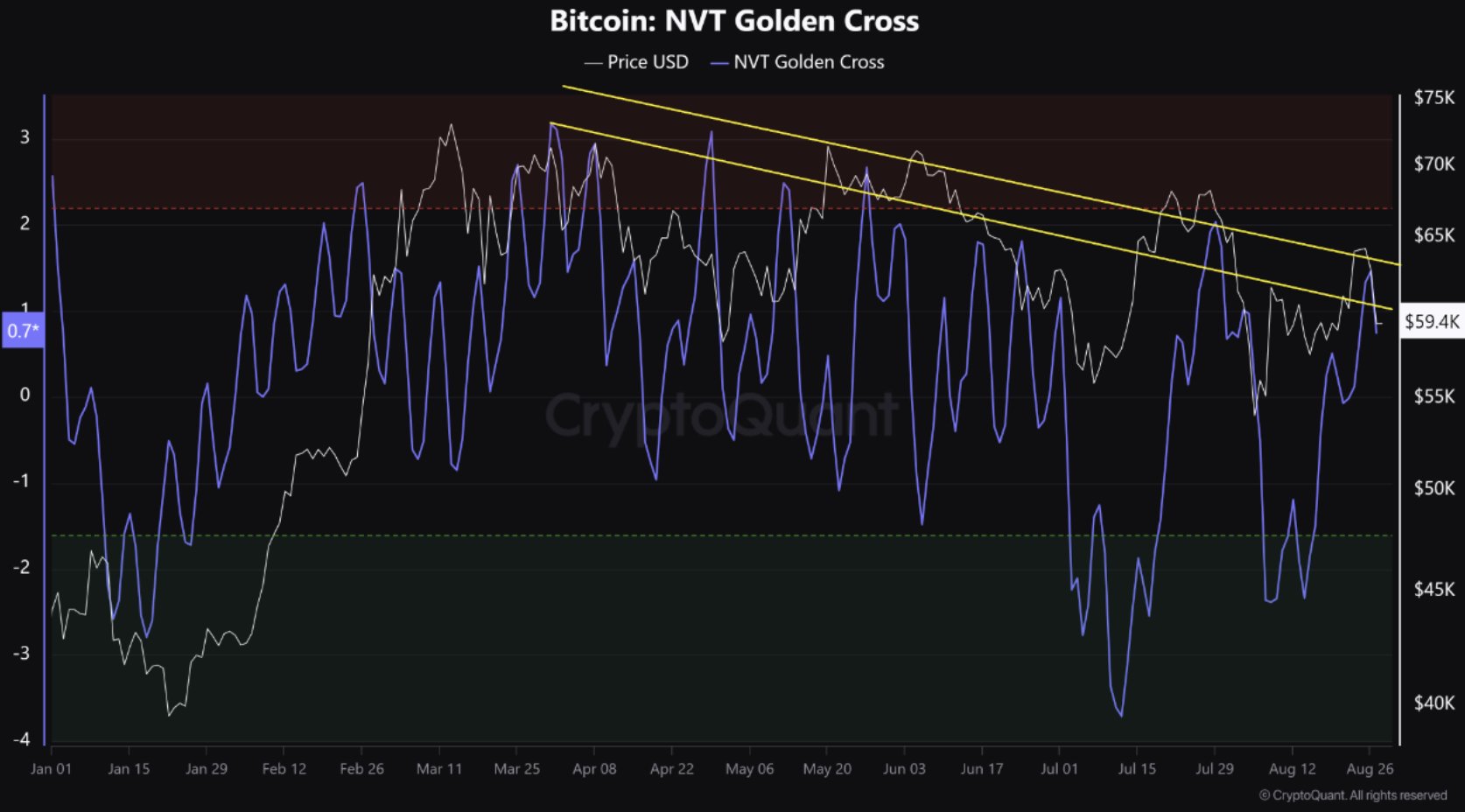

CryptoQuant metric NVT Golden Cross for Bitcoin is struggling to surpass its previous peak. This indicates that the current uptrend is losing momentum. The NVT Golden Cross needs to surpass the previous peak with support from bulls to regain the upside momentum.

Moreover, Bitcoin options worth $3.65 billion and Ethereum options worth $1.35 billion are set to expire on the largest derivatives exchange Deribit. This could further bring long liquidations in BTC and ETH, triggering a market correction amid the US PCE inflation data.

Meanwhile, ETH price also jumped 2% from the 24-hour in the past 24 hours, with the price currently trading at $2,570. Ethereum also saw a breakout in 1-hr timeframe. The trading volume has decreased by 25% in the last 24 hours.

In the daily timeframe, Ethereum price is facing strong resistance currently. RSI is near the neutral area at 41. The fib replacement indicates the price is bouncing off the 0.236 level at $2,450. The price may drop again to the level during the ETH options expiry as max pain point is higher at $2,800, as per Deribit data.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: