Altcoin

Ethereum Price To Hit $10K As BTC Eyes $200K Rally: Standard Chartered

In a recent bold forecast, Standard Chartered said that Ethereum price is poised to hit $10,000 in the near term, sparking optimism amid the ongoing rally. Besides, the report also notes that besides ETH, Bitcoin is also gearing up for a strong run towards the north, potentially reaching the brief $200K mark. This forecast comes as the broader digital assets space is witnessing a positive momentum with Donald Trump’s election win and the 25bps Fed rate cut this week.

Standard Chartered Predicts Ethereum Price To Hit $10,000

According to a recent report, Standard Chartered predicts a 4X surge in the overall crypto market cap by the US mid-term elections in late 2026. As the current market cap hovers near the $2.5 trillion mark, the prediction, if comes true, indicates that it could potentially hit $10 trillion by that time.

In addition, the leading financial firm reiterated its previous target for Ethereum at $10,000. The firm said that the second-largest crypto by market cap could breach the level as soon as 2025 ends, bolstering market optimism amid an already strong rally.

Meanwhile, Standard Chartered Head of Research Geoffrey Kendrick cited several factors for his bullish prediction like the recent Republican victory, anticipated clear regulatory path, and others. He said that Donald Trump’s presidency is likely to drive the adoption of crypto-friendly policies, that could drive the adoption of digital assets higher in the near term.

Besides, the firm also anticipates the US SEC will take a soft stance towards the cryptocurrency market under the Republican administration. This also sparked discussions, as recent reports indicate that SEC Chair Gary Gensler may exit the office as soon as this year.

Notably, echoing a similar sentiment, prominent crypto market expert Ali Martinez said that Ethereum hitting $3,000 is “just the beginning” of its bull run. Previously, he said that ETH could mirror a similar trend as S&P 500, and could hit $10K in the coming days.

What’s Next For ETH and BTC?

The bank also reiterated its prediction that the Bitcoin price would hit $200K at the same time that the Ethereum price would hit $10K. The report said that Bitcoin and top altcoins like Solana, and ETH, among others, are poised to benefit the most under the new administration.

Besides, Standard Chartered also considers the possibility of the US implementing Bitcoin as a strategic reserve for the nation, which might support the strong run for the crypto. However, it also noted the probability of such development is quite low. But Donald Trump has previously said that he would make BTC the strategic reserve for the US, while Senator Cynthia Lummis also assured the same recently.

Meanwhile, BTC price today was up 0.3% to $76,532, after touching a 24-hour high of $77,252.75. Besides, the strong inflow into US Spot Bitcoin ETF reflects the growing institutional support towards the crypto. \

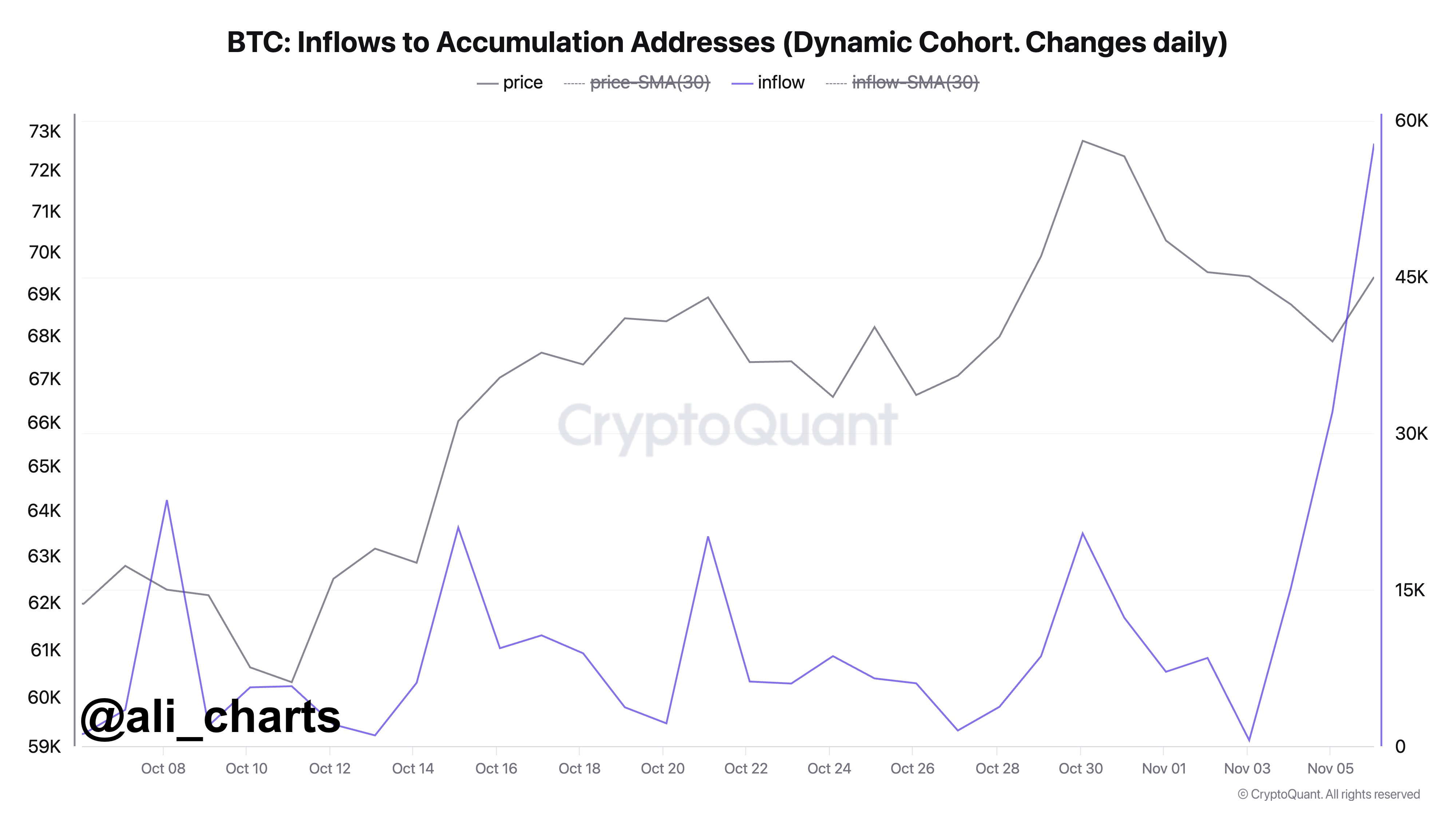

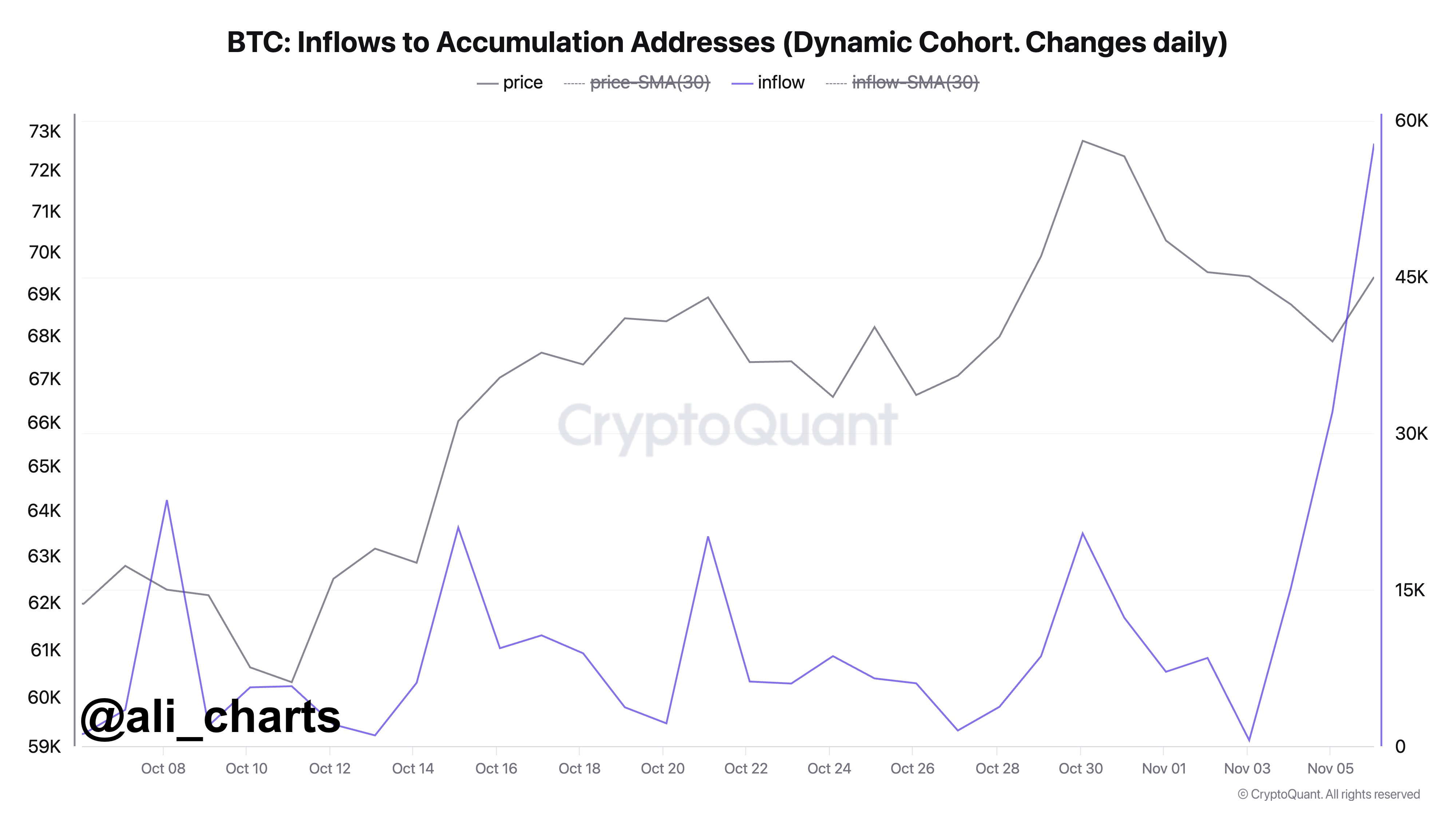

Notably recent report indicates that many fresh wallets have also started accumulating BTC as the crypto’s appeal keeps soaring among traders. Further boosting the sentiment, Ali Martinez highlighted that more than 57,800 BTC has been accumulated over the last few days, valued at around $4.16 billion.

On the other hand, ETH price rose 4% and crossed the $3,000 mark today, with its trading volume at $32.76 billion. Additionally, Ether Futures Open Interest also saw a surge of 4%, suggesting strong market confidence towards the leading altcoin.

Amid this, US Spot Ethereum ETF also started witnessing strong demand again, suggesting further rally ahead. Besides, a recent Ethereum price analysis indicates that crypto is targeting the $4,000 mark next, further supporting its potential rally to $10K by next year.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: